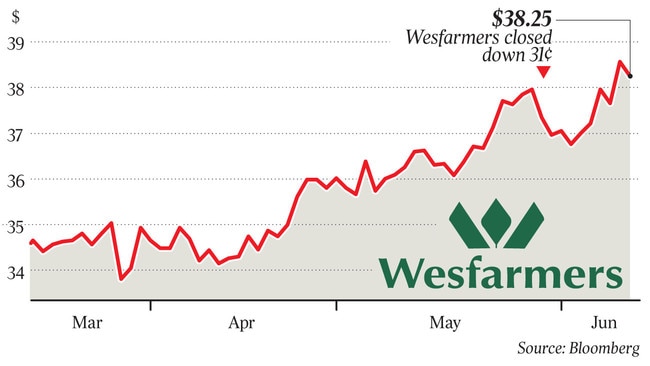

Wesfarmers buys online retailer Catch for $230m

Wesfarmers’ shopping spree has continued, with the conglomerate yesterday buying online retailer Catch for $230m.

Wesfarmers chief executive Rob Scott’s multi-billion-dollar shopping spree, which began in March with the Perth-based conglomerate’s $1.5 billion tilt at Lynas and then accelerated with a $776 million bid for Kidman Resources, switched from mining to retail yesterday when the company agreed to buy online retailer Catch Group.

Wesfarmers will this morning hold its annual investor day, the first one in more than a decade without former retail flagship Coles, as investors and analysts look to hear more about the group’s investment plans and business development. Wesfarmers is expected to announce the rollout of Bunnings’ click-and-collect online service to Melbourne after a successful trial in Tasmania, while Officeworks should confirm that its back-to-school sales are strong and the business is meeting targets.

Retail will still be a cornerstone of the Wesfarmers day-long presentation, with hardware chain Bunnings delivering the bulk of group earnings. But with its recent ventures into mining — lithium via Kidman and rare earths with its bid for Lynas — there are plenty of growth options for Mr Scott.

He believes yesterday’s $230m purchase for the loss-making Catch will deliver to the Wesfarmers group, which also includes Kmart and Target, another avenue to growth, with Catch’s valuable online platform coming with all the bells and whistles of the digital marketplace such as access to customers and rivers of data.

“(Catch) has built a very impressive platform,” Mr Scott said.

“It now has about 1.5 million active customers and has developed a marketplace approaching two million stockkeeping units.

“This is a really exciting platform for us to put alongside our existing retail operations. It will further accelerate our own digital and e-commerce ambitions and provide us with access to a whole category of the market that we are not able to access through our bricks-and-mortar stores, so it increases the addressable market for the group,’’ Mr Scott added.

Mr Scott also downplayed suggestions Wesfarmers had been on a shopping spree since March — when it bought small tech services business Geeks2U — saying the only active deals were Kidman and Catch, while the total funds committed to these deals was tiny compared to Wesfarmers’ $44bn market capitalisation and annual capital-expenditure budgets.

“If you actually look at the amount of capital we have committed to acquisitions — and the only one active at the moment is Catch and Kidman — they are relatively modest amounts of capital for a group of our size,” he said.

“We spend over a billion dollars a year of capital expenditure in our business and these two acquisitions, three if you include the very small Geeks2U, are bolt-on acquisitions to strengthen our existing business.

“And we are really excited about the opportunities, both for our shareholders and also to our core businesses.’’

Mr Scott said Catch was profitable and generating cash, although latest financial results available for the privately owned online retailer show a loss of $4.26m for the 2018 fiscal year, which is down from a loss of $17.8m in 2017.

In 2018, revenue rose more than 40 per cent to $262m. Mr Scott declined to provide a recent financial report for Catch.

He said Wesfarmers had been investigating the online marketplace sector for at least a decade and had considered building its own platform before beginning talks with Catch that eventuated in yesterday’s deal.

The move on Catch, one of the first online retailers to launch in Australia as internet shopping took off in 2006, also derails any plans that its founders and owners had to take the business to the sharemarket in an IPO, and underlines Wesfarmers’ recent interest in technology and digital businesses. Catch was co-founded by brothers Gabby and Hezi Leibovich more than 10 years ago and employs about 800 staff. Investors in Catch have included casino billionaire James Packer and Andrew Bassat, the co-founder of online employment service Seek.

Subject to completion of the transaction, Catch will operate as an independent business unit under the oversight of Ian Bailey, the managing director of Kmart.

Mr Bailey said Catch had built a successful first-party and fast-growing marketplace business underpinned by a leading technology platform and data capabilities.

“We are excited to work with the Catch team and look forward to leveraging our capabilities to grow the business and accelerate the customer-driven, omni-channel initiatives across Kmart and Target,” Mr Bailey said.

“This will further drive best practice in supply chain, fulfilment and online execution across our brands, including opportunities for Target to secure online fulfilment capacity and productivity benefits.

“Catch will also benefit from the support of Kmart Group’s scale and capabilities to drive its continued growth in its existing marketplace business.”

Catch managing director and CEO Nati Harpaz said the company’s team was looking forward to becoming a part of Wesfarmers and working with Kmart for the benefit of Catch’s business partners and customers.

“Catch will continue to deliver innovation in the online market in Australia, with the focus of delivering great value and savings to our customers,” Mr Harpaz said.

Completion of the acquisition is subject to several conditions, including approval by the Australian Competition & Consumer Commission merger clearance process, which is expected in the coming months.

The acquisition will be funded from existing debt facilities and is not expected to affect Wesfarmers’ existing credit ratings.