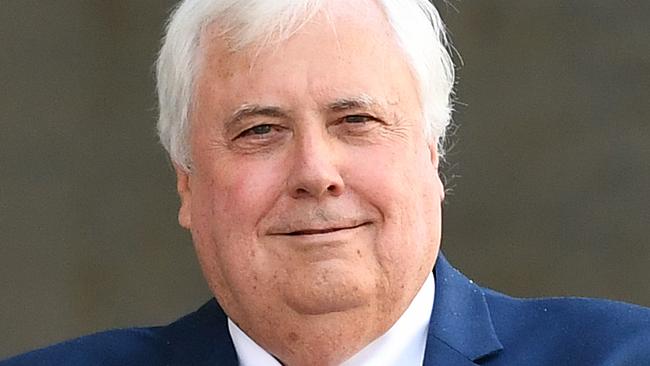

‘Victory’ for Clive Palmer in Queensland Nickel verdict

Liquidators of Queensland Nickel have lost their bid to claw back more than $100m for creditors from Clive Palmer’s Mineralogy.

Liquidators of Queensland Nickel have lost their bid to claw back more than $100m for creditors from Clive Palmer’s flagship company Mineralogy.

Supreme Court judge Debra Mullins found QNI, which managed Mr Palmer’s nickel refinery and had given money to Mineralogy, had done so on behalf of its joint venture owners.

The judge, who handed down her findings from last year’s trial in Brisbane on Wednesday, found that the company was insolvent at least five days before it went into voluntary administration.

The nickel and cobalt refinery in Townsville collapsed in January 2016, leaving 800 people jobless and creditors chasing hundreds of millions of dollars.

Justice Mullins found that two transactions entered into by QNI with two Palmer-owned entities five days before the appointment of administrators were uncommercial and voidable. The transactions, worth $135m, with Galilee Basin mining operations Waratah Coal and China First effectively put them ahead of other creditors.

In ordering the transactions voidable, Justice Mullins said the matter would return to court to determine whether any relief should be ordered.

In a statement released after the judgment was delivered, Mr Palmer claimed victory and said the general purpose liquidators — FTI Consulting — would not be getting the money they were chasing to pay back their funder, Vannin Capital.

“It’s clear all payments from Queensland Nickel have been paid properly for the purpose of that business,” Mr Palmer said.

He said he would consider launching a “$50m” legal case against the liquidators. The liquidators said they were “reviewing the matter and considering their response to the judgment”.

The bulk of QNI’s creditors, including taxpayers who funded a $70m entitlement guarantee scheme, were paid out last year when Mr Palmer settled claims made by the government-appointed special purpose liquidator for about $90m.

The general purpose liquidator continued to press its claim, hoping to recoup $102m transferred to Mineralogy via forgiven loans.

Justice Mullins found the common practice of QNI paying money from its bank accounts to cover Mineralogy’s expenses was done on behalf of the joint venture partners, and not a loan from QNI. She said the practice was a “tax-effective” way to disburse the funds of the joint venture partners “to a company with the same ultimate owner”.

The judge’s dismissal of the claim could render moot her decision that the Waratah Coal and China First transactions were void. The China First transaction, entered into five days before administrators were appointed, was a share subscription agreement for two billion shares in the coalmine project for $135m, payable from December 31, 2017.

When QNI went into voluntary administration, China First became a creditor for $135m.

The second transaction was a $US100m security deed with Waratah Coal.

Mr Palmer’s companies claimed the transactions were commercially beneficial to QNI because they could be used as security to borrow money to satisfy companies chasing QNI for debt.

During the trial, an expert witness for the liquidators said the China First shares at the time had no market value. Mr Palmer’s companies claimed the transactions were done in a late effort to allay rail freight company Aurizon, which gave QNI until January 18 to pay $28m. Aurizon ultimately rejected the security offered by the mining tenements.