The billionaires and what they emerge with from the Chemist Warehouse-Sigma deal

Health and retail powerhouse Chemist Warehouse could contribute six members to the Richest 250 list under its proposed reverse takeover of Sigma Healthcare, new documents show.

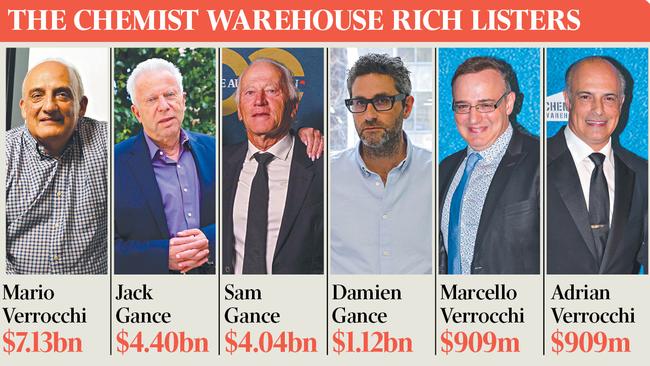

Chemist Warehouse could account for at least four billionaires, and up to six individuals with stakes potentially worth more than $900m, new documents show.

A Chemist Warehouse scheme meeting and booklet, released late on Friday ahead of its proposed reverse takeover of ASX-listed Sigma Healthcare, reveals the huge paper valuations held by the retail giant’s billionaire founders and other key executives.

Based on Sigma’s current share price, billionaires Jack Gance and Mario Verrocchi – who together started Chemist Warehouse in 2000 – would emerge with stock worth a combined $15bn in the merged entity.

Their shareholdings in the privately held Chemist Warehouse, those of other executives and family members, and how they will convert to Sigma shares and cash are detailed in the scheme booklet.

Every Chemist Warehouse shareholder will get about 44c for each Chemist Warehouse share they own, and about 6.32 shares in the combined Sigma ASX-listed entity if and when shares of the newly formed combined company commence trading on February 13, on a normal settlement basis under a proposed timeline.

Based on Sigma’s Friday closing share price of $2.79, Mr Verrocchi would have a stake worth about $7.13bn and Jack and Sam Gance would have shareholdings worth $4.40bn and $4.04bn respectively.

There are also several members of their families who will also emerge as potential members of The List – Australia’s Richest 250.

Damien Gance, the son of Sam, is Chemist Warehouse’s long-time commercial director and is set to be a member of the newly combined Sigma board. He will have a stake worth an estimated $1.12bn.

Meanwhile, Mr Verrocchi’s sons, Marcello and Adrian will each have shares worth $909m if the Sigma share price holds up. Marcello Verrocchi is the chief media officer of Chemist Warehouse, while Adrian Verrocchi is chief marketing officer.

Chemist Warehouse director Sunil Narula could have a shareholding worth $462m and chief operating officer Mario Tascone a $438m stake. Executive director Danielle Di Pilla’s Chemist Warehouse shares could convert to a $105m shareholding in the combined Sigma, the document reveals.

“Since Sam, Mario and I became partners in 1982, we have focused on building a business which is today a leading retail pharmacy franchisor and owner of the iconic Chemist Warehouse brand, with a presence across all Australian states and territories and four international markets,” Jack Gance, Chemist Warehouse’s chairman, wrote in the scheme booklet.

“Chemist Warehouse has an enviable track record of consistent year-on-year growth in both the Chemist Warehouse retail network and Chemist Warehouse retail network sales.

“In the 20 years to June 30, 2024, the number of Chemist Warehouse retail network stores has increased by approximately 11 times and Chemist Warehouse retail network sales have increased by approximately 57 times.”

The Gances and Mr Verrocchi and his family have built Chemist Warehouse into a retail powerhouse, with sales of their centrally held private company CW Group Holdings – a major chunk of the entire Chemist Warehouse business – reaching almost $3.3bn in the 2024 financial year.

CW Group made a $541m net profit and paid its shareholders $365m in dividends, including $148m paid in September.

“The transaction represents the next step of our evolution,” Jack Gance wrote.

“The Chemist Warehouse board believes that the combination of Chemist Warehouse and Sigma makes strong commercial sense and represents a compelling opportunity for Chemist Warehouse shareholders.”

An independent expert’s report by Kroll Australia contained in the scheme documents assessed the value of the equity of Chemist Warehouse to be in the range of $9.51bn to $10.74bn.

Kroll valued shares in the “New Sigma” as being worth $0.98 to $1.13 as a fundamental value based on an earnings multiple of about 16 to 18 times earnings before interest and tax.

The scheme meeting for Chemist Warehouse shareholders is scheduled for January 29.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout