Wesfarmers boss Rob Scott takes aim at struggler Target

Wesfarmers chief Rob Scott has warned that the long-struggling Target is not pulling its weight within the conglomerate.

Wesfarmers chief executive Rob Scott has sounded an ominous warning that the long-struggling Target is not pulling its weight within the Perth-based conglomerate and that the general merchandise chain’s store network is “not fit for purpose” to face the economic challenges ahead.

To make matters worse, analysts have valued the Target business at close to zero and warned that, with about $1.6bn in lease liabilities, a total closure of the retailer could be the cheapest option for Wesfarmers, rather than another attempt to turn its fortunes around.

Although he stopped short of declaring the loss-making Target a basket case and set for closure, Mr Scott said the poor performer would probably need to slash its store numbers as well as the size of the store formats at a time when the retailer is under pressure from the wipe-out triggered by the coronavirus pandemic.

Target has undergone countless strategic reviews in the past and racked up billions of dollars of losses and impairments under Mr Scott and his predecessor, Richard Goyder, but the chain’s limp growth has been made all the worse by a crashing economy and the accompanying health crisis.

This pushed Mr Scott to trigger an accelerated and more formal strategic review of the business, declaring that all options were on the table as Wesfarmers shareholders deserved a business that was making a proper return on their investment.

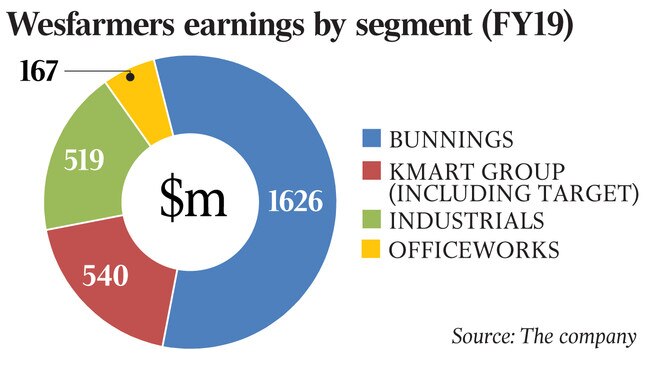

In a trading update on Tuesday that showed an uptick in sales at Bunnings and Officeworks as isolated people spent up on home repairs and improvements as well as fitting out home offices, Target earnings were revealed to have decreased significantly during the national lockdown. Wesfarmers’ other merchandise retailer, Kmart, was trading better than Target.

Mr Scott said the review would need to find a path for a “commercially viable” Target.

“Prior to the coronavirus, if you think about department stores, there was really only one in Australia that gets a return, that delivers a return above its cost of capital, and that is Kmart,” Mr Scott told The Australian.

“It is clear that within Australia and globally there are some structural changes going and disruption affecting department store businesses and COVID has just accelerated some of the pressures, and businesses like Target were barely profitable and this is obviously made it unprofitable.

“So from our point of view it is important to face into some of these commercial challenges and that is why we are undertaking a more formal strategic review because we think it is important to find a way to leverage the positives within Target,” Mr Scott added. “The current network, size of the stores, are not fit for purpose for the future.”

It was a similar downtrodden view from Mr Goyder four years ago, when Target also blotted Wesfarmers’ copybook as it spilt hundreds of millions of dollars of losses across the accounts.

“When you announce a couple of billion of impairments, even though they’re non cash, I’m not doing cartwheels about it,” Mr Goyder said in 2016 when Target lost more than $100m in a single half.

Analysts are similarly downhearted, with Citi analyst Bryan Raymond on Tuesday saying the “clock is ticking for Target” and the possibility of an exit by Wesfarmers was growing.

“Target earnings have deteriorated further, prompting Wesfarmers to accelerate its review of the business,” Mr Raymond said.

“Given the capital that would be required to sustainably turn Target around and a $1.6bn lease liability, we view a closure as most likely.

“Our Target valuation is close to zero, reflecting the near-term losses and costs to exit leases. Given Kmart’s existing network of 236 stores, the potential to convert stores is likely limited to around 20 per cent of the 285 store Target network, in our view.

“A downside scenario if the rest of the Target network is closed is a lease break fee cost of around $500m-$1bn, depending on landlord support in addition to a further writedown of around $300m-$500m of brand value and other assets.”

Meanwhile, Mr Scott also called for the national cabinet to be preserved once the coronavirus crisis was over, saying it should be repurposed to solve Australia’s looming economic crisis and to drive a program of economic reforms.

Mr Scott said the national cabinet, formed with the intention of bringing clarity and decision-making to the coronavirus issue, had proved its worth and would be well equipped to take a leadership role in repairing the nation’s economy and implementing crucial reforms. This kind of leadership would be key as Australia faced its toughest economic challenges in almost 40 years, he added.

“Although the future is uncertain it is likely we will see much higher unemployment, lower economic growth and we are probably about to embark on the most challenging period economically that Australia has in 30 or 40 years,’’ Mr Scott said.

“So that in itself provides a catalyst for us to consider reform options and I think there is a really important role for the national cabinet, which has been a really effective way of bringing state and federal leaders together to make key decisions on a timely basis.

“I think there is an opportunity for the national cabinet to work on some of these key reform options to grow the economy on the other side of COVID-19.

“What has been so effective with the national cabinet is a clarity of purpose and focus and the timeliness of decision-making.

“The reality is that we are all in this together, so the federal government can’t solve all these problems, state governments can’t solve all the problems — it requires a collaborative approach. I think a national cabinet or a similar vehicle could play an important role.’’

Business leaders are calling on governments to use the coronavirus pandemic as an opportunity to tackle economic reform once the health crisis passes, including tax reform, industrial relations, GST, superannuation and the cutting of red tape to help accelerate the return to growth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout