Treasury Wine Estates slammed at Sohn Investment Conference

A hedge fund manager says Treasury Wine is inflating sales figures and its share price has a “50pc downside”.

A US hedge fund manager has savaged Australian winemaker Treasury Wine Estates, accusing it of inflating sales figures and warning that one of its big-selling US wines is facing stalling growth.

The 24th annual Sohn Investment Conference in New York was also told that Treasury’s share price has at least a 50 per cent downside.

Angela Aldrich, the founder and managing partner of Bayberry Capital Partners, was the only fund manager on stage at the conference to talk about an Australian company.

In a series of slides and talking points she attacked the Melbourne-based winemaker and called out what she saw as major operational problems for the business in the US, as well as in its big growth and earnings market of China.

Angela Aldrich at Bayberry pitches a short on $TWE with channel stuffing and bundled distribution as two primary catalysts #Sohn2019 #sohnconf19 #SohnConferences #sumzero

— Sohn Conf Foundation (@SohnConf) May 6, 2019

Investors in Australia later reacted to the attack by marking Treasury shares by more than 30 cents at the opening of trade, although the stock soon rallied to be down less than two cents.

The Sohn conferences are held all over the world, including one held in Melbourne last year, where high profile fund managers and investors talk about their big picks in equities, focusing on just one stock that they are investing in on behalf of their own investors.

Typically a stock primed for super premium returns is chosen, but in this case Ms Aldrich, a hedge fund manager, chose to attack Treasury Wine and its model.

In a scathing presentation to hundreds of investors, media and guests in the audience she said that after a recent run that has seen Treasury Wine shares rally by more than 350 per cent, she is now “short’’ the Australian winemaker and believes it has at least 50 per cent downside.

She said the “bull’’ thesis for Treasury Wine was the huge growth opportunities in China and that Treasury Wine’s labels in the US, such as 19 Crimes and Beringer, were “killing it’’.

However she said the real picture was that Treasury Wine’s business in China was being threatened and undercut by fakes and counterfeits and that 19 Crimes was facing slowing growth.

In a blistering slide she accused Treasury Wine of so-called channel-stuffing - defined as the practice in which a company inflates its sales figures by forcing more products through a distribution channel than the channel is capable of selling.

In a slide headlined “TWE’s AU special sauce…’’, Ms Aldrich quoted wine industry executives claiming Treasury Wine was engaged in large scale channel-stuffing, including doing this online.

Unnamed wine distributors and former Treasury Wine employees were also quoted in the allegations of channel-stuffing, including for its premium luxury label Penfolds.

Angela Aldrich at Bayberry pitches a short on $TWE with channel stuffing and bundled distribution as two primary catalysts #Sohn2019 #sohnconf19 #SohnConferences #sumzero

— Sohn Conf Foundation (@SohnConf) May 6, 2019

Ms Aldrich also focused on recent export data from Wine Australia showing a sharp drop in wine volumes exported to Asia for the 12 months to March. Treasury Wine had felt it necessary to put out its own press release “just minutes later’’, according to Ms Aldrich, in an attempt to counter the official poor export data.

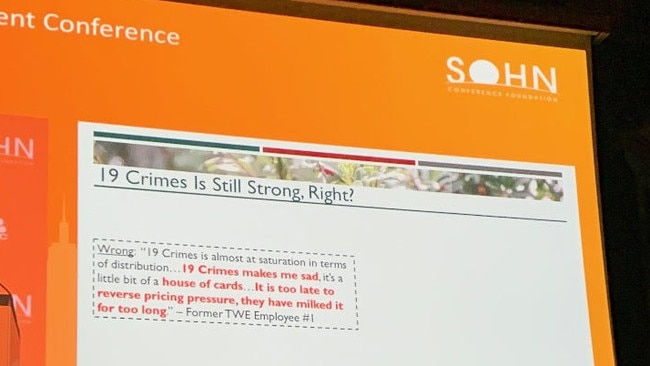

In another slide she attacked the idea that Treasury Wine’s blockbuster wine in the US, 19 Crimes, was “still strong”.

“Wrong,” Ms Aldrich said, adding a quote from a “former TWE employee” that: “19 Crimes is almost at saturation in terms of distribution. 19 Crimes makes me sad. It’s a little bit of a house of cards. It’s too late to reverse pricing pressure, they have milked it for too long.”

Ms Aldrich also told the Sohn conference about recent management departures at Treasury Wines. These included five division heads, four chief financial officers and three global executives in the last five years.

She said Bayberry sees at least a 50 per cent downside on the stock.

Ms Aldrich’s firm Bayberry is a long-short equity firm that invests globally. Prior to founding the firm, she spent almost six years at Blue Ridge Capital and has also worked at Goldman Sachs in their investment banking division.

Treasury Wine CEO Michael Clarke was not commenting this morning but the company said in a statement to The Australian: “TWE recently reiterated guidance to the market for reported EBITS growth of approximately 25 per cent for F19, and in the range of approximately 15 per cent to 20 per cent for F20. We are pleased with how the business is performing across all regions and across our portfolio.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout