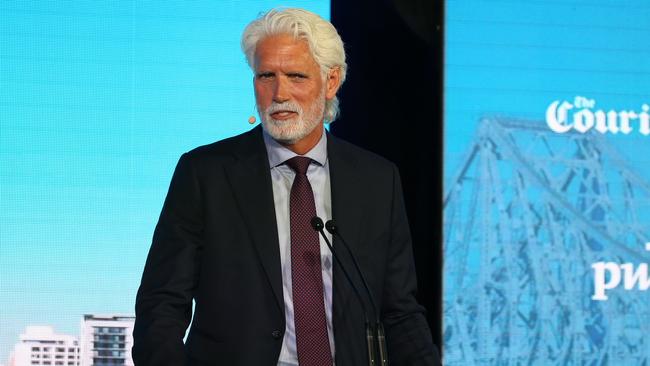

Transurban can fill the infrastructure gap if governments retreat: Scott Charlton

Transurban chief executive Scott Charlton says the toll road operator is prepared to step in and fill the potential gap from a pull back in government spending.

Transurban chief executive Scott Charlton says the toll road operator is prepared to step in and fill the potential gap caused by the Albanese government’s decision to investigate the worthiness of hundreds of infrastructure projects worth more than $120bn, as cash-strapped governments turn to the private sector for help.

Mr Charlton, Transurban’s prolific dealmaker who will step down at the end of the year from the $46bn toll roads and infrastructure specialist, is eyeing opportunities in the space as budgetary strains for federal and state governments threaten to constrict the pipeline of new projects across the country.

“What has typically happened over time is they (governments) turn to the private sector for the ability to fund and deliver infrastructure, so we think over the medium term that will actually create opportunities for us because they are going to need the private sector to help deliver not only on transport, but also the energy transition and elsewhere,” Mr Charlton told The Australian on Monday after holding a Transurban investor day.

A flurry of deals including stepping in to pick up the slack from governments and bidding for a controlling stake in Melbourne toll road EastLink will likely fall into the lap of Mr Charlton’s successor.

That field has narrowed after Transurban veteran and boss of its Sydney WestConnex toll road Andrew Head said he would leave at the end of the year. His shock departure sharpens the odds that the CEO reins will be handed to Transurban chief financial officer and former ANZ Bank CFO, Michelle Jablko.

Federal Infrastructure and Transport Minister Catherine King announced on Monday a 90-day independent review of Australia’s 10-year, $120bn infrastructure pipeline, conceding it had blown out under successive Coalition governments from 150 projects to nearly 800.

Transurban believes it could take a more hands-on role to help deliver infrastructure projects, particularly given recent announcements on Australia’s enlarged immigration program.

“I think that’s why you see so many global funds and other people interested in Australia because there is a lot of infrastructure still to be built because of a growing population which is a strong tailwind for us,” Mr Charlton said. “And then when government budgets are under constraints, that means they are going to have to look to people like Transurban to help.”

While the demographics were stacking up as a win for players like Transurban, Mr Charlton added that “nothing happens quickly in infrastructure”.

“We are always in discussions on how we think we can improve the network but, again, nothing happens in infrastructure quickly, so you have got the NSW government getting their feet under the table, you have got a federal government getting their feet under the table.

“Obviously Queensland has got the Olympics coming so maybe some stuff there, but over the medium term we believe this is good for Transurban as you’re going to have the combination of migration or growth in population and constrained budgets which usually means they turn to the private sector for help.”

Transurban told investors it had harnessed improving traffic numbers across its roads after the end of Covid-19 lockdown restrictions and better-than-expected outcomes on its financing costs to ratchet up its distribution guidance for 2023.

It is the second time in six months Transurban has lifted guidance, highlighting the strong rebound in traffic numbers as the country emerges from Covid.

Unveiling the new distribution guidance for 2023 before the start of its investor day on Monday, Transurban said the rising traffic momentum and advantageous financing had more than offset higher investments in strategic development.

This has seen Transurban issue an upgraded guidance of 58c per share, representing 41 per cent growth on 2022 and 1c above prior guidance of a 57c payout.

Mr Charlton highlighted the growth opportunities for its infrastructure assets which include WestConnex and toll roads spread across Melbourne, Brisbane and the greater Washington area in the US.

Although traffic numbers across its toll roads was returning there still was a gap of around 12 per cent linked to airline travel which was holding back some activity on its roads. Stubbornly low CBD office tower occupancy rates in Melbourne were also impacting traffic numbers.

Investors were reminded Transurban owned a high quality portfolio of assets with embedded inflation-linked toll charges helping to protect earnings and its key toll roads bolstered by strong macro trends. This included unemployment remaining low with population growth forecast in each market.

In Sydney more than 60 per cent of the population lived within 5km of a Transurban toll road, in Brisbane the figure was more than 45 per cent, and in Washington more than 20 per cent.

Across all key markets – Sydney, Melbourne, Brisbane and Washington – there were strong forecasts for population growth and low unemployment.

There was a strong pipeline of future toll road opportunities, investors were told.

Transurban also updated investors on its West Gate Tunnel project in Melbourne, with 99 per cent of tunnelling and portal excavation works now complete, meaning most of the riskiest parts of the build had been finished, and progress was made on the 40 or so bridges being constructed or improved across the project.

Transurban shares fell 7c or 0.5 per cent to $14.92.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout