Tax lost as $16bn profits go offshore

About $16 billion a year in corporate profits are being shifted out of Australia into tax havens, according to research.

About $16 billion a year in corporate profits are being shifted out of Australia into tax havens, according to research that finds around 40 per cent of multinational corporate profits globally are being booked in low or no-tax jurisdictions.

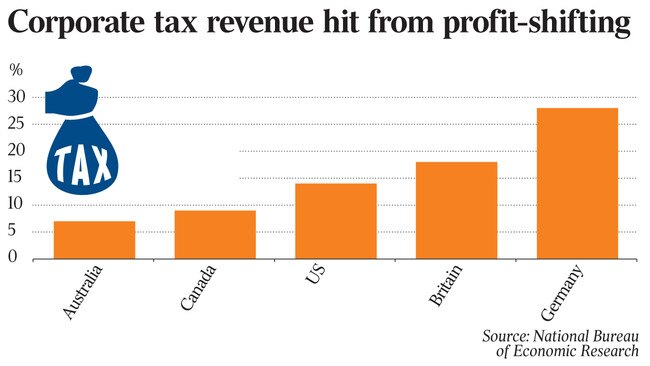

In the first study of its kind, using new data, economists at the Universities of California, Berkeley, and Copenhagen found profit shifting out of OECD countries ranged from 28 and 22 per cent of company tax revenue in Germany and France, to 7 per cent in Australia (about $5.4bn in forgone tax) and 2 per cent in Korea.

“In non-tax haven countries [like Australia], foreign firms are systematically less profitable than local firms; in tax haven by contrast, foreign firms are systematically more profitable however — and hugely so,” the study found. The research suggested the tendency to shift profits to low-tax jurisdictions was particularly great among the subsidiaries of US multinational companies.

“In 2016 for instance, Google made $19.2bn in revenue in Bermuda, a small island in the Atlantic where it barely employs any workers or owns any tangible assets, and where the corporate tax rate is zero per cent,” the study said.

In Australia, Canada, the US and UK, foreign firms’ declared profits as a share of their local wage bills were about 36 per cent, compared to about 200 per cent in well-known havens of Luxembourg, Ireland and Puerto Rico.

The ratio soared to 800 per cent in Ireland, the biggest tax haven internationally, which enjoyed $US106bn ($142bn) in shifted profits in 2015, more than any other haven and just ahead of the Caribbean islands with $US97bn.

“There is nothing natural in the decline of corporate income tax rates … profit shifting, more than tax competition for productive capital, is the key driver of this decline,” the authors concluded, noting the dramatic reduction in company tax rates as rich countries fought for global investment. “Machines don’t move to low-tax places, paper profits do,” they asserted. The US cut its corporate tax rate from 35 per cent to 21 per cent this year.

Meanwhile, the federal government’s plan to cut the corporate tax rate to 25 per cent by 2026 hasn’t yet passed the Senate.

In the May budget, following years of controversy about the adequacy of tax paid by Facebook and Google in Australia, the government said it was “committed to ensuring that digital businesses paid their fair share of tax in Australia and was actively engaging with the OECD in exploring options for taxing the digital economy”.

The three authors, including economist Gabriel Zucman, found co-operation among tax agencies in rich countries was counter-productive. Pursuing tax artificially booked in other higher-tax countries was “feasible, cheap and fast”, whereas clawing it back from tax havens was “hard, costly and lengthy”.

“None of the profits made by Apple in the US or in Ireland, Jersey, or similar tax havens which are known to be used by Apple are visible,” they said.

The analysis was based on 2015 data, before the government introduced a Diverted Profits Tax, expected to raise an extra $100 million next financial year, and a Multinational Anti-Avoidance Law in late 2015, which increased penalties for tax reporting obligations.

“Profit shifting merely reduces the taxes paid by multinationals, which mostly benefits their shareholders, who tend to be wealthy,” the authors said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout