Tissot’s timeless strategy to take on Apple Watch

Tissot boss Sylvain Dolla has a plan to take on the rise of the Apple Watch, which has outsold the entire Swiss watchmaking industry for the first time.

Tissot chief executive Sylvain Dolla doesn’t buy into the doomsday predictions that the Swiss watch industry is spiralling into another existential crisis at the hands of US tech titan Apple.

After all, the Swiss watch industry has shown it can adapt. The Swatch Group, Tissot’s parent company and owner of other brands from Hamilton to Omega, was formed almost 40 years ago to counter the rise of cheaper and reliable Asian quartz watches.

While in the early 1980s quartz watches were seen as a threat to Swiss watchmaking, Dolla says he doesn’t see history repeating itself with the Apple watch.

And this may appear odd. Earlier this year it was revealed annual sales of the Apple Watch had overtaken all the Swiss brands combined for the first time, and by a significant margin.

The US tech company — which effectively killed off Nokia and BlackBerry after it launched the iPhone in the late 2000s — shipped 31 million Apple Watch units worldwide in 2019, compared with the Swiss watch industry’s 21 million, according to a report from Strategy Analytics. That’s a margin of 10 million units: half the total sales of the Swiss watch industry.

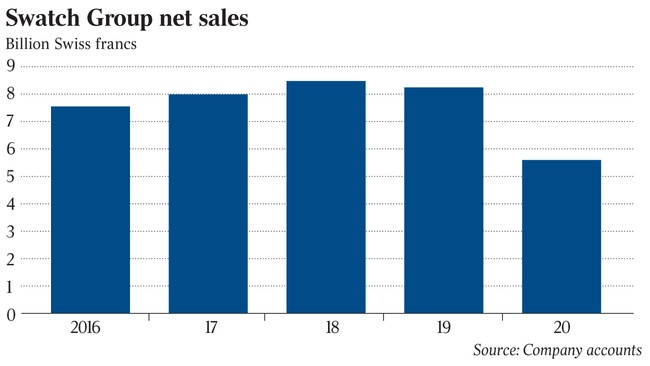

Making matters worse for Swatch Group, its 2020 full-year results were awash with red ink as it sank to its first loss in almost 40 years after the COVID-19 pandemic shut down shops and drove down consumer spending.

Sales dived 28.7 per cent to 5.59 billion Swiss francs ($7.88bn) during 2020, versus a 22 per cent slide across the Swiss watch industry overall. Meanwhile, the company posted a loss of 53 million Swiss francs ($74.73m), its first since 1983 when Swatch Group launched its first plastic watch.

But when it comes to the rising threat of smart watches Dolla isn’t fazed — or at least doesn’t appear to be.

“We are in a totally different world and I don’t see it as competition,” he tells The Australian from Switzerland.

“I am not concerned at all because I see a radical difference. Any brand that does a smart watch, they are in the consumer electronics world, meaning doing a very high technology product but with a very short life product. That’s the opposite to what we are doing.”

It’s true that consumers love quality and hope their products have some longevity. But history is littered with examples of companies that collapsed because they made products that lasted for years — think Fletcher Jones before it entered its slow-moving death spiral at the hands of fast fashion.

Companies have to strike a balance to keep generating sales but not to the point their products become disposable. And Dolla is betting on watches not only marking time, but being timeless.

After all, watches are often given as graduation presents or parting gifts to long-serving employees — or as a reward to employees, like the Cartier watches Christine Holgate gifted to Australia Post executives. They are symbolic. And nothing shows off a greater symbol than the words “Swiss made” painted neatly on a watch dial.

This is the market Dolla wants to serve.

“Millions of people who buy a Tissot watch every year look to the long-term, they look for longevity in the product,” Dolla says.

“We have people that after 10 years come back to get their watch refurbished. Try to refurbish your phones that are 10 years old — good luck — or any consumer electronics product.”

Dolla was appointed Tissot’s chief executive in June last year, after running stablemate Hamilton for more than 10 years.

His appointment coincided with the launch of Tissot’s own long-awaited smartwatch, the T-touch connect solar. But Dolla doesn’t call it a smartwatch. Instead he refers to it as a connected watch.

“It’s a different value proposition. We are not selling a commodity — a consumer electronics device that will be phased out after two years and will not be working after three years.

“We have added connectivity for key functions. But even in let’s say six years — let’s go crazy and say bluetooth doesn’t exist anymore — you’ll still have a fine watch with hands, with functions that can be used in the non-connected way and you still keep the value of your watch.

“We started to sell it very well. We are very happy with the first four months.”

Despite the challenges from COVID-19 lockdowns, Dolla is confident sales will rebound and he says Tissot has been stepping up its investment in innovation, marketing and people to ensure it is well placed when the pandemic eases.

“When there is a crisis there are two ways to approach it: you can get scared and stop thinking long-term and think short-term, or you have confidence in the team, the brand and you still invest and accept to reduce your profitability in the short-term to be able to get even stronger when the crisis is over.

“In the fourth quarter of last year we continued to recruit people. It’s not the time to get the team scared by redundancies. It’s not the time to be laying off people. It’s a time of strengthening the team to get to the position we need to be.

“We have accelerated our digitisation of the company because of the COVID-19 situation. I have to say I’m very satisfied with the performance and the way the teams have reacted in the countries. I was checking yesterday the Swiss watch price point exports and the market share of Tissot and I saw we had an increase of 1.9 per cent in our market share in the Swiss watch exports … so we gained market share.

“We have a whole different strategy of believing in the brand, in the future, and it pays back.”

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout