Star executives accused of misleading inquiry

Doubt has been cast on the evidence of two senior executives at the royal commission-style inquiry into Star Entertainment.

Two senior executives at Star Entertainment have been accused of attempting to mislead a royal commission-style inquiry investigating whether the gaming group should be stripped of its licence to operate its Sydney casino.

Star chief financial officer Harry Theodore rejected allegations that he had used “sham” invoicing to disguise almost $1bn of suspicious gambling transactions as hotel charges, conduct that was described by the inquiry as “misleading and deceptive”.

Mr Theodore, in his first day of giving evidence to the inquiry run by Adam Bell SC, was also accused of “making things up” and not being truthful.

Mr Theodore is expected to resign within weeks – as previously flagged in The Weekend Australian – following former chief executive Matt Bekier who left last month. Mr Theodore said on Friday that he had told executive chairman John O’Neill he would “consider my position” after he gives testimony at the inquiry.

Doubt was also cast over the evidence of Star Entertainment’s NSW chief casino officer Greg Hawkins, after he was accused of misleading the Bergin inquiry into rival Crown Resorts about illegal Chinese cash transactions at an exclusive gaming salon.

The review heard Star’s anti-money laundering compliance officer earlier this year considered a “Shanghai swindler” and “loan shark” a suitable casino patron.

On Friday, the inquiry heard Mr Theodore believed Star did not have to comply with China Union Pay’s rules banning the use of its debit cards in gambling.

He formed that view solely on advice from the company’s general counsel Oliver White. Mr Theodore said he never checked Union Pay’s rules himself or the merchant agreement with National Australia Bank, which facilitated the transactions.

And despite Union Pay probing Star, via NAB, about almost $1bn worth of suspicious transactions over several years, Mr Theodore said he believed CUP knew they were related to gambling, given casinos across the region adopted the same practice.

That practice included allowing cashed-up Chinese gamblers to swipe their CUP cards at Star’s hotel, with the funds then transferred to fund gambling chips.

“From my perspective, there have appeared to be tacit acceptance of cards been used over a long period of time, across a number of properties,” he said.

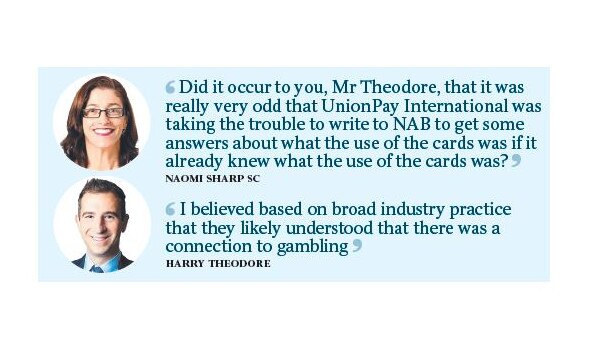

Counsel assisting the inquiry Naomi Sharp SC asked: “Did it occur to you, Mr Theodore, that it was really very odd that UnionPay International was taking the trouble to write to NAB to get some answers about what the use of the cards was if it already knew what the use of the cards was?”

“I think my evidence was that I believed based on broad industry practice that they likely understood that there was a connection to gambling,” Mr Theodore said, although he later conceded he did not know for certain. “I wasn’t certain one way or the other.”

Star issued what Ms Sharp branded “sham documentation”, allocating “fake” hotel rooms to patrons who used CUP cards to disguise the fact that they were using the cards for gambling.

Mr Bell asked Mr Theodore if that was “misleading and deceptive” conduct.

“I don’t believe it’s misleading and deceptive, and believe it only describes a portion of the transaction,” Mr Theodore said.

Mr Bell said: “Sitting here now as the CFO of Star, you see nothing misleading or deceptive in this document being provided to explain the transaction?”

Mr Theodore replied: “I think it depends on the context, and it’s been provided, Mr Bell, to be able to answer that question.” He later conceded the practice of allocating “dummy” hotel rooms was “incorrect documentation”.

Mr Theodore said he had had a meeting with Andrew Bowen, then a NAB banker, in September 2016 where they discussed the fact that CUP cards were being used to buy gambling chips and that Star’s hotel debit card terminal could be used “indirectly” for that purpose.

But in an email Mr Bowen sent Star soon after he said: “We must ensure that no proceeds or deposits for gambling are placed through this terminal.”

Ms Sharp asked Mr Theodore why he didn’t tell his then manager, former chief financial officer Chad Barton, that NAB had emailed a contradictory instruction. Mr Theodore said he had a phone call with Mr Barton about the discrepancy.

“Why didn’t you say in writing ‘what Mr Bowen is saying here is completely contrary to the conversation I recently had with him’?” Ms Sharp asked.

Mr Theodore said this was because they spoke on the phone.

Ms Sharp said: “Are you just making this up at the moment … you’re having us understand, are you, that a senior representative of NAB is writing an email instruction to you that is completely contrary to the understanding that he or you shared?”

Mr Theodore said: “Again, I understood this email to continue to maintain the position that it’s not gaming transactions at the point of sale.

“I think that the transaction being placed through the terminal refers to the first stage of the transaction at the point of sale, and that’s how I read at the time, and that was the basis on which the service was established and being operated,” he said.

But Mr Theodore conceded that Mr Bowen’s email “caused concern to consider whether NAB’s position had changed from what we previously understood”.

And when Union Pay asked questions of Star via NAB – after China’s central bank observed individual card holders spending more than $20m at Star and was “struggling to see how this level of expenditure could be made on non-gambling entertainment” – Mr Theodore said he did not understand the nature of the inquiries. Ms Sharp said: “Is that your real truthful evidence?” Mr Theodore replied it was.

Earlier on Friday, the inquiry heard Star granted Sixin Qin – one of its biggest Chinese junket operators – a $50m credit line via a cheque cashing facility and a $166m loan. But when it came time to pay a $12m debt, which remains outstanding, Mr Qin would not reveal his source of funds, breaching anti-money laundering laws.

Mr Theodore, who briefed Star’s board on Mr Qin last May, said he would not allow Mr Qin to settle his debt – even in increments – because “he wasn’t providing sufficient information to us to make us comfortable to accept those funds”.

Asked if he was surprised Star’s anti-money laundering compliance officer decided earlier this year that Mr Qin was an “appropriate patron”, Mr Theodore said he would need more information to make that call.

Mr Theodore’s evidence began after Mr Hawkins’ four-day testimony, which finished dramatically when Ms Sharp accused him of proving misleading answers when she grilled him during the Bergin inquiry.

Mr Hawkins told the Bergin inquiry in August 2020 that Chinese junket Suncity would not be able to exchange cash for chips at its exclusive gaming salon at Pyrmont, despite rival Crown Resorts permitting the practice, which breached anti-money laundering and casino laws.

The inquiry continues on Monday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout