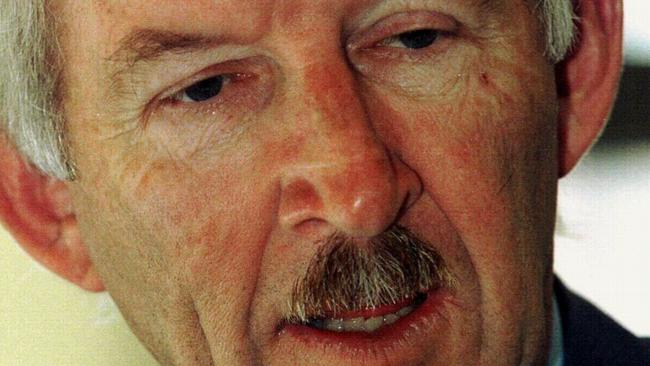

Sir Ron Brierley severs last ties with ASX

Accused businessman Sir Ron Brierley has severed all ties with the ASX after almost 60 years in the investment game.

Accused businessman Sir Ron Brierley has severed all ties with the ASX after almost 60 years in the investment game.

Listed fund Sandon Capital on Thursday announced the resignation of Sir Ron from its board, just a day after allegations the prominent businessman had amassed a vast collection of child pornography material over two decades.

“The company announces the immediate retirement of Sir Ron Brierley as a director of Sandon Capital Investments Limited and each of its relevant subsidiaries,” Sandon said in a statement.

“The company confirms he will no longer have any involvement in the group’s operations or investment decisions,” it said.

Sandon was Sir Ron’s last involvement with ASX corporates after it was merged with his Mercantile Investment Company in June.

He stepped down from his role as chairman of Mercantile at that time, citing “age and ill health”, but remained on the Sandon board as a non-executive director.

As at the date of the merger, Sir Ron had 25 million shares in Sandon, worth roughly $20m.

All references to Sir Ron were missing from both Sandon’s and Mercantile’s website on Thursday.

In the 1980s, Sir Ron was one of the most feared corporate raiders, playing critical roles in campaigns for control or dominance at well-known companies. These included Woolworths, Coles, AGL, David Jones, the collapsed Adelaide Steamship of the 1980s and Air New Zealand, as well as a string of smaller companies across a wide range of sectors such as property development, lotteries, hotels, IT, mining, dairy and farming.

Among his most recent hardball takeover attempts, Sir Ron lobbed an offer for Mark Bouris’s Yellow Brick Road, but it was described by the target as “grossly inadequate” and nothing eventuated.

Sir Ron has been charged with six counts of possessing child abuse material and granted conditional bail to appear at Sydney’s Downing Centre Local Court on February 10.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout