Singapore buy sets scene for battle with Etihad over Virgin

Singapore Airlines has upped its stake in Virgin Australia a week after Air NZ flagged its intention to sell out.

Singapore Airlines has upped its stake in Virgin Australia just a week after Air New Zealand signalled its intention to sell out of the local airline and as ownership uncertainties continue to hang over the company.

In an announcement to the Singapore stock exchange, the Singaporean airline, the third-largest shareholder in Virgin behind Air NZ, which holds 25.9 per cent, and Etihad Airways, which holds 25.1 per cent, increased its stake from 22.91 per cent to 23.11 per cent.

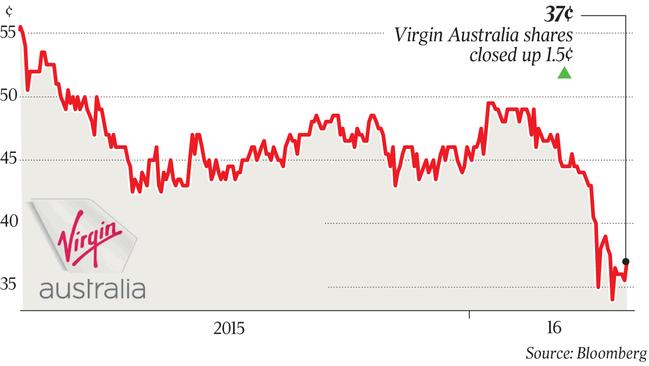

The increase came as Singapore Airlines settled a series of equity swaps at a cost of about $3.2 million, or 46.72c a share, a premium to Virgin’s Wednesday closing price of 33.5c.

In a note to clients, Citi credit sector specialist Anthony Ip said it was interesting that Singapore chose to physically settle the swap, rather than cash settle.

“Physically settling obviously incrementally increases Singapore Airlines’ shareholding in Virgin Australia, but it also increases Singapore’s participation in any future equity injection/shareholder financial support (assuming no dilution),” Mr Ip said.

“So if one wanted to draw a loose conclusion from last night’s announcement, it’s that Singapore does not seem to have objections to injecting further cash into Virgin.”

Singapore has Foreign Investment Review Board approval to increase its stake up to 25.9 per cent.

The increase of Singapore Airlines’ stake comes a week after Air NZ announced a review into its 25.9 per cent stake in the Australian airline. The potential selldown of Air NZ’s stake has set the scene for a takeover battle between Etihad and Singapore Airlines.

Industry analysts believe it is Singapore that has more to lose by letting competing Asian airlines swoop on Air NZ’s holding and take a foothold in the Australian market.

Centre for Asia Pacific Aviation boss Peter Harbison recently told The Australian: “This is a wonderful opportunity for Singapore Airlines to buy in, especially with the dual ownership structure Virgin Australia now has. And really, they should be desperate to buy it, probably up to 100 per cent for the domestic airline.’’

A Singapore takeover would trigger a FIRB application.

Singapore’s increasing stake in Virgin comes as the Australian carrier’s financial credibility has been battered by credit rating reviews from Moody’s and Standard & Poor’s.

Moody’s this week placed the airline’s credit rating under review for a downgrade and S&P recently downgraded its Virgin outlook from stable to negative.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout