Treasury Wine Estates mulls Penfolds demerger

Penfolds, one of Australia’s best known wine labels, is set to be spun off under a surprise plan announced by owner Treasury Wine.

Outgoing Treasury Wine Estates chief executive Michael Clarke insists a planned demerger of the company’s flagship Penfolds business has not been rushed, despite equity markets facing their most brutal collapse since the global financial crisis.

Mr Clarke unveiled the proposed demerger, which would create a new ASX top 50-100 company worth at least $7.5bn, on Wednesday after spate of profit warnings and the completion of a strategic review.

The decision to split Penfolds came as a surprise, given Mr Clarke said in January that the strategic review would “include options such as internal divisionalisation but not demerger”.

Even before the outbreak of coronavirus, Mr Clarke warned of an earning hit as the company struggled with an oversupply of wine in the US which has fuelled aggressive discounting a dramatic rise in private label brands.

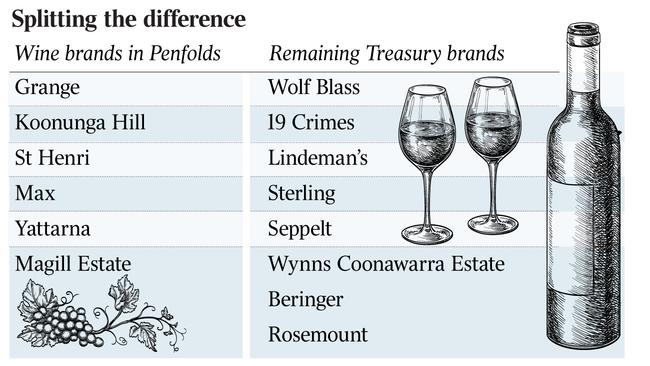

The intent to split Penfolds from the rest of Treasury Wines brands, which include Wolf Blass, Beringer and Lindeman’s, comes as the company faces a class action from angry investors, who say the winemaker should have known the US wine glut would hit earnings before it issued its first profit warning in January.

Mr Clarke confirmed he would step down from the company as planned on July 1 and declined to give details about the proposed demerger, including future production and distribution arrangements between a stand-alone Penfolds and the remaining Treasury Wines business.

He said as part of the strategic review the company has explored “all options” including selling off brands and company assets as well as demerging its commercial wine business.

But Mr Clarke said the demerger of Penfolds — which comprises about 10 per cent of Treasury Wines’s volume but more than 50 per cent of earnings — was the most straightforward option.

“Penfolds operates through a different structure so it’s very easy to separate and we have already done the feasibility work, otherwise we wouldn’t have mentioned it,” Mr Clarke said.

“It’s a lot easier to demerge than the commercial business being demerged from luxury, which has been discussed … and would involve a lot of work.”

But Credit Suisse analyst Larry Gandler believed splitting Penfolds, which he valued around $7.5bn, from the rest of the group was easier said than done.

“It is very difficult to isolate Penfolds. The essence of the Penfolds brand is to use technology to blend the best grapes from an array of vineyards that supply other brands as well,” Mr Gandler wrote in a note to investors last month.

“That is why Treasury Wines is the largest vineyard holder in Australia with many brands under its roof.”

Chief operating officer Tim Ford, who will take over from Mr Clarke in July, said Penfolds and the remaining Treasury Wines could “stand on their own two feet”.

“While there is a significant amount of fruit and vineyards and grower contracts allocated to Penfolds, as well as the other brands, by separating these businesses both businesses will compete for the opportunity to source fruit … to fuel their growth going forward,” Mr Ford said.

Treasury Wine’s shares jumped as high as $11.54. They later eased to close 0.5 per cent higher at $10.61 versus a 0.9 per cent drop in the broader sharemarket.

CLSA analyst Richard Darwick asked why Mr Clarke had announced the intent to demerge Penfolds now, given the current coronavirus-fuelled volatility and global uncertainty.

“It just feels and looks like this is quite rushed,” Mr Darwick said on an investor call.

Mr Clarke stressed that the plan had not been cobbled together or designed to deliver a share price boost.

“It is anything but rushed. We constantly work on different options on how we run the business, how we will manage the business and how to deliver the best return to shareholders,” Mr Clarke said.

“We have detailed plans in place for everything that we are talking to. We know numbers and details of what we are trying to achieve.”

Mr Clarke said he unveiled the proposed demerger now instead of at the company’s full-year results in August to prevent any leaks.

“There are a lot of people internally who are working on this and there are a lot of people externally who are helping us work on this. There is always the chance of leak and we’d rather get this out before anything leaks and therefore you can control the agenda.”

He said Treasury Wines was at a competitive disadvantage when it came to releasing more details about the demerger and its business.

“People would always like more detail from Treasury Wine Estates (but) we have a distinct disadvantage versus our competitors whether they are private or listed.

“Private wine players don’t share details and the big listed players globally also don’t share details because they’re bigger businesses tend to be beer or cannabis or tobacco so they don’t get into the detail.”

Since its first profit warning in January, Treasury Wines’s share price has dived 40 per cent from a high of $17.70. It is for this reason that one analyst said the company had a change of heart regarding a demerger.

“When your share price has been belted to buggery, the dynamics change,” the analyst said.

“The scenario changes when the share price is $9-10 versus $17.”

Morgans analyst Belinda Moore said there had long been a desire to demerge Penfolds, given it was the “jewel in the crown” of Treasury Wines and worth more than the rest of the business.

She said Treasury Wines was still a solid company with a range of iconic brands. “It’s not that anything is broken it’s just that the industry conditions are very tough.”

“There has been an oversupply in the US, rapid growth of private label and competitors being irrational. Then there is COVID-19, which no business is immune from, which as led to a material fall in Asian sales.”

Meanwhile, Bank of America Merrill Lynch analyst David Errington welcomed the proposed demerger. “I’ve been waiting 25 years to see Penfolds as a stand-alone and I think it’s fabulous.”

The demerger remains subject to a detailed evaluation of the costs and benefits to shareholders, along with final board, shareholder and regulatory approvals. Mr Clarke said it was also subject to the stabilisation of market volatility and the COVID-19 pandemic.

“If a decision is made to proceed and is approved by shareholders, the potential demerger is expected to be completed by the end of calendar year 2021,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout