Webjet shares fall amid travel doubts, even as profit rises

Webjet shares fell after the travel company flagged uncertainties due to the trade war, Brexit and “perceptions of over-tourism”.

Webjet was punished after the travel company flagged uncertainties for the year ahead as a result of the global trade war, Brexit and “perceptions of over-tourism”.

Unveiling a 45 per cent increase in net profit after tax to $60.3 million, and a fully-franked final dividend of 13.5 cents per share, up from 12c last year, Webjet managing director John Guscic said trading had been strong in the first six weeks of the new financial year.

“We’ve had a cracking start to fiscal year 2020,” Mr Guscic told The Australian, as Webjet said the outlook for travel remained positive.

But the company which specialises in online air ticket and hotels booking, downgraded its earnings before interest, tax, depreciation and amortisation guidance in its B2B WebBeds hotel booking business for the year ahead to between $27 million and $33 million, down from at least $40 million at the half year.

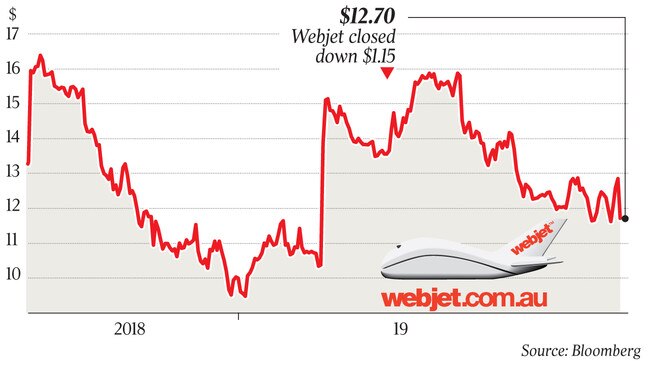

This triggered a 8.3 per cent fall in its shares to $12.70, in the face of a broadly stronger market.

That downgrade came despite Webjet saying the B2B business had grown in all regions in fiscal year 2019, even in the face of difficult conditions in Europe and the Middle East. Total transaction value for WebBeds lifted 59 per cent to $2.15 billion for the period.

“Europe saw strong growth notwithstanding the ongoing impact of the record hot 2018 summer, uncertainty surrounding Brexit and poor growth in Germany, Europe’s largest travel market,” Webjet said.

But total transaction value expected to be delivered by to WebBeds by troubled Europe region partner Thomas Cook in the 2020 year was revised down from between $300 million and $450 million to just $150 million to $200 million. In July it was reported that Thomas Cook was in £750m ($1.34 billion) rescue talks with major shareholder, China’s Fosun, which would hand control of the control of its package holiday business to the Chinese group.

Webjet’s total revenue increased 26 per cent to $366.4 million, with the WebBeds business underpinning the lift.

As well as driving organic growth in the business, the company remained on the lookout for acquisition opportunities to supplement its existing businesses, Mr Guscic said.

Royal Bank of Canada analysts said confidence in Europe may continue to drive the Webjet’s share price but they remained upbeat on the stock.

“With 30 per cent organic (earnings) growth in fiscal year 2019, we remain positive on the outlook, as a growing proportion of total transaction value is sold through direct contracts, which is supportive of revenue margins,” RBC analysts said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout