Shareholders back Caltex call to reject Couche-Tard offer

Caltex investors have backed the board’s decision to reject an $8.6bn bid by Couche-Tard.

Caltex investors have backed the board’s decision to reject an $8.6bn bid by Couche-Tard while still leaving the door open for a higher bid, as its Canadian suitor prepares to engage with the company in limited due diligence.

While Couche-Tard has yet to comment on the rejection of its $34.50-a-share offer, Caltex was justified in pushing back against the deal on the table, shareholders said.

“I think it’s a very sensible and well thought out strategy by the board,” Caltex shareholder Touchstone Asset Management investment director Jack Chemello said. “We’re pleased with their response.”

The Australian fuels retailer will hold its annual investor day on Thursday, when it is expected to lay out more detail on its goal of unlocking value in its assets — including a planned $1bn property spin-off — and how it plans to execute a new retail strategy across its network.

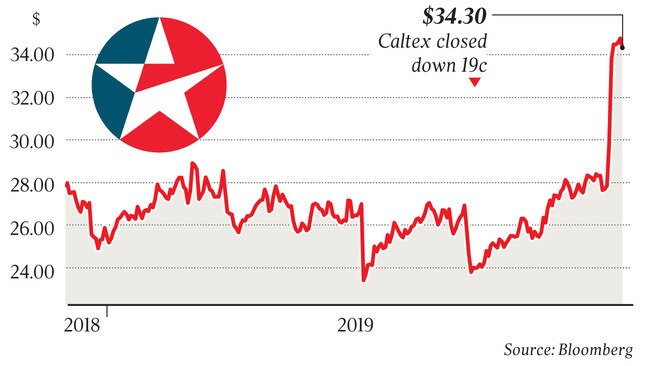

Caltex shares fell further below the $34.50 takeover offer price on Wednesday as the market weighed whether Couche-Tard would return with a higher bid.

Caltex left the door ajar for the convenience store giant to bump up its bid after offering some extra, confidential information to the suitor.

The Sydney-based company’s shares fell to $34.31 on Wednesday and one Couche-Tard analyst said investors may be worried at the earnings outlook for its Australian target.

“Investors may be concerned about the year-to-date depressed earnings from Caltex’s overall business, as well as Couche-Tard acquiring assets beyond convenience stores and gas stations,” Canada’s BMO Capital Markets said.

Couche-Tard is a well-established convenience store player but does not own a refinery, raising speculation it may look to hive off some of Caltex’s infrastructure assets should it ultimately win control.

Gaining Foreign Investment Review Board approval may also “not be easy given the nature of the infrastructure and terminal assets for Australia, despite the ownership of these assets by international companies previously,” Ord Minnett noted.

The Australian broker said it was unclear how Couche-Tard might respond to the rejection.

“Caltex’s rejection of the latest bid raises the possibility that: further due diligence occurs, although the prospect of a bid to satisfy Caltex is uncertain; or Couche-Tard walks away despite the strategic appeal,” Ord Minnett said in a note. “The next catalyst for the stock is the Couche-Tard response and Caltex’s investor day.”

Caltex will probably present an “upbeat” message to investors on Thursday, according to Ord Minnett, with a potential upgrade in cost savings to be announced.

Caltex has rejected bids of $34.50 and $32 a share by Couche-Tard on the grounds that the offer undervalued the company. Some of its major shareholders have indicated a bid closer to $40 a share was required to seal a deal.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout