Revealed: Star casino ‘not suitable’ and more supervision needed inquiry lead recommends

The casino needs as much as five years in its path to becoming suitable again, according to the confidential closing submissions of the Bell inquiry.

Star Entertainment should not be considered suitable to hold a casino licence and the appointment of the external manager needs to be extended indefinitely until the under-pressure operator shows it can change its ways, a confidential submission to the explosive Bell inquiry reveals.

It will be a long path for the casino operator to win back trust, and this could take up to five years, the submission says.

Those are the final recommendations of Caspar Conde, the lead counsel to NSW’s Bell inquiry into the troubled casino operator, as part of his highly confidential written closing submission.

There are five key recommendations, contained in Mr Conde’s 100-page written closing submission to inquiry head Adam Bell SC and seen by The Australian.

The closing submission does not represent the final recommendations of Mr Bell. However, it is expected to go a long way into shaping the outcome of the inquiry’s recommendations.

The closing submission has emerged as Mr Bell handed his final report to the NSW Independent Casino Commission on Wednesday.

The Bell inquiry was called in February to help the NICC consider the next step as it weighed up whether Star was ready to regain its licence after it was suspended in October 2022 and a manager appointed.

The NICC, headed by former commercial lawyer Philip Crawford, is not expected to release the Bell report publicly until it has had time to consider it.

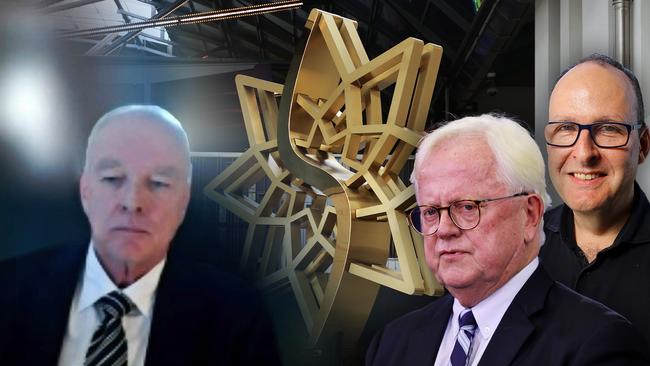

Significantly, Mr Conde’s closing submission does not make any finding of wrongdoing against key executives, including former chief executive Robbie Cooke, or any of the directors of Star, including former chairman David Foster.

It also concedes there is limited evidence to suggest Star had broken any of NSW’s casino laws, even as the casino was facing extreme external financial pressures.

However, the casino did breach its own internal control manuals “at least four times” over the past year, the submission says, although these events were uncovered by the casino’s own investigations team.

One of these involved a software error that allowed a gaming machine to pay out more than $3m in small transactions. More than 40 patrons found out about the glitch, including at least 18 considered “persons of interest”.

On another occasion, a casino staff member in the high-security “cage” failed to fill out accounting records correctly, a move that leaves the casino vulnerable to money laundering.

Separately on Wednesday, Star confirmed the resignation of its chief risk officer Scott Saunders, a former Westpac executive who worked with the bank during its Austrac action. No reason was given for the exit. Mr Saunders will remain in the role for six months while a successor is found.

Mr Conde’s closing submission was critical of some of the evidence given to the Bell inquiry by Mr Saunders, and recommended some be “rejected” in favour of those by the independent manager, Nick Weeks.

In April, Mr Saunders told the Bell inquiry he had never been involved in an organisation that had been under the pressure that Star was experiencing.

Mr Weeks’ appointment as manager is set to expire at the end of September, but Mr Conde’s closing submission argues that Star is a long way short of regaining its licence.

“There is no basis in the evidence – and, in particular, no basis to the standard of ‘clear and convincing evidence’ … to discern a future time by which the inquiry can be satisfied that The Star and Star Entertainment will or are likely to become suitable,” it says.

Mr Conde said it was ultimately a matter for the casino regulator, but “there should continue to be a form of external management or supervision” after Mr Weeks’s current term expired.

He also concludes that Star “is only six months down a transformational path” that will take between three to five years.

While no wrongdoing is found, the closing submission attempts to paint a picture of both Mr Foster and Mr Cooke acting without the support of the board during the casino’s explosive battle with the state regulator. It also suggests both were a roadblock in the casino being found suitable to hold a licence.

There “have been a number of recent changes, some of which occurred during and as a result of this inquiry, which have both reoriented Star Entertainment and removed barriers to the possibility of achieving suitability in the future,” the closing submission says.

“This has included the removal of Mr Cooke and Mr Foster … and generally, a more mature and realistic approach to remediation and transformation.”

Mr Cooke, the former boss of Tatt’s Group, resigned from Star at the end of March after just 15 months, saying it was in the best interests of the group and would help the casino win back its licence. Mr Foster stepped down as executive chairman in April as the Bell inquiry was under way. He left the casino shortly after.

Mr Conde’s closing submission reviews the three weeks of hearings from mid-April. Some 20 witnesses, including Mr Cooke and Mr Foster, gave evidence around the events leading up to and during the dispute with the NSW casino regulator.

The inquiry was looking at whether Star’s culture had been reformed enough following an initial inquiry, also held by Mr Bell, which in 2022 uncovered poor behaviour that had allowed the casino to be used by organised crime.

Mr Conde’s closing submission also draws heavily on the evidence of two business cultural consultants, Attracta Lagan and Elizabeth Arzadon.

The submission suggests the Star board should have moved quicker in dismissing Mr Cooke after the NICC privately declared last December that it had lost confidence in the chief executive.

“The board kept Mr Cooke on as CEO and he proceeded to lead the work on Star Entertainment’s written response to the manager’s reports. That was a mistake,” the submission says.

The submission also claims Mr Foster and Mr Cooke knew that Star’s 67-page response to a highly critical report prepared by Mr Weeks “would be controversial”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout