Shoe sales run high for Accent Group

Footwear retailer Accent Group is expecting gains from strong consumer spending throughout the COVID-19 recovery period.

Footwear retailer Accent Group is the latest company to reap a windfall from strong consumer spending throughout the COVID-19 recovery period, forecasting on Thursday that first-half earnings would rocket by up to 45 per cent.

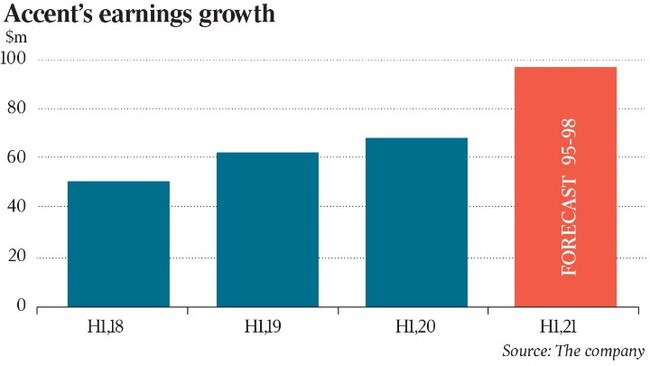

The company, which operates over 420 shoe stores under brands including Hype DC and Athlete’s Foot, told the sharemarket it expects earnings before interest, tax, depreciation and amortisation in the half year to December 27 to grow between 40-45 per cent compared to the previous period.

It means the company will book an EBITDA in the range of $95m-$98m on the back of a total sales increase of 12.3 per cent.

Accent, which also distributes popular footwear brands such as Dr Martens, Vans and Skechers, said holiday shopping season sales over November and December were “stronger than expected,” up 7.4 per cent in these months on a like-for-like basis.

Like-for-like sales over the full six-month period were up 2.7 per cent and digital sales hit a record high of $108.1m, up 110 per cent, and formed 22.3 per cent of the company’s total sales.

Also contributing to the result were rental abatements received due to the COVID-19 lockdown as well as $9.4m in wage subsidies from the Australian and New Zealand governments.

Alongside its rivals, Accent Group was hit hard in the initial weeks of the COVID-19 pandemic, closing all 500 stores in March and standing down 5000 staff without pay.

But unlike many others the group bounced back with a pivot to online retailing, saying the accelerated digital push attracted many customers who had not previously shopped with Accent.

The online surge also coincided with the federal government’s early super access program, as younger shoppers dipped into their superannuation accounts and splurged on discretionary goods.

Accent’s Platypus stores are targeted towards an age demographic between 15 and 25, while its chains of HypeDC are positioned to 20 to 30-year olds.

On Thursday, Accent chief executive Daniel Agostinelli attributed the group’s earnings forecast to strong merchandising and a capacity to handle digital orders.

“Our strong focus and capability in digital, combined with operational excellence in merchandise and store execution has delivered a strong, trading led result,” he said.

“The company’s store network and best in class digital fulfilment capability, allowed us to fulfil significant volumes of online Christmas customer orders placed up until December 22, in time for Christmas Day.”

Mr Agostinelli said Accent would continue to focus on growth areas while anticipating a busy back to school trading period.

“We continue our focus on Virtual, Vertical and VIP with our growth initiatives progressing well across the board,” he said.

“We are well set for the significant back to school trading period across our digital, virtual and store sales channels.”

The group, which earned a full-year net profit after tax of $58m in the previous financial year, declined to provide guidance for the second half of the current financial year due to ongoing COVID-19 uncertainty.

Ahead of the market update, shares in the retailer closed at $2.35, down 0.84 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout