Star casino will benefit from Crown woe, but not for long

Star Entertainment Group could benefit from being able to capture more of the high-roller market as Crown’s expansion into Sydney is nobbled.

Star Entertainment Group could benefit from being able to capture more of the high-roller market as Crown’s expansion into Sydney is nobbled, but a “muted” recovery in that end of the sector means the advantage should not be overplayed, one analyst claims.

Star, which operates Australia’s second-largest casino at Pyrmont overlooking Sydney’s Darling Harbour, said on Tuesday it was still digesting the implications of Commissioner Patricia Bergin’s report into Crown Resorts, and would make a comment in the coming days.

Star already has a 10 per cent cap on any one shareholder’s ownership of the company, meaning that recommendation, included in the report, would not affect the company.

But other suggestions, such as the possibility of a new independent Casino Control Commission with the powers of a standing royal commission, a proposed prohibition on dealing with junket operators who fly in high rollers, and stricter requirements for reporting suspicious transactions to the money-laundering regulator AUSTRAC, could put a high regulatory burden on the incumbent.

Morningstar equity analyst Angus Hewitt said the broker was still factoring in a second casino opening in Sydney at some stage, and while Star would benefit from Crown’s delays, the findings and recommendations in the report did not trigger a stock rerating.

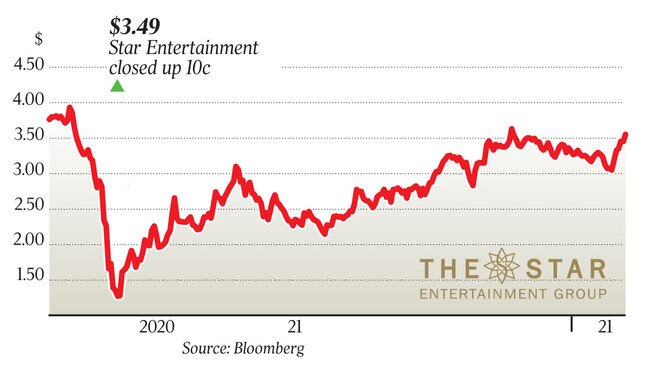

Mr Hewitt said both Star and Crown were trading around Morningstar’s fair value estimates of $3.90 for Star and $10.70 for Crown. The two stocks closed on Tuesday at $3.90 and $10.15.

While Star now had a head start on tapping the VIP market as it recovered from COVID-19, and had invested into its VIP offering as the threat of Crown’s Barangaroo casino opening loomed, the “more muted activity” in high-end gaming going forward meant the advantage could be short-lived, Mr Hewitt said.

“The inquiry (report) is scathing but it’s not surprising,’’ Mr Hewitt said. “We maintain our position; we don’t anticipate a complete prevention of Crown Sydney opening.’’

He said Morningstar expected any regulatory changes that flowed from the inquiry to be applied across the board, meaning there would be no benefits longer term. However, he said Star currently had the jump as Crown had already ruled out dealing with junket operators from now on unless they had approval to do so.

“Star hasn’t put that restriction on themselves, so the door remains open,’’ Mr Hewitt said.

“It’s obviously very early days. If the gaming authority says we are not going to deal with junkets, or they need to be regulated, the effect will be the same for both.’’

But even though Star had the jump on Crown at the moment, there was clearly little capacity to take advantage of that, Mr Hewitt said, with international travel at a virtual standstill.

Mr Hewitt said Crown still presented a threat once established, evidenced by the much stronger performance of its Melbourne casino against Star’s Sydney asset.

The commissioner’s report noted that in terms of junket-related earnings, “in FY19 the VIP normalised earnings were 11.8 per cent of Star’s total earnings’’.

Citi analyst Bryan Raymond said in a note to clients — issued before Tuesday’s announcement — that Crown could be a potential target for private equity or trade buyers or even major shareholder Blackstone.

“We do not see the financial merit in a Crown/Star merger, given synergies are limited and largely driven by head office consolidation and non-gaming procurement,’’ Mr Raymond said.

He also said they were trading near fair value, with $4 and $9.90 price targets respectively.

He cautioned that “in event of longer-term earnings impacts resulting from the review, there is a potential for a negative surprise’’.