Tabcorp braces for annual loss, $1bn virus hit

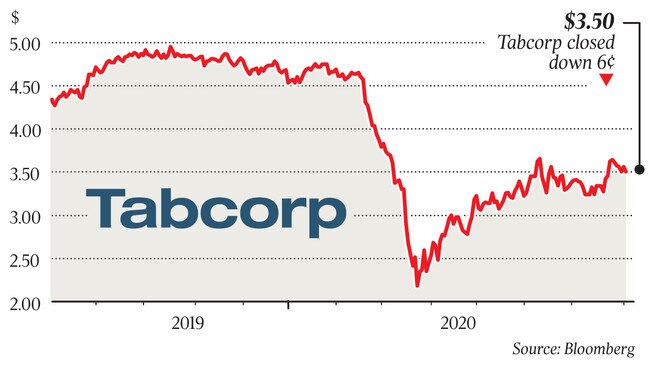

Tabcorp will tumble to a full-year loss after the gaming company flagged an impairment of up to $1.1bn due to COVID-19.

COVID-19 has accelerated the decline of Tabcorp’s largely retail-focused wagering business after the gaming giant announced a writedown of up to $1.1bn and as more punters shift from visiting the tote to tapping their smartphones to place their bets.

The mass shutdowns of Tabcorp’s retail outlets and growing pressure from its upstart digital rivals, that fuelled a $1.1bn writedown of Tabcorp’s wagering assets, have investors and analysts question whether its over-the-counter wagering business can bounce back.

The gaming giant has warned investors there is little relief in sight for its wagering division, despite it last week completing its torturous integration with UBET, which it acquired during its $11bn merger with Tatts.

The non-cash writedown comes a little over a week after long-serving chief executive David Attenborough and chairman Paula Dwyer announced their impending exits, and a day after the Victorian government enforced stage four restrictions, which will continue the closure of TAB retail outlets.

Mr Attenborough blamed the writedown on the COVID-19 pandemic and the “direct impact” of the government’s attempts to control it.

Tabcorp generates close to half its wagering turnover from its over-the-counter premises, therefore their continued closure cuts off a vital source of betting for the company. And while customers are still betting on the TAB app, it is understood growth during the pandemic for its digital-only competitors such as Sportsbet, now merged with BetEasy, and Ladbrokes, has outstripped Tabcorp’s.

Mr Attenborough warned of the “possible acceleration of retail contraction”, “the level of competitive intensity” and “structural changes” in Tabcorp’s wagering business.

“COVID-19 has materially impacted our wagering and media and gaming services businesses,” Mr Attenborough said.

“We are facing into a challenging and uncertain environment, and the current operating conditions and those expected into the future are relevant factors in assessing the value of the goodwill in those businesses at this time.”

Tabcorp said it already expects its full-year net profit before significant items to slump more than 32 per cent to $267m. Including the writedown, this could mean Tabcorp will dive more than $800m into the red.

The company, which stood down 700 staff early in the pandemic, has already lined up for the federal government’s wage subsidy, JobKeeper, after its revenue slumped 50 per cent in April.

But before the pandemic the company’s wagering division was struggling, weighed down by the costs of integrating UBET and what Mr Attenborough branded as the company’s current “uncompetitive” offering.

And while customers are still betting on the TAB app, it is understood growth during the pandemic for its digital-only competitors such as Sportsbet, now merged with BetEasy, and Ladbrokes, has outstripped Tabcorp’s.

JPMorgan analyst Donald Carducci said COVID-19 had accelerated the shift to online betting and while some retail punters will return to Tabcorp, not all of them would.

“If you think about what Tabcorp is levered to they are generally a retail, racing tote, and if you look at where the growth is in the market you see it mostly in online fixed odds and sport,” Mr Carducci said.

“Really, you haven’t seen growth in retail, tote or racing for the past three to four years. Pre-COVID-19 it had definitely come off. In general, retail was declining 2-3 per cent and tote was declining 3-5 per cent, and racing it really just depended on different state regulations.

“If you look at who the retail punter is they will likely come back but not all of them. You’ve seen a lot of sticky players since retail reopened in NSW that have not gone back to retail. They have stayed with online. So COVID-19 has accelerated that shift.”

Tabcorp completed its integration with UBET last week, saying TAB account customers in Queensland, South Australia, Tasmania and the Northern Territory can access new products, live US sport and exclusive promotions.

“We have been investing heavily in our offering in the past year in Victoria and NSW ahead of this integration of our systems, which allows us to bring those innovations to all our customers,” Tabcorp managing director wagering and media, Adam Rytenskild, said.

“It also gives us the platform we need to roll out new products and future enhancements across all our states and territories simultaneously subject to regulatory approvals.

“This will be great for TAB customers, as well as Tabcorp’s racing and industry stakeholders and other partners.”

Mr Attenborough said the writedown would not affect the company’s financial covenants with its lenders. The book value of goodwill for these segments at June 30, 2019 was $2.95bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout