The boss of Nestle Australia warns input costs are on the rise

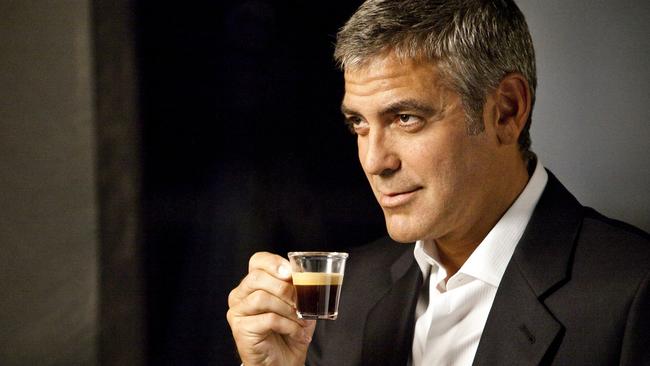

Owner of powerhouse brands Nescafe and Kit Kat has warned it will eventually have to pass on higher costs to consumers.

Nestle Oceania chief executive Sandra Martinez is battling inflationary pressures that are infiltrating “everywhere” across her food business, from steeper coffee and sugar prices to pricey shipping containers, and which she concedes will eventually be passed on to the consumer to protect the viability of the industry.

It comes as the craze for home baking that saw households in Covid-19 lockdown pump out sourdough bread has started to fade as people venture outside again, hurting sales of Nestle’s scratch baking goods, while consumers going back to their favourite barista are buying less instant Nescafe coffee and Nespresso coffee pods for the home.

Empty office towers too are weakening the interest in large tubs of Milo and instant coffee that once featured in kitchenettes.

But the explosion in pet ownership last year as people sought companion animals was helping to bolster sales of Nestle’s flagship pet food brand Purina.

Ms Martinez told The Australian on Wednesday the dramatic increases in costs over the last 12 months was forcing Nestle to work on value propositions for the consumer to help take some of the load, and that this was a challenge facing not just Nestle but the entire food and grocery industry.

With shipping container prices almost doubling, rising utility costs and a sustained climb in raw commodity prices, Ms Martinez warned the viability of the sector would be threatened without the ability to shift some of the higher costs to customers.

“It is everywhere. We are having huge input costs in terms of logistics, transport, we have a lot of headwinds from input costs,” Ms Martinez told The Australian after Nestle Australia lodged its most recent financial report, which showed a 7.9 per cent increase in sales to $2.37 billion for calendar 2020. It recorded a sharp rise in profit to $122.6 million in 2020 from $30.7m in 2019 when $48m in impairments hit its bottom line.

“All raw material costs are increasing, sugar, coffee, cereal, you name it, transport is increasing quite dramatically if we look at the limited availability of shipping containers in this part of the world.”

Nestle is not the first company to testify to inflationary costs now feeding into the industry with other businesses and retailers in particular sweating over the huge leap in the price of shipping containers which have almost doubled as there is a global shortage.

Ms Martinez warned at some point Nestle, the global food conglomerate whose powerhouse brands include Nespresso, Nescafe, Milo, Purina Pet Foods as well as a stable of baking, cereals, snacks and cooking ingredients, would need to recoup some of those higher prices from customers.

“We work very hard to try to offset as much as we can of those costs with initiatives, but at one point we will have to find a way of how we can design a value proposition that the consumer is ready to pay for.”

Ms Martinez said without some price relief for brand owners and manufacturers who were battling rising inflation it would challenge the viability of the sector.

“Otherwise it is not viable and I think everybody is on the same boat.”

Ms Martinez said Nestle in Australia was facing a return to overall sales growth in particular categories seen before Covid-19 as restrictions in Australia were eased, however some categories such as coffee were now suffering as lockdowns ended.

“What we are seeing this year is that we are basically back to normal levels before 2020,” she said.

“When you compare with 2019 there is some growth but not the level we saw in 2020, it depends on which categories we are talking about, so coffee consumption at home is still strong but not as strong as it was before. Australians love to get your coffee from your special barista, but there is still more home cooking.

“One category that we are seeing a stronger decline is home baking and maybe because you require a lot of time to bake from scratch and that is the one we are probably seeing a more decline than others. But in 2020 home baking was going through the roof, it was one of those categories that was really very interesting, Anzac Day making biscuits with Uncle Tobys oats or a chocolate baking range for Christmas was really important.”

Ms Martinez also said the working from home trend that had continued even as Covid-19 was retreating across most of the country would keep office towers empty for many days of the week and impact Nestle’s sales of milo, instant coffee and Nespresso pods to workplaces.

“The office channel remains slightly limited because I don’t think anybody is going back to the office as we used to before, five days per week, and we at Nestle have certainly implemented a very flexible work environment and people choose between two and three days a week to be at home.

“That impacts then the consumption of coffee in the offices, and that is not back to the levels it was before.”