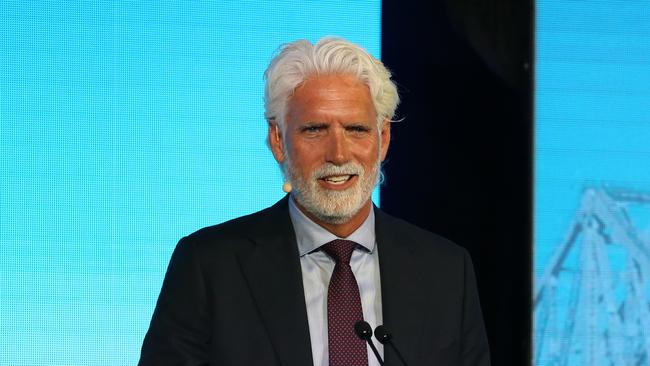

Transurban chief Scott Charlton warns of labour, materials risk

Labour and materials shortages pose the greatest risks to Australia’s $647bn infrastructure pipeline, says outgoing Transurban chief Scott Charlton.

Labour and materials shortages pose the greatest risks to Australia’s capacity to deliver its $647bn infrastructure pipeline, according to outgoing Transurban boss Scott Charlton.

Mr Charlton announced his departure from the toll roads giant on Tuesday after close to 11 years as chief executive, and as the company pushes ahead with its own pipeline of road projects in Melbourne and Sydney.

He said he would spend time considering new opportunities in the corporate world before finishing up with Transurban at the end of the year.

Before then, excavation works at Transurban’s $10bn West Gate Tunnel project in Melbourne are expected to be completed by the middle of the year, while final regulatory approvals for its $1.7bn M7-M12 Integration project in Sydney are expected imminently.

Speaking after handing down the company’s first-half results, Mr Charlton said Australia was well placed to weather the economic storm and avoid a recession, but labour and materials shortages continued to be a significant challenge for major infrastructure projects nationwide.

“Victoria has got a strong pipeline, NSW still has a strong pipeline, but I think the biggest risk for major infrastructure projects is the skill set to deliver that pipeline, and having enough materials because for almost everything we do we need to import steel from overseas, import a lot of other materials,” he said.

“Labour in the construction sector is still constrained. We’re really pleased because we’ve been pushing for more skilled migration – particularly for certain skill sets, which has come through and that’s good.

“But I think rather than interest rates, I think the biggest risk is the capacity and the capability of the market to deliver these mega projects.”

Mr Charlton’s comments echo the findings of Infrastructure Australia’s market capacity report, released in December, which stated that the infrastructure market was “arguably at capacity”, with “unprecedented uncertainty on project outcomes”.

“It is no longer a question of if a project will slip but more likely when, by how long and at what cost,” the report says.

In crafting its own development pipeline, Transurban uses data science to model the impact of population forecasts and traffic trends across cities.

The company is the dominant player in Australia’s toll road market, helping to deliver new and expanded road networks across Sydney, Melbourne and Brisbane, and with motorways in Canada and the US.

Mr Charlton said there’d been “tense times” will all state governments he’d worked with over the years, but those that were able to cut through the bureaucracy were most likely to deliver the best results for taxpayers.

“Where we’ve had the best results, like NorthConnex, is where we sat down with the NSW government and said we think we can deliver this project 10 years earlier than your plan, we think we can deliver it for less money and with less homes being taken,” he said.

“And they said great, let’s do this. And how do we ensure value for money for taxpayers and good outcomes? And that’s been a great asset in Sydney.

“For us, we’ll provide good policy advice, traffic advice, data, to any government. We’re not here to be liked, we’re here to be respected for what we can do and what we can bring to the table, and hopefully we’ll show over time that for all governments we’ll be a good partner.”

Transurban on Tuesday handed down its strongest revenue growth on record for the six months to December, on the back of rebounding traffic numbers and inflation-linked price rises.

Proportional EBITDA, which reflects the company’s ownership interest in its toll roads and is the company’s preferred measure of performance, increased 53.7 per cent from the same time last year to a record $1.24bn, off a 42.6 per cent increase in proportional revenue to a record $1.66bn.

The company will pay an interim dividend of 26.5c, and lifted its full-year payout guidance to 57c, up from an earlier estimate of 53c.

Average Daily Traffic (ADT) figures exceeded 2.5 million trips for the first time in November across its Australia road network, with record traffic volumes reported in the first half across Sydney and Brisbane.

However, Melbourne has been slower to recover from Covid-19, with traffic levels still 7 per cent lower than before the pandemic, despite a 45.7 per cent increase from the same time last year.

Mr Charlton said the slower recovery reflected the severe lockdowns that gripped the city at the height of the pandemic, but was confident traffic volumes would return to their pre-Covid levels with “six months to a year”.

“When we look at Toronto and a few of the other global cities, those cities that were in lockdown for longer, and restricted for longer, it’s just taking a longer time to recover,” he said.

“So we saw Brisbane recovered very quickly and it probably had the least amount of lockdowns. In Melbourne, it’s just a bit slower, and we would put that down to the extent and the amount of lockdowns and the impact, particularly on the CBD and the offices.

“And obviously City Link is more exposed to the CBD and to the airport. But we’re seeing the airport traffic come back so that will continue to improve.”

Mr Charlton said while the shift to hybrid working was taking some commuters off capital city roads, it was being offset by an increase in freight and weekend traffic, and a growing number of workers choosing to drive rather than take public transport.

Transurban also announced on Tuesday it had agreed to sell a 50 per cent stake in its A25 toll road and bridge network in Montreal for $C355m ($385m) to Canadian investment group CDPQ.

However it intends to make a play for Melbourne toll road EastLink, which is currently being prepared for sale.

EastLink, which links the Eastern Freeway in Melbourne’s eastern suburbs to the Frankston Freeway in the southeast, is owned by a consortium of offshore superannuation and pension funds and is thought to be worth up to $4bn.

It is unclear which of the current owners are looking to selldown their stakes.

“At this point in time we’re just registering our interest and then we just have to wait and see how the process plays out,” Mr Charlton said.

“If we’re going to be involved we prefer to be involved in a meaningful way. But depending on who the partners are and the terms I think it’s a bit early to speculate.”

Transurban said it had commenced a global search for a new chief executive, but Mr Charlton noted there were also several internal candidates suitable for the top job.

Transurban’s WestConnex boss and one time PwC executive Andrew Head and former investment banker turned chief financial officer Michelle Jablko are among those leading the race.

In a note to clients Citi analyst Suraj Nebhani said Mr Charlton’s departure would be a loss for the company.

“Scott has been instrumental in the strong growth that the business has seen,” he said.

“While press had previously reported potential for Scott Charlton to leave, we believe confirmation of Scott leaving will be seen as a loss for Transurban investors, and expect the stock to react negatively.”

Transurban shares closed 8c, or 0.6 per cent, lower on Tuesday at $13.95.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout