Super Retail eyes road trips to riches

Super Retail chief Anthony Heraghty sees the return of the family roadt trip benefitting his company.

Super Retail chief executive Anthony Heraghty is imagining a not-too-distant future where families embrace the old-fashioned “great Australian road trip” by shunning overseas holidays to locations like Bali to pack the car with the kids and head to the great outdoors.

Mr Heraghty believes that, like the Kerrigan family of hit movie The Castle, families will take up pursuits such as fishing, camping and boating in once popular locations such as Victoria’s Bonnie Doon, where the Kerrigans had a holiday house, perfectly placing his retail chain to service these recreational activities.

“For the foreseeable future, international travel is going to be challenging and so the great Australian road trip is back,” Mr Heraghty said. That meant “cars, car maintenance and camping” would be more important, and instead of Christmases in Bali, “maybe instead it’s off to Bonnie Doon and frankly that is a good thing for our business,’’ Mr Heraghty added, as Super Retail on Monday unveiled a $203m capital raising and trading update.

Mr Heraghty, whose Super Retail owns retail stores Rebel, Supercheap Auto, BCF and Macpac, said the coronavirus pandemic and resulting economic shockwaves would lead to permanent changes to the economic landscape, including the way people spent their leisure time.

This started to emerge in May as Australians came out of home isolation and lockdowns.

“We are seeing a release as lockdowns started to fade and certainly customers were starting to get back into their passion pursuits. We are seeing a transition from a services economy — cafes, restaurants, bars — to a goods economy, as people are now buying fitness equipment and certainly are very keen to get back out fishing and camping,” Mr Heraghty said.

This pent-up demand from Christmas and Easter showed up in Super Retail’s latest sales update, with its like-for-like sales plunging 26.2 per cent in April but then rebounding 26.5 per cent in May.

However, cost mitigation measures have partially offset the gross margin impact. Super Retail said May year-to-date gross margin percentage was 20 basis points below the first half. May to date normalised operating costs as a percentage of sales were broadly in line with the first half.

There was minimal disruption to Super Retail’s supply chain, with the exception of some domestic freight capacity for inbound and online delivery.

As a result of the strong May trading and measures undertaken to reduce inventory holdings, inventory levels at May was reduced by $65m.

Temporary extension of key supplier terms affected payables. An estimated $40m of pre-tax abnormal costs is expected in the 2020 fiscal year.

Super Retail on Monday announced it was raising $203m through an entitlement offer, with Macquarie Capital and UBS on the ticket. Shares are being sold at $7.19 each, a 7.9 per cent discount to their last traded price on Friday. The raise represents 14.3 per cent of shares on issue.

Proceeds of the raising will enable the group to continue to execute its strategy and pursue strategic growth initiatives.

They will also allow Super Retail to position the business to take advantage of changing consumer trends by returning capital spending to historic levels of about $90m a year, even if a softer trading environment emerges.

These changing consumer trends included a shift to online shopping, Mr Heraghty said.

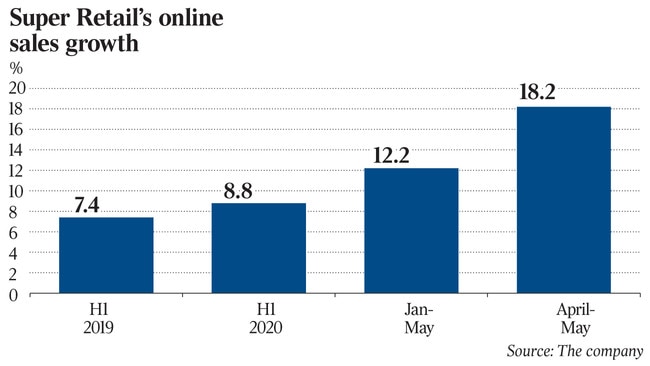

“There has been an acceleration of channel shift from stores to digital and online,” he said.

“We peaked at an 18 per cent penetration of sales (online) over April and May combined. That is a big number for us. The days of single-digit online penetration feels like they are numbered.”

Mr Heraghty said that, during the coronavirus pandemic, there had been a recommitment to health by many consumers, which Super Retail’s retail chains such as Rebel were picking up on.

“Now we have the football season coming back so there are footy boots you need to go and buy,’’ he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout