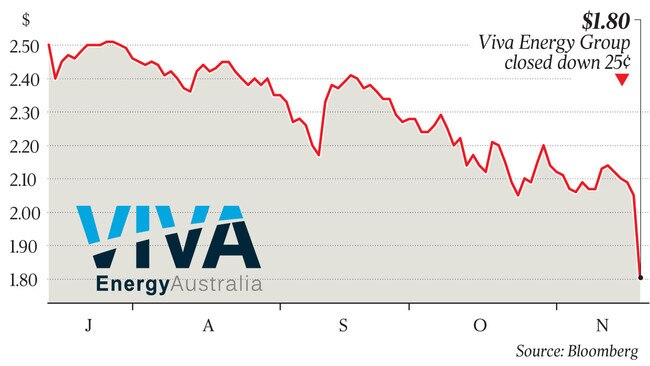

Viva Energy under pump as profit forecast takes a hit

Viva Energy has blamed lower margins and a refinery blackout for a lower profit forecast.

Lower oil price margins and a refinery blackout has forced Viva Energy to cut profit forecasts just four months after its sharemarket debut, amid an emerging battle to improve its underperforming alliance with supermarket giant Coles.

The $4 billion oil refiner and fuel retailer, which floated on the ASX in July, said 2018 financial-year earnings before interest, tax, depreciation and amortisation would be $543 million against prospectus forecasts of $605.1m, while net profit would be $280m compared with initial estimates of $324.1m.

It pinned the blame on weaker regional refining margins in October and November, triggered by higher crude prices and growing petrol stocks, along with a week of lost output from its Geelong refinery after a power blackout in August. Shares in the Melbourne-based company, which is 45 per cent-owned by Swiss commodities giant Vitol, fell 12.1 per cent to $1.80 yesterday, now 28 per cent below the $2.50 price that investors in the IPO paid.

Viva has a long-term retail supply deal with Coles but said volume growth in the second half of 2018 had been disappointing.

“I think the retail business and the alliance has the capability to perform much better than it has,” Viva chief executive Scott Wyatt said.

“I’d like to see the alliance network deliver more strongly.”

Mr Wyatt hinted at some frustration at the performance of the Coles tie-up, with high prices trimming sales.

“Some of that is out of our control. Coles, ultimately, set the pump price — that’s part of how the relationship works — so in terms of how competitive they are in the market and how that drives additional volumes is really something that is their responsibility, and they need to take the lead on that to improve its competitiveness in the marketplace,” he said.

“I think it’s a lost opportunity is how I see it.”

Mr Wyatt said higher oil prices and a lower dollar had also contributed to a decline in demand from consumers for petrol, with total fuel volumes 1-1.5 per cent below the prospectus target of 14,086 million litres.

Viva also downgraded its Geelong refining margin for 2017-18 to $US8, from $US9.20 outlined in its prospectus.

“It wouldn’t be surprising that higher oil prices correlating to higher pump prices will be having some impact on market demand through that time,” Mr Wyatt said.

Oil markets have been in volatile territory over the past few months. After jumping to $US81 a barrel at the start of October to trade near four-year highs, crude has declined by about 25 per cent to $US56 a barrel.

“Certainly, in more recent weeks as the oil prices has eased and that’s flowed through to the pumps, we are seeing some stronger weeks as a result,” Mr Wyatt said.

“It’s probably not a sustained decline in terms of the market, and should wind out as oil prices stabilise again.”

Viva’s assets include the Geelong refinery, one of only four in Australia, and a network of more than 20 fuel-import terminals through which it supplies a quarter of the nation’s refined fuel needs. It supplies fuel to 50 airports around Australia and also operates 1100 petrol stations throughout the country.

The week-long outage at the refinery was also to blame for the earnings downgrade after the failure of the Queensland and South Australia power interconnectors in August that tripped, forcing electricity to be cut to big industrial users in Victoria and NSW.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout