Seek ditches final dividend payout to preserve capital

Online recruitment platform Seek has ditched its final dividend payout in a move to preserve capital and fund its long-term growth strategy.

Online recruitment platform Seek has ditched its final dividend payout in a move the company says will preserve capital to fund its long-term growth strategy.

In a market update ahead of its annual results announcement next week, Seek said it wouldn’t pay a final dividend but moved to reassure shareholders, saying it was operating within its debt covenants and had strong liquidity.

“The combination of our debt capital market transactions and the decision not to pay a final fiscal year 2020 dividend increases our funding flexibility so we can continue to invest for the long term, even in this uncertain economic environment,” Seek chief executive and co-founder Andrew Bassat said.

“The dividend decision was not taken lightly but we believe it is the right trade-off to maximise returns for long-term shareholders.”

Until now, Seek has paid an interim and final dividend each year since it listed in 2005.

It paid a final dividend of 22c a share fully franked last July, and then an interim dividend of 13c a share earlier this year.

The company said it intended to resume its dividend payout when economic conditions improved.

Morningstar equity analyst Gareth James said the decision to scrap its dividend payout aligned with Seek’s long-held strategy to reinvest in its business, which he considered to be a good move in the technology sector where a one dominant market player tended to emerge.

“Very often there isn’t really a second or third place,” he said.

“It is important to invest and win that market share as quickly as you can and to develop offerings before other firms do, so all of that makes perfect sense.

“I think the strategy that Seek has been pursuing makes perfect sense, and the cancellation of the dividend — sure it’s kind of related to the coronavirus situation, but I think it kind of fits into that strategy that the firm has been pursuing anyway.”

Mr James said the Seek business was doing well, having refinanced its debts and avoided having to raise new capital, but that it did make sense to be more cautious at this point in time.

“It does make sense to just be a bit prudent. Suspending their dividend isn’t a huge issue for Seek investors, I think, because Seek isn’t really a dividend stock anyway. It’s more of a growth stock so I don’t think it’s going to particularly upset investors with that decision,” Mr James said.

Seek’s announcement comes ahead of what is expected to be a dire reporting season for Australian investors, with a collapse in earnings as well as dividend cuts.

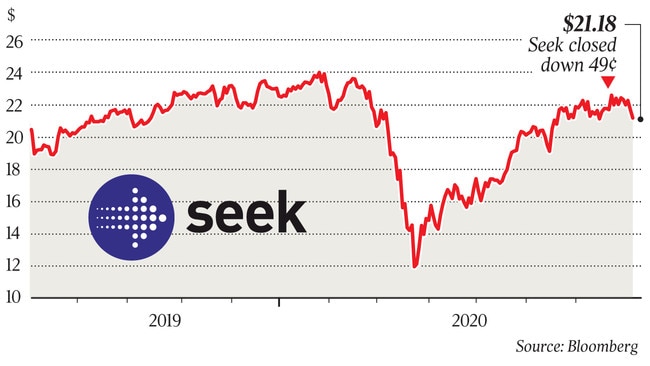

Seek shares closed down 2.3 per cent at $21.28.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout