There’s a quiet revolution going on inside Qantas boardroom

A financially strong airline is good for customers, just as much as investors. And one subtle change from the Joyce-era has big implications over how Qantas is run.

The final piece of Qantas’s pandemic recovery has fallen into place, with the airline sending $400m to shareholders – and another $400m to Canberra.

More than anything, dividends and tax are a symbolic return to business as usual for the airline after the near-fatal Covid-19 chaos.

This first dividend payment after six years puts Qantas back in the club of international majors, with the likes of Singapore, Delta and British Airways-owner IAG all resuming dividends.

Even Lufthansa started sending cash back to its suffering shareholders more than a year ago.

The new Qantas is minting spare cash; it’s rebuilding the balance sheet; and, importantly, by spending billions on new aircraft, it’s investing in customers. And just like many big airlines around the world, its shares are flying high.

A financially strong airline is good for customers just as much as investors. And a stunning December half underlying profit of $1.39bn, underpinned by its discount Jetstar arm, means the airline is now back on track. However, aviation is prone to boom and bust cycles, probably more than any other industry. And the good times now won’t last forever.

Discipline key to success

Chief executive Vanessa Hudson, the airline’s former finance boss who took over from long-serving boss Alan Joyce in 2023, is steadily working on the operational rebuild of Qantas and, along with new chair John Mullen, there’s a quiet revolution taking place inside the boardroom.

The pair have quietly overhauled the framework for balancing dividends against all the spending that’s needed to keep the airline running smoothly and growing into the future.

As we saw during the Joyce era, when there’s a loss of balance in capital allocation and too much goes back to investors, customers lose out, and this ultimately has savage reputational implications.

To sweeten the deal, Mullen has committed to pay shareholders a minimum of $500m a year as a dividend ($250m per half), as long as conditions allow over time.

They’ve made it more explicit around how capital is spent. Gone is the Joyce-era blanket ambition of “expanding competitive advantages” when it comes to spending money.

There are now return hurdles in place for all new spending. Debt targets are included to keep a disciplined credit rating and strong balance sheet. And after investments are made Qantas has promised to return any surplus funds to shareholders as special dividends, on top the “base dividends”.

Under the changes, Qantas has subtly de-emphasised ESG spending under its financial framework – although firm ESG targets remain in place elsewhere. The airline’s financial framework is now about earnings growth through the cycle and having total shareholder returns at the top of the pack among global airlines.

All capital spending now goes through continuous review, with the hard questions asked on whether it should instead be redirected to higher-returning parts of the business. This helps avoid the traps of value-sapping M&A.

Hudson says it’s about disciplined spending in a phase of reinvestment. Capex is not just about new planes, its also around how existing aircraft are used, route planning and ground facilities.

“The reason why we bought that more to the forefront is that we’re going through a major fleet renewal, and every dollar of capital is precious,” Hudson tells The Australian.

“With those resources we owe it to our people, we owe it to our customers, and we owe it to our shareholders to make sure that we are spending every dollar and deploying every existing dollar of capital in the most efficient way.”

The financial and capital framework is aimed at benchmarking Qantas against some of the best-run airlines in the world.

A more focused framework results in a more sophisticated Qantas where capex spending is predictable. It helps avoid some of the wild swings in aviation where capex is slashed during tougher times to keep shareholders onside.

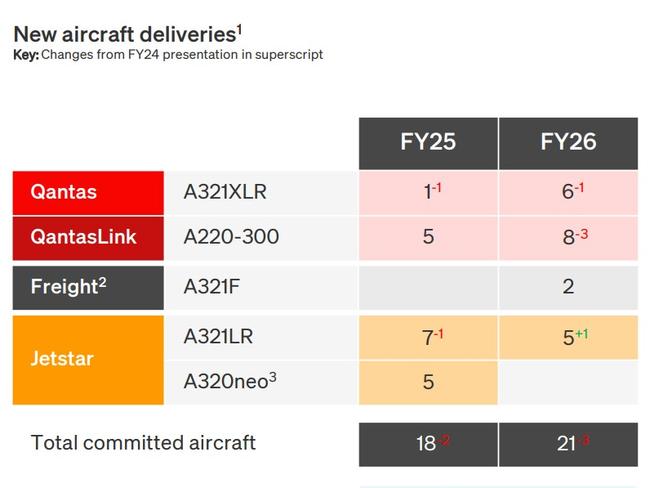

This year, Qantas will spend up to $3.9bn on new planes and refurbishment, increasing to $4.3bn next year. In the five years leading up to the Covid pandemic Qantas was averaging annualised capital spending of $1.5bn and $1bn in dividends.

.

Future growth

For some that might not seem that revolutionary, but it’s through a capital allocation framework that fundamentally changes the way capital-intensive companies plan for future growth and look after investors.

The best example of this is BHP under outgoing chair Ken MacKenzie. He drove what is now an obsession with capital allocation at the mining giant, to steer it through its own boom and bust cycles, giving it a platform to focus on longer-term planning while making it less prone to delivering negative shocks.

MacKenzie set the ground rules for return hurdles for investments, M&A, and sending surplus cash back to shareholders.

For decades BHP had been operating on the other side of the ledger. Too much of its spare cash was being directed back into simply growing the business with little measure of return, meaning investors came out second best.

It’s similar to the playbook that Mullen used at Telstra, where as the former chair he confronted years of lack of capital discipline.

It got to the stage of a dividend trap for Telstra management, where nearly every dollar of earnings was being sent back to shareholders. This had meant Telstra simply lacked the firepower needed to make the necessary investments to make its business more productive.

Telstra now operates around four principles, which commits the telco to investing for growth and returning excess cash to shareholders.

Under both Hudson and Mullen, financial changes in the boardroom and through management have the promise to fundamentally reinvent Qantas into a more balanced and better airline.

Coles makes running

With Woolworths struggling to get its mojo back, Coles boss Leah Weckert is using data and analytics like never before to squeeze sales growth from her supermarkets. Her supermarket sales jumped 4.3 per cent during the December half, although Coles got a $120m revenue benefit from the extended industrial dispute that crippled Woolworths.

Importantly, those sales fell through to the bottom line, with Weckert managing to expand margins through the period.

Part of this is using data to help determine range and even product size across stores.

For example, in fresh meat, Weckert says Coles has analysed sales and reduced the number of cuts on offer in some classes such as pork. This increases space for pork products that customers want to buy. It also reduces waste. The same goes for dry goods. Even with a storewide review of products on offer under way, the Coles boss insists it’s not about reducing choice, but removing duplication.

She says paring back the 13 types of table salt on offer, for example, frees up shelf space for other and sometimes cheaper products customers want.

There’s an additional 14 categories of specialty products from international foods and entertaining that now are being rolled out using suburb-by-suburb buyer preferences.

At the same time, Coles was able to use the data from its Flybuys loyalty scheme to pivot early to providing value, as customers were starting to feel the pain of inflation. It was noticeable early last year that more people were switching to points to help pay for the weekly shop, pointing to the financial stress many households are under.

The big focus for Weckert, however, was the performance of her new billion-dollar smart warehouses outside Sydney and Brisbane. And of all things it was Woolies that delivered the test during its pre-Christmas strike.

Even with the warehouses still in ramp-up phase, they were able to absorb a significant spike in volumes and ship more product to Coles stores in the southern states, where shoppers were switching from Woolies to Coles.

An additional $880m automated warehouse is planned for Victoria in coming years, giving Coles a significant edge over its rival in lowering the costs of running its supply chain.

Also coming online are Coles’ new fulfilment centres that use robots to pick and pack orders for home delivery. These also delivered during the demand spike last November and December. Woolworths is still in the construction phase of its version of fulfilment centres.

Weckert is revitalising a long underperforming Coles. She’s improving the fresh food offering, using technology better and cutting costly theft and waste. She’s paying up to secure these gains, with $1.3bn to be spent in the coming year, matching the peak spending of the past two years. However, investors are getting more comfortable with the benefits on offer. Coles shares on Thursday surged to a fresh record high. Woolworths is trading near four-year lows.

Liquor remains a soft spot that Coles has not been able to get right for more than a decade. However, with supermarket sales rising 4.3 per cent and profit margins widening, Coles is getting it most import businesses right.

A key difference is focus. For Coles, Australian supermarkets generate more than 90 per cent of its sales, for Woolworths it’s 74 per cent.

This means at Coles, management can respond quicker to the things that matter most to customers.