Tabcorp in control of Melbourne Cup broadcast rights as it calls for bids from television networks for the big race

The wagering company has written to the free-to-air networks asking for bids to the biggest horse race in the country, for six years from 2024 onwards.

Tabcorp’s bid for Melbourne Cup broadcast rights appears to be a fait accompli, with the wagering giant calling for bids from the commercial networks for free-to-air rights to race that stops the nation.

Tender documents were sent to the networks and Racing.com, the horse racing network owned by Racing Victoria, on Friday and over the weekend, asking for bids for the Melbourne Cup from 2024 onwards.

The move, with the imprimatur of the Cup host Victoria Racing Club, means Tabcorp will almost certainly be in the unique position of being a wagering company and a broadcast rights broker.

As first revealed by The Australian in late May, Tabcorp has been negotiating with the VRC to take all broadcast rights, including free-to-air, pay-television, digital and international rights, from 2024 onwards.

Network Ten currently broadcasts the four-day Melbourne Cup carnival, which includes the Victoria Derby, Oaks and Champion Stakes days, but 2023 marks the end of its five-year $100m cash and contra contract.

While only the Melbourne Cup itself is covered by the federal government’s anti-siphoning protections that require it to be offered to free-to-air networks, Tabcorp has told the commercial broadcasters it wants to strike an agreement for all four days for six years from the spring of 2024.

Tabcorp and the VRC have agreed for the wagering operator to try to broker a deal with one of the networks under a sub-licencing agreement.

Tabcorp would maintain all the other rights – it also has a sponsorship contract with the VRC for the Flemington racecourse – in what is understood to be a contract that would likely see it pay the VRC more than $20m in cash alone annually.

Free-to-air networks would be required to have Tabcorp’s TAB brand be 50 per cent of all the betting advertising inventory and its betting odds would be integrated into the coverage. (Tabcorp and Ten currently have a similar arrangement.)

Sources have told The Australian there is no guarantee that Tabcorp will be able to strike a deal on financial terms that are suitable for both it and the VRC, and that there is no guarantee the two parties will agree to the deal in its entirety.

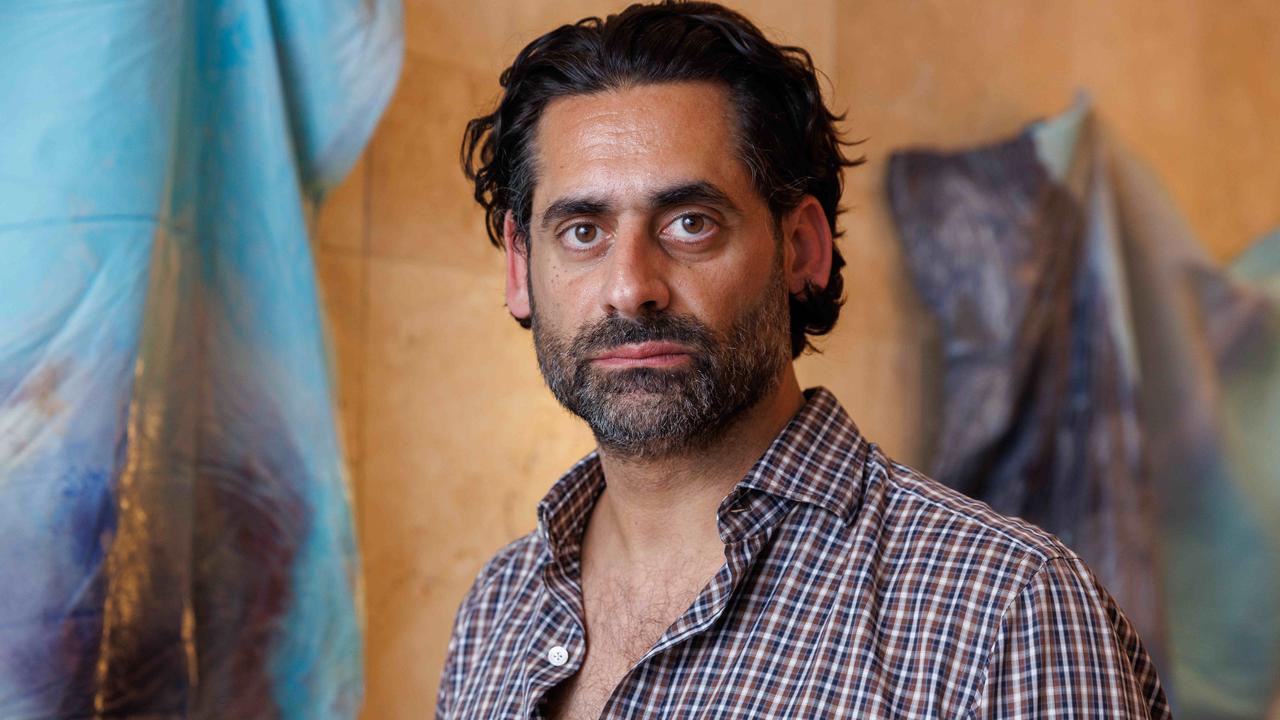

But given the tender documents that have been sent to the networks – which are signed by Tabcorp chief executive Adam Rytenskild and titled “invitation to respond” – the most likely scenario is that Tabcorp gains control of all the Melbourne Cup broadcast rights.

The potential deal would mean a wagering business owns all the rights to the biggest horse race in the country for the first time.

If Racing.com, which uses Seven spectrum to broadcast on free-to-air, also makes a successful bid it is likely Tabcorp’s brand would also be advertised on that channel.

While Ten is keen to keep the rights, racing authorities may prefer a deal with Seven West Media given it broadcasts the sport on most Saturdays and has achieved strong ratings while showing racing from NSW tracks during the Melbourne Cup carnival in competition with Ten’s coverage.

Nine Entertainment Co is also understood to be contemplating a bid, and may include its streaming service Stan in its pitch.

Tabcorp’s tender request is also due in the same week as the bids for Victorian wagering licence, which Tabcorp has held since 1994.

It faces competition from at least Greek gaming company Intralot for the rights, which are said to be worth somewhere between $600m to $900m.

Entain Group, the London-listed owner of the Ladbrokes and Neds brands in Australia, has told the Victorian government it does not want to bid.