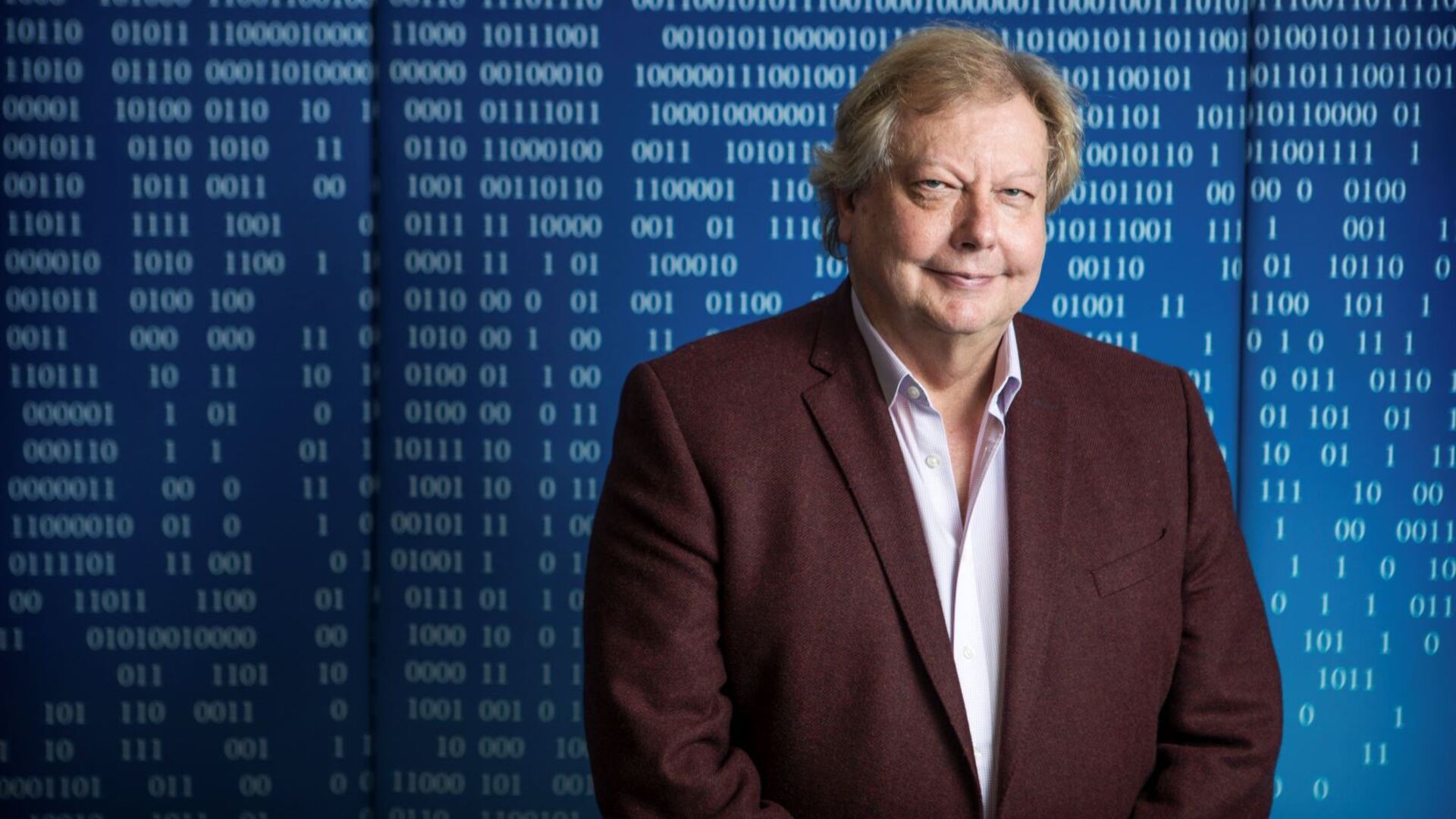

A dramatically weakened board has gifted White an ultra long-term contract that entrenches the 70-year-old as executive chairman and chief innovation officer until he turns 80. There’s an option for him to go until 85. Who knows – he may go beyond.

The audacious deal exceeds the landmark nine-year, $10m contract for AFL star Buddy Franklin when he joined the Sydney Swans, and breaks new ground for guaranteed executive tenure in Australia. In contrast just a few months ago White had semi-retired from WiseTech under a cloud of personal crisis.

That all changed when staged his own board coup in February, prompting all of WiseTech’s independent directors to quit.

White remains a controlling shareholder with a near 39 per cent stake, meaning he calls the shots in the boardroom. As a founder of the $28bn company he has outsized influence in every part of its operation.

The long-term employment agreement provides some protection if the other 61 per cent of investors banded together and turfed White from the board – if it ever came to that.

Adding to his hand, White has been filling out the vacancies with his long-time supporters, including a clutch of former WiseTech foundation directors who have become fabulously wealthy on the back of their involvement in the tech company.

This became obvious following the board’s non-response to findings of a recent investigation that found White misled former board members over his previous relationship with staffers and commercial dealings with women he has been intimately involved with.

Since White’s recent board upheaval, Australia’s biggest super fund AusSuper dumped its WiseTech stake. The focus is now on industry fund HESTA, which has talked a big game on governance. HESTA says in a statement it is focused on the need for WiseTech to appoint a majority independent board.

By refusing to let go, White is essentially closing the book on succession planning and this is becoming an ever-growing weak spot for WiseTech.

When White initially agreed to step back last year, there was no obvious internal successor.

This forced WiseTech’s then-board to look outside to bring in a new chief executive. White’s return as executive chair massively complicated the search, although his other big investors are demanding a CEO being installed.

Current interim chief executive Andrew Cartledge has ruled himself out and has previously flagged his retirement, but has agreed to stay on until a permanent chief is found.

The prospect of White running the show now as executive chair for the next decade is going to make it even more limiting for a new CEO to make their mark on the company.

White says there is a shortlist of candidates and is hopeful of having someone in place by the annual meeting in November.

While its governance is a mess, for now WiseTech the business is sitting pretty. Helped by White’s aggressive acquisition spree over two decades, it now dominates the logistic software space.

Its products are used by nearly all of the top transport players in the world. To hold its position, it needs to keep ahead of the game. The biggest threat is often unseen and companies built around tech rise and fall on challenging themselves and drawing in fresh talent.

Leaders have to be prepared to make tough calls and good boards recognise CEOs need room to be able to drive change.

WiseTech is no longer a start-up that’s an extension of one individual.

It’s a business at a much different life cycle. There are 3500 employees and globally connected customers. This all means the demands on management will continue to evolve.

The risk is a long-term executive chair like White becomes too comfortable or worse, actively resists internal change.

Even when he makes it to his 80s, White’s business instincts might be sharp as ever but is he really the one to be leading WiseTech’s tech development?

From BlackBerry to Yahoo, the tech industry is littered with examples of companies that believed their dominance guaranteed their long-term success.

Even the biggest of the biggest, Apple and Google-owner Alphabet, are having a tougher time adapting to the disruption being wrought by artificial intelligence.

Microsoft was one headed for its own mediocrity, but it took a new CEO who had the room to move – in this case Satya Nadella – to break from the past. This involved ending the dependence on PC computing; embracing cloud-based systems; while making major bets on AI. Microsoft today is the world’s second-biggest company.

By holding on too long, Richard White is selling WiseTech short.

BOQ’s big switch

Patrick Allaway has put effectively put a deadline around his part in the Bank of Queensland rescue mission, with the former chairman-turned-chief executive to stay on until the end of next calendar year.

Allaway, a former Citi and UBS banker, parachuted himself into the role when as chairman more than two years ago he forced out then star CEO George Frazis under a cloud. Shortly after, with the backing of the bank’s new chair Warwick Negus, Allaway was named permanent CEO.

Through recent talks with Negus over his future, Allaway has committed until at least 2026, that’s when much of BOQ’s restructuring program rolls off and gives the board enough time to start thinking about a CEO to take the bank to the end of the decade.

After taking charge as chairman since 2019, Allaway had better insight than anyone when he took on the role what investors were demanding. BOQ was a perennial underperformer; the cost base was out of proportion for its size, and it was rapidly losing relevance in a competitive banking market.

Compounding the challenge, BOQ’s owner-manager branch network was a relic of the past and no one was prepared to confront the franchising model that underpinned its national expansion in earlier decades.

In a year, Allaway has made significant headway on this front. He’s bought back all the 114 owner-manager branches, turning them now into corporate-owned branches. However, it’s not without pain. BOQ is locked in a legal dispute with 63 managers that are demanding higher compensation than the $115m the bank has set aside. BOQ is so far holding firm on the payout on offer.

The branch conversion, which also includes a shrinking of BOQ’s national branch footprint, is the most outwardly noticeable in the four-point Allaway plan, all designed to get BOQ’s return on equity back to 8 per cent and putting it in line with its regional banking rivals.

The owner-managed branches were good for driving sales, but this growth was coming at a heavy cost, including more than $120m in commission-based payments.

The mantra is now about profitable loans across the business rather than loans per se, and this has come at a cost to closely watch volume growth line. For Allaway this is a capital play. He’s targeting the higher returns from small and mid-sized business lending over the lower-returning and intensely competitive mortgage book.

Other areas include the new end-to-end digital bank now being switched on. This project, started under Frazis, puts it on a more even playing field at the customer level, while importantly lowering costs. Then there’s pulling $250m of costs out of the bank.

The numbers are moving in the right direction. BOQ’s half-year results show return on equity jumping and the bank’s first half cash earnings are up 6 per cent to $283m. Allaway says the work so far has been tough, but it’s encouraging to see the payback. BOQ’s shares jumped 5.5 per cent on the first half numbers.

“We’ve got really high conviction in the strategy,” Allaway tells The Australian. He says returns are expected to accelerate through to the second half of next financial year – helped by the cost-saving program.

The coming benefits of the digital rebuild has Allaway most excited. The project involved shutting down a legacy bank that operated across as many as 22 different platforms. This materially reduces complexity and costs.

“We were well behind. It’s giving us the opportunity to move ahead.”

It also allows BOQ to take a more defined strategy to a crowded market.

“As a small bank, we want size to be our superpower. We’re agile. We’re focused on specialist segments. We don’t want to be everything to everyone. We’re targeting segments where we can compete and win.”

Queensland, remains BOQ’s “core strength”. With ANZ in control of Suncorp following its $4.9bn buyout of the BOQ rival, Allaway is eyeing potential disruption from that merger. “We are doubling down in Queensland.”

In a single act, Richard White has consolidated power at the tech company he founded, while sowing the seeds of its long-term mediocrity.