Transurban eyes start of economic recovery

Transurban has moved into recovery mode after a bruising six weeks of steep traffic falls from the COVID-19 pandemic.

Toll-road giant Transurban has moved into recovery mode after a bruising six weeks of steep traffic falls from the COVID-19 pandemic with drivers returning to its Australian roads more quickly than expected.

Saturday marked the best weekend day of traffic for NSW and Queensland since March 21, just before coronavirus restrictions were put in place, although Melbourne barely budged given tougher lockdown measures remain in place.

While traffic was still 50 per cent lighter in the two states than for the same period a year ago, the figures indicate the worst is now behind Transurban after it was slugged with falls of two-thirds during other Saturdays in the six-week period.

“You could definitely tell the change in travel restrictions in Queensland and two people in NSW being able to visit other people also had an impact,” Transurban chief executive Scott Charlton told The Australian.

“The restrictions in Victoria are still there so we didn’t see a change in that state.”

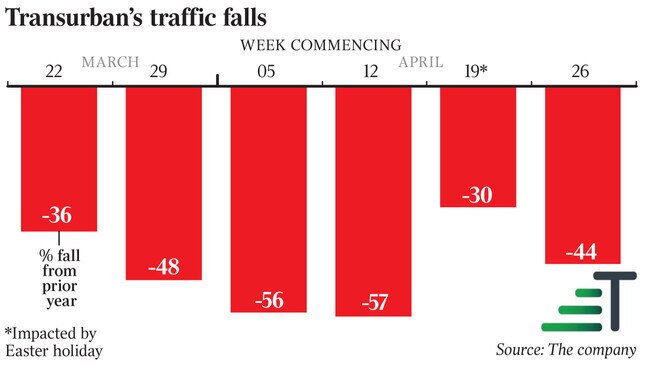

More broadly, Transurban said traffic was slowly returning to Australian roads with falls in April of 50-65 per cent on its Sydney and Melbourne toll roads easing in the last week as COVID-19 restrictions were loosened. Still, making a broader call on the trajectory of Australia’s economic recovery remains highly uncertain given the global nature of the health crisis and the potential effects from a second wave of the virus.

“For us it’s impossible to call because it relates to what happens for the potential for a second wave of infections, or not, and then where our global trading partners are and how they continue to handle the virus,” Mr Charlton said.

“Compared to where we were three weeks ago, we are certainly a lot more optimistic but it’s too early to call and we’re preparing for quite a few different scenarios. There’s still a long way to go before we come out the other side.”

Transurban has looked to China for a guide on how Australia may ultimately recover from its economic slowdown and noted people had used less public transport and more car travel in the early stages of recovery.

“For those areas that have started to recover that has been the trend and we’ve seen pick-ups in our roads and private vehicles but haven’t seen much pick-up yet in public transport,” Mr Charlton said. “That would make sense in the short term when things come back online given the lack of congestion on the network as well as concerns about those public environments.”

Despite the big falls, Transurban said it had no plans to raise equity, with that option only being pursued should it consider striking a deal. Still, tougher restrictions in North America remain, putting some pressure on covenants linked to its US private activity bonds.

Traffic dropped by 70 per cent in the week starting April 5 across its three roads in Washington and Montreal following mandated lockdowns, in line with peer toll-road operators in Europe, which dived between 60 per cent and 80 per cent due to lockdowns. North American traffic eased to be 61 per cent down in April’s final week.

Transurban’s overall traffic decreased by 44 per cent in the week starting April 26 after hitting a 57 per cent decline during mid-April.

Heavy truck traffic held up more strongly, down 13 per cent in Sydney and 20 per cent in Melbourne for the week starting April 26, after falls of 27 per cent and 36 per cent in mid-April.

The company has $3.5bn of funds available from April this year to the end of the 2021 financial year, with $2.9bn committed through capital spending or debt refinancing. It raised an extra €600m ($1.08bn) in the European bond market on April 2. The company abandoned its second-half dividend guidance on April 1 and UBS expects the 31c payout will be slashed to just 11c with only underlying cash flow to be paid.

Transurban also said it had poached one of AGL Energy’s top executives, Simon Moorfield, as its new head for customer and technology and would soon hire a new head of risk management.

Transurban rose 2.8 per cent to $13.63.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout