Seven Group’s earnings beat expectations, Stokes family says inflation targets are unrealistic

Seven Group beats earnings expectations but the billionaire Stokes family says the RBA must rethink its inflation target or risk hurting the economy.

The billionaire media and industrials Stokes family has the Reserve Bank of Australia “more in the foreground” than usual.

It has called for the bank to reconsider its inflation target because of the impact its consecutive rate rises are having on the economy.

Speaking after the family controlled Seven Group unveiled a higher-than-expected 16 per cent increase in underlying half-year earnings, chief executive Ryan Stokes said the RBA needed to reconsider its “objective” of getting inflation back down to its target range.

“This notion of having a target of 2 to 3 per cent inflation in our view is not realistic, nor is it appropriate, Mr Stokes told The Australian.

“Our fear is the current structure could lead to an overshoot, which is not ideal … it feels like it’s far more damaging across the economy.”

RBA governor Philip Lowe faced questions in the Senate on Wednesday after last week’s decision to increase the official interest rate to a 10-year high of 3.35 per cent and his warning of more rises to come as he worked to bring inflation down to target.

“It’s an artificial target that was actually set when they were actually trying to boost inflation,” Mr Stokes said. “The target hasn’t changed from a period where they were printing money effectively. What are they trying to achieve?”

Mr Stokes’ family is well placed to monitor the impact of both rising inflation and rising interest rates on the economy because of its diverse investments across energy, media, industrials and construction.

Not surprising then, that Seven Group’s investments with the strongest pricing power performed the best in the first half.

Forager Funds chief executive Steve Johnson said the first-half earnings before interest and tax (EBIT) of $595m – up 16 per cent – was “a good result” from a collection of “well run businesses”.

Mr Johnson believes it is by design, not accident, that the company invests in areas with pricing power and has been diversifying away from media.

“It’s been a very intentional strategic decision to only own and invest in businesses where this is the case,” said Mr Johnson, whose fund owns Seven Group shares.

Of the company’s investments with the most growth potential, Mr Stokes pointed to Boral, which Seven took control of last year.

Boral, which makes products such as cement, concrete and bitumen, introduced a dynamic pricing model just as inflation was starting to bite and those increased prices combined with increased volume led to a jump in margins.

“From a growth and delivery perspective in dollar terms, Boral is earning a 5.7 per cent EBIT margin today,” Mr Stokes said.

“We should over time double that, assuming revenues are the same, so that for us is the key opportunity. We think it’s got a lot more potential and will be a key part of our industrial portfolio.”

Boral is currently the third biggest contributor to EBIT, and produced a 23 per cent increase, to $95m, in the first half.

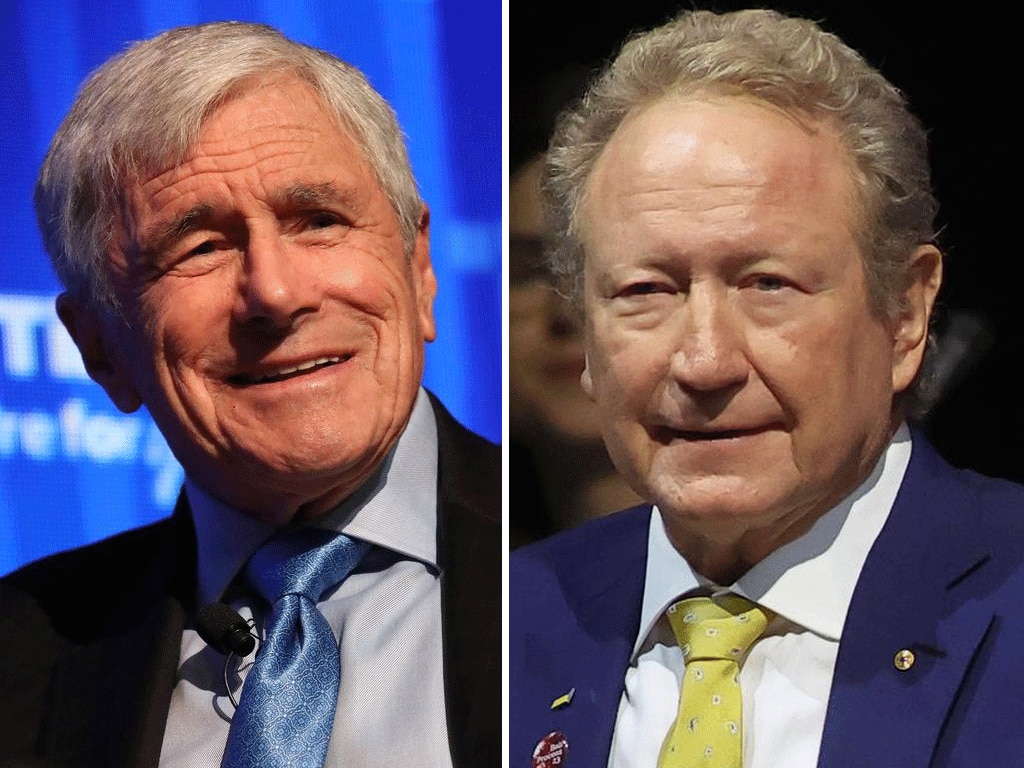

WesTrac was again the biggest earner for Seven Group. As the sole Caterpillar dealer in the key mining state of Western Australia as well as New South Wales, the company has strong pricing power – although rival West Australian billionaire Andrew Forrest is partnering with Liebherr trucks at its Fortescue Metals Group, which could create pricing tension.

WesTrac accounted for 43 per cent of EBIT – an increase of 21 per cent on its previous corresponding period, to $254m.

The next largest was industrial and general hire business Coates, which posted a 25 per cent increase in EBIT to $149m.

Its energy division, which includes Beach Energy, saw EBIT drop 14 per cent to $57m.

Earlier this week, Beach Energy doubled its interim dividend despite reporting a 10 per cent fall in underlying first half-profit and refusing to give production guidance beyond June 30.

Mr Stokes said he was “disappointed” with market sentiment around Beach, which will have “great cashflow” over the next few years, having gone through a major capital investment.

Commenting on the Federal Government’s snap decision just before Christmas to introduce a price cap on coal and gas, Mr Stokes said it was “not a positive” for the economy and that pricing caps would “exacerbate” the supply issues.

EBIT from the company’s media division, which includes the West Australian newspaper, fell 2 per cent to $50m.

This week Seven West Media decided for the 11th consecutive period to not pay a dividend due to the “prevailing market conditions”.

Seven Group’s statutory results showed a drop in NPAT of 73 per cent after the company sold a number of businesses, including in the US.

Seven Group expects earnings before interest and tax (EBIT) to rise to “low to mid-teen per cent EBIT growth” for the full year on the back of continued strength in the industrials sector.

Mr Johnson said Seven Group, which makes up 3 per cent of the Forager investment portfolio, looked like a safe option as continued interest rate rises hit the economy.

“Three months ago we would have considered selling at this price to buy some really small cap stuff we thought was cheap, but that’s changed a lot and now I’m more biased towards some of these large stable businesses as we go into what’s going to be a very difficult economic environment,” Mr Johnson said.

Seven Group shares rose as much as 2 per cent on Wednesday to $23.49. The stock is up more than 13 per cent this year.

The company announced a fully franked dividend of 23c per share.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout