Star Entertainment stands down over 8000 staff as casinos close

Star casino lay-offs in Sydney and Queensland include senior management, and follow the lead of Crown and SkyCity.

The Star Entertainment Group’s move to stand down 90 per cent of its 9000 staff and slash operating expenses is expected to dramatically reduce its cash burn and stave of the prospects of the casino group needing to undertake a dilutive capital raising.

The Star on Wednesday followed the lead of the James Packer-backed Crown Resorts and Auckland-based SkyCity Entertainment by closing its gaming floor, food and beverage and conference facilities at its Sydney, Gold Coast and Brisbane properties.

The 8100 Star staff impacted will receive two weeks of paid pandemic leave while they will be able to access any accrued annual and long service leave entitlements.

The board and senior management will also forego a significant percentage of entitled directors’ fees and salaries, which is still to be determined. Some senior managers will also be stood down.

Star and Crown have been working over the past week with the United Workers Union on their response to the coronavirus crisis. The union is believed to back the support both groups are giving to staff affected by the stand-downs.

“This is a unique environment and one beyond our control in which we’re determined to balance the necessary measures needed to protect the business while considering the considerable human impact to our workforce,’’ said Star Chairman John O’Neill.

Managing director and chief executive Matt Bekier described the current COVID-19 situation as “an unprecedented challenge.”

Star has also seen bigger than usual winners and losers in its high roller rooms in recent times when it has had a number of VIPs on extended stays.

As at 24 March 2020, The Star had available cash or undrawn committed debt facilities of $480 million. At December 31 it had debts of $1.6bn.

Star is part of a consortium undertaking the $3.6bn Queen’s Wharf development in Brisbane that involves the construction of 600 apartments and 1000 hotel rooms.

It has already invested around $400m into the project and is not currently required to invest more capital.

It is understood construction of the project, which is two years behind Crown’s $2.4 billion Barangaroo development, will not be affected by Wednesday’s announcements.

Evans & Partners analyst Sacha Krien said the move to stand down staff should see Star’s fixed monthly wage bill of around $40m (excluding casual employees and variable costs) fall to single digit $millions per month.

“Assuming Star also cuts other opex and capex aggressively – some projects will cease during a lockdown – then we estimate the company can reduce its cash burn in a closure from approximately $95m per month to $30m per month,’’ the broker told clients.

“This increases the company’s chance of avoiding a dilutive capital raising.”

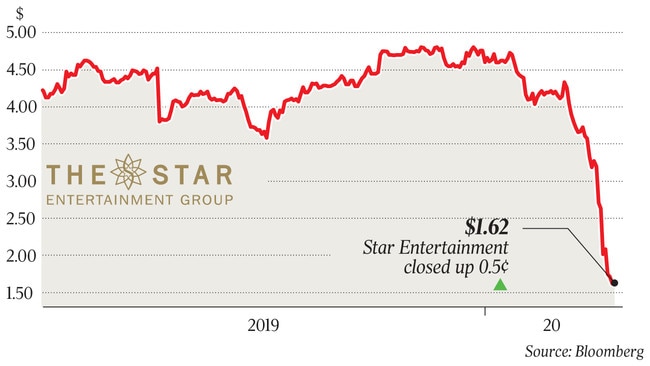

Shares in the company have lost 65 per cent of their value this year amid a wider market downturn.

Star shares closed almost unchanged yesterday at $1.62, while Crown shares closed more than 4 per cent higher at $6.75.

On Wednesday international ratings agency Moody’s Investors Service joined Standard & Poors in placing Crown’s credit rating under review, warning that closures of its Melbourne and Perth casinos would “severely cut Crown’s revenues, earnings, and cash flow generation during the closure period”.

While Crown has very little debt on its balance sheet following a string of asset sales in recent years, both agencies noted the company’s outstanding commitments on the $2.4 billion Barangaroo development in Sydney.

It is understood Crown still has spend a further $700 million to finish the project.

“Despite low leverage levels, we expect the impact of the virus will result in negative free cash flow for an unknown period. That said, the ongoing changes in the industry reduce the ability to forecast accurately,’’ Moody’s said.