‘They’re all gamblers’: high-stakes Crown still in play

James Packer’s Crown empire is still in play, despite Wynn Resorts shutting down talks because of premature disclosure.

Billionaire James Packer’s desire to sell his Crown Resorts casino empire is still alive, with the company now in play and disgruntled suitor Wynn Resorts not ruled out to return.

Crown Resorts, in which Mr Packer holds a 46.8 per cent stake, surprised the Australian market on Tuesday when it revealed it was in talks with Wynn about a $10 billion takeover.

The Las Vegas giant initially confirmed it had engaged with Crown but made a surprise announcement only hours later that it was walking away because the preliminary discussions had been “prematurely” disclosed.

Despite the abrupt end to the talks, Crown’s shareholders believe a deal will be completed at some point to sell the Australian company.

James McGlew, the executive director of corporate stockbroking at Perth's Argonaut and a Crown shareholder, said it was not the last Crown would hear from Wynn. “There has been a clear shot fired across the bows of the Crown board that the company is being eyed off,” he said.

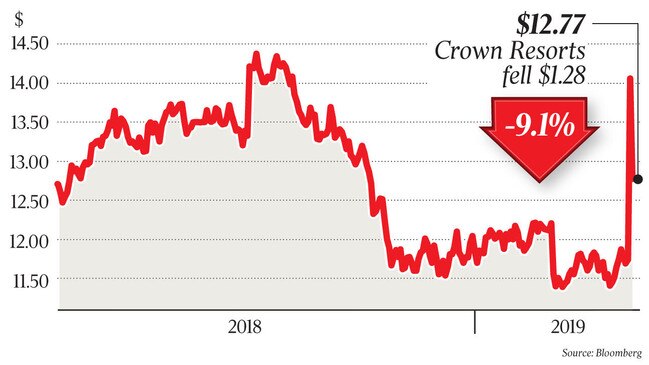

Crown’s shares jumped almost 20 per cent on the news of a potential Wynn deal but fell 9.1 per cent to $12.77 yesterday. The share price suggests the casino company is in play, with a takeover premium now priced into its stock.

Crown has said it was approached by Wynn but industry insiders said the company had been seeking potential suitors, driven by Mr Packer’s plan to exit Crown. The billionaire stood down from the Crown board last year, citing mental health issues, and it is understood he is looking to offload the company and potentially become a passive shareholder in a global casino entity.

If the Wynn deal had proceeded, Mr Packer could have walked way with $2bn and a 10 per cent stake in Wynn.

One person familiar with the company said the leaking of the deal talks, which forced Crown to disclose to the Australian market details of the Wynn proposal, was to flush out other bidders or force Wynn’s hand on finalising its bid.

“Crown felt cornered, its stock has underperformed for some time,” the person said.

Macquarie’s analysts said the biggest question now for Crown’s shareholders was whether another suitor would come to the table.

“We think that for a transaction to stack up, it would need to be supported by revenue synergies with increased VIP volumes being redirected from Asia into Australia,” the analysts said.

“Galaxy Entertainment have significant VIP businesses in Macau, while Genting have significant Asian gaming operations.”

An industry source said there would now be several large US-based players casting their eye over Crown, adding that any casino company with exposure to Macau — a market that can be volatile — would be looking to Australian assets.

The cash and scrip proposal Crown said was put forward by Wynn, the second approach the suitor had made, had an implied value of $14.75 per share — a 26 per cent premium to Crown’s share price before the bid talks were disclosed.

One industry observer said while the offer price revealed by Crown was unlikely to have been endorsed by the board, it was clear Mr Packer was a willing seller around that price.

“It is likely that Wynn is still interested and Mr Packer is obviously a willing seller,” he said.

“We will see more play out on this as they are all gamblers and the last thing you do as a gambler is walk away from a big amount of money on the table.”

Crown told the Australian market yesterday it noted Wynn’s announcement that it had terminated all discussions with Crown.

Angus Gluskie, the managing director of White Funds Management, which holds Crown shares, said it was clear Wynn was incredibly frustrated with the fact the information had been released.

Mr Gluskie added that while Crown’s detailed release to the market on the talks was driven by corporate governance rules, there was suspicion the leak that led to that disclosure could have been to try and create tension around the negotiations.

“I think, given there are so many permutations there and we don’t have the full information around who started the (deal talk) process, it is impossible to be definitive about what is going to happen,” he said.

Industry insiders said the Wynn board was spooked by the disclosure of the deal talks as its main focus was dealing with a review of its casino licence in Massachusetts.

The Massachusetts Gaming Commission is analysing whether Wynn is suitable to hold a gaming licence after sexual misconduct allegations against former chief executive Steve Wynn, which he has denied.

Analysts have predicted that Wynn was looking to take over Crown to beef up to defend against potential suitors looking to take control of Wynn, amid regulatory concerns in the US and the expiry of its Macau gaming concession in 2022.

The acquisition of a casino company with a Macau asset was likely the only way for a new entrant to gain exposure to Macau.

Crown, which has casinos in Melbourne and Perth and a development in Sydney, has been facing headwinds of its own and its board would likely welcome a bid at the right price.

Prior to the bid being revealed, Crown’s shares had been down about 20 per cent from their recent highs, reflecting concerns about main-floor gambling revenue and the company’s efforts to rebuild its VIP business after employees in China were arrested in 2016 and sentenced for gambling-related crimes.

Crown Resorts reported a 12.2 per cent fall in its VIP turnover to $19.9bn at its half-year result in February, flagging that while it had a “reasonable” number of visitors from China, their spending was down.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout