BlueScope: Outlook best in a decade, plans to extend Port Kembla smelter

BlueScope boss Mark Vassella says the ‘wake-up call’ from COVID-19 has put the outlook for manufacturing on its best footing in years.

BlueScope Steel boss Mark Vassella says the “wake-up call” from COVID-19 has put the outlook for Australian manufacturing on the best footing he has seen in years as the nation’s biggest steelmaker looks to spend up to $800m to extend the life of its Port Kembla plant into the coming decades.

BlueScope recorded a 78 per cent lift in first-half net profit and projected stronger earnings in the second half, with Mr Vassella signalling the likely relining of a mothballed blast furnace at its Port Kembla steelworks as its means to ensuring the company is still operating in Australia into the 2040s.

The operating blast furnace at Port Kembla will come to the end of its natural life somewhere between 2026 and 2030, and Mr Vassella said on Monday the company had launched a feasibility study into refurbishing a nearby furnace, idled in 2011, as a means of ensuring a seamless transition of BlueScope’s operations.

Relining the furnace would cost $700m-$800m, Mr Vassella said, and would probably give Port Kembla up to another 20 years of life.

Mr Vassella told The Australian that, while high energy prices were still a concern for manufacturers, support for Australian industry was the strongest he had seen in his decades of managing manufacturing businesses.

“What we went through in COVID-19 was a wake-up call for everybody,” he said. “For years we’ve let some of these industries struggle and whither on the vine, and all of a sudden when you wake up and realise you can’t get something domestically it changes the context and the way people think about things.

“I’ve not had the sort of feedback and positive context that we’ve had out of Canberra on sovereign capability ever in my lifetime of managing these tough businesses like steel businesses.”

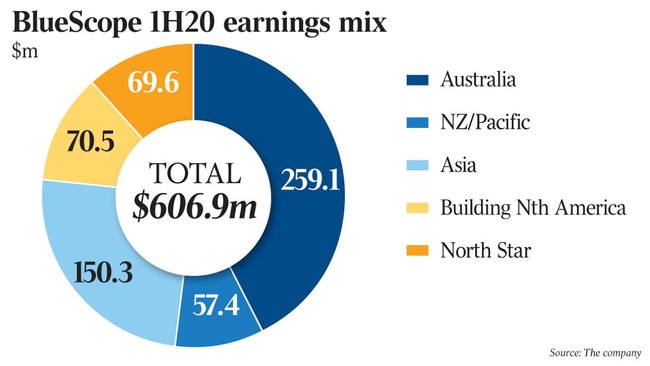

The steelmaker reported a net profit of $330.3m for the six months to the end of December, up from $185.8m in the same period a year earlier, with underlying earnings before interest and tax up 75 per cent at $530.6m.

BlueScope said it expected second-half underlying EBIT in a range of $750m-$830m.

The company declared an interim dividend of 6c a share, flat on a year ago, and elected not to extend its share buyback given that the outlook for parts of its business was still volatile.

Mr Vassella earlier on Monday said he believed the Australian trend away from high-density living was accelerating in the wake of the pandemic, noting that net migration to regional areas was up 60 per cent and the share of detached dwellings from total approvals was up 6 per cent at 67 per cent in the second half of the year.

“We have seen it manifest in sales. The Australian steel products business had the highest level of sales that it’s had for 10 years. Part of that was the additions and alterations that we’ve called out, where people at home are thinking about the amenity they have in their homes,” he said.

“But there’s no doubt we’re seeing that shift towards lower density and the regions. And that move to regionalisation works well for us.

“How long will it last? I don’t have a definitive answer to that, but we’re guiding to another six months of really quite strong activity in the Australian domestic market between now and June. Our customers — builders, etc — are largely telling us they’ve got strong order books through 2021, so it will be interesting to see where this ends.”

BlueScope’s Australian steel business had delivered EBIT of $259m for the half year, up 103 per cent.

Mr Vassella said BlueScope was working on plans to reline the blast furnace at Port Kembla, most likely through the refurbishment of a furnace idled in 2011, at a likely cost of $700m-$800m.

While that would allow BlueScope to take advantage of developments in modern technology for blast furnaces, he played down the possibility it would be able to replace the coking coal used in the blast furnace by hydrogen by that time, saying he did not believe the technology would be ready for commercial use in time — or that a cheap supply of green hydrogen would be a commercial option for some time to come.

Meanwhile work is accelerating across the globe to replace carbon-intensive steelmaking with lower emissions options, including research that would replace coking coal with the use of hydrogen.

BlueScope would be a “fast follower” if other steel makers could prove that hydrogen could work cost-effectively in the steelmaking process, Mr Vassella said, although he warned the challenges would be immense.

He said the technical challenges were significant, but generation of hydrogen on an industrial scale would also need the resolution of difficulties around the energy required to produce the commodity, and issues around its transportation.

“It’s pretty sexy at the moment and there are a lot of people jumping on the hydrogen bandwagon. But there are enormous structural challenges to deal with this,” he said. “It’s not going to be ready for us in 2026.”

Earnings at BlueScope’s North American building products division rose 189 per cent to $70.5m, but its North Star mill operations felt the pinch from the fall in automotive manufacture, with EBIT down 39 per cent at $69.6m.

BlueScope gained 39c, or 2.3 per cent, to $17.67 on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout