The chief executive of Equity Story, Trent McGraw, has resigned

Trent McGraw has resigned as chief executive of stocks advice firm Equity Story, and also resigned from the board, less than a year after it listed on the ASX.

Equity Story chief executive and director Trent McGraw has resigned all of his roles with the company less than a year after it listed on the ASX.

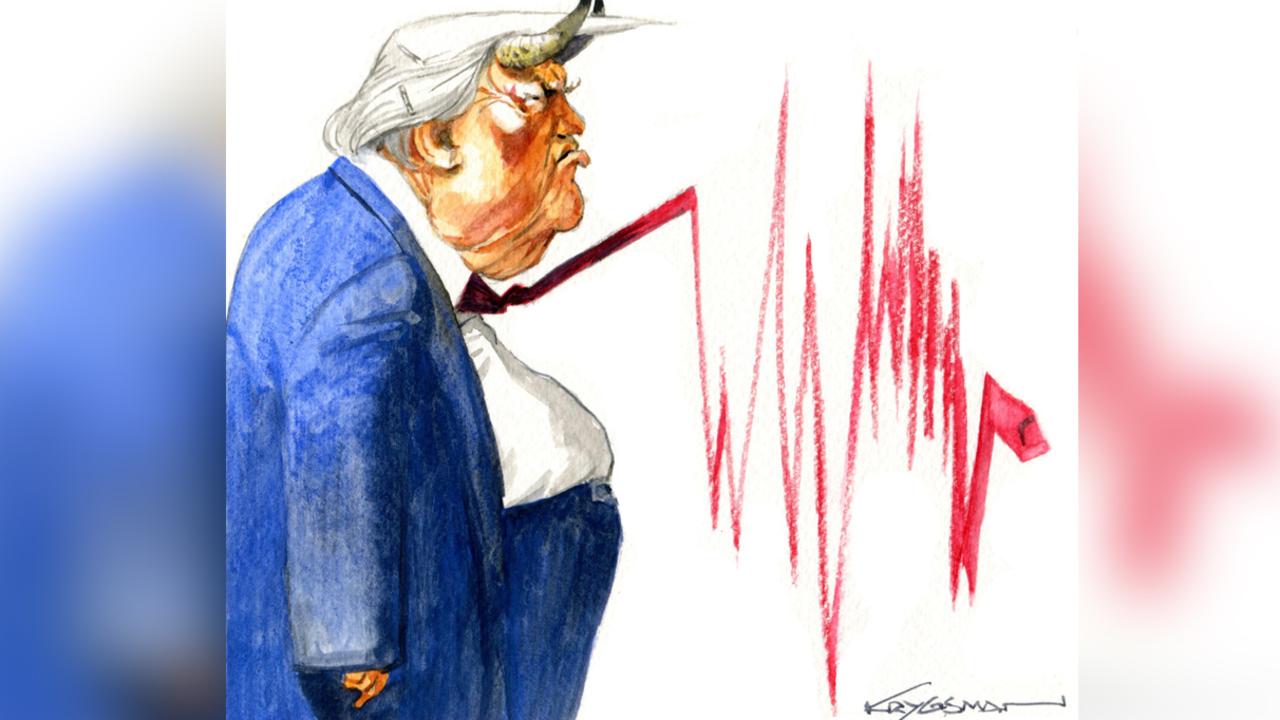

The company’s shares have struggled since listing at 20c apiece in May 2022, and are now trading at just 4c, valuing the company at $4.3m.

The company did not give a specific reason for Mr McGraw’s departure, however chairman Ben Loiterton thanked him for his contributions in a statement to the ASX on Tuesday.

“Trent contributed so much to the growth and ASX listing of Equity Story, and his efforts in the past two years were especially remarkable,’’ Mr Loiterton said.

“We understand and respect the reasons for Trent’s decision to resign. On behalf of the board, we sincerely wish him all the best for the future,” he added.

Mr McGraw said in the statement that it was not an easy decision. “The decision to move on was difficult, but it was the right time,’’ he said. “Much of the past year in particular has been focused on firstly executing the IPO and delivering on key milestones which included establishing US licensing; upgrading of AFSL licensing; establishing and generating first revenues from a new capital markets division; completing our first acquisition; making our first strategic investments; executing the first revenue sharing partnerships; receiving first revenues for paid research services; launching an independent education offering and now streamlining the executive team.

“I am glad to be moving on from (Equity Story) with this important work completed.’’

Equity Story’s annual report said Mr McGraw owned 11.2 million shares in the company, which would put his stake at just less than 10 per cent, and another 1.5 million options exercisable at 25c by May 4, 2025.

Equity Story executive director David Tildesley will assume the role of acting chief executive.

Equity Story had initially aimed to list in March last year however the float was pushed back to May with the Australian Securities and Investments Commission asking for clarifications around its business model.

The company provides stock picking advice to subscribers via a daily podcast and through other forms of regular investment recommendations, with packages priced at $1597 and $2597.

It also run a small investment fund open to wholesale investors.

Equity Story posted a $1.98m loss in the 2022 financial year, up from a $536,837 loss, while revenue fell 16 per cent to $897,164.

The company said in its annual report that the financial performance last year was “substantially impacted” by delays in the IPO process, and it was now focused on growth.

It acquired online investing and news site A Rich Life for $500,000 in June last year, with $250,000 of that payment to be made over the next two years.

Equity Story has also signed up Australian cricketing legend Glenn McGrath as an ambassador and has committed to donating 1 per cent of revenues from subscriptions and course fees to the McGrath Foundation.

In its latest quarterly report for the three months to the end of September Equity Story said receipts from customers were up 124 per cent quarter on quarter to $467,000 and it had $2.6m in cash at the end of the period.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout