Retailer Temple & Webster shoots for the stars

Fighting stuff, especially when you look back at the company’s nine-year story. It was started by Coulter and three others with backgrounds at eBay Australia and News Corp Australia’s then digital division. Their idea? That no one was selling the category of furniture and homewares well online. The rollercoaster took off into a brave new world of retail e-commerce.

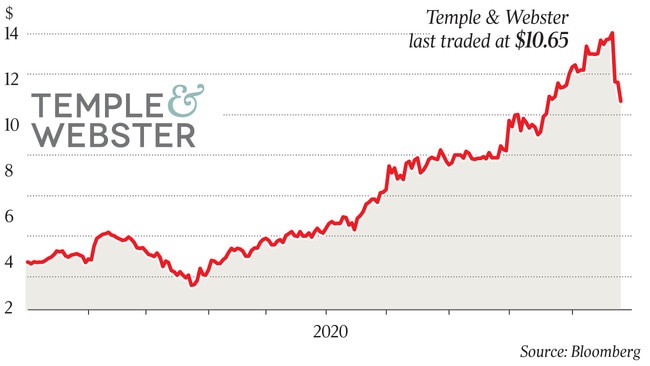

In 2016, Temple & Webster was written up as the worst float of the year, but by June this year it was a unicorn.

“In the very early days it did accelerate fairly quickly,” Coulter says. He talks fast.

“Then like all businesses it reached a hard bit, you get all the scaling problems and then we jumped again. We bought a couple of our competitors, we did a jump, we listed, then we went back to the drawing board and thought about what the new Temple & Webster is.

“It’s really the last few years that everything has worked together. It feels like the site is good, the range is good, the team is good, our customers services is good, our delivery experience is good and that’s made the Temple & Webster you see today.”

The company now offers over 180,000 products online.

Naturally, the COVID shutdown put the business into overdrive. The question now is whether the rollercoaster will continue as bricks and mortar shopping becomes pleasurable again. And why did Coulter think he could beat existing category killers in furniture who must be moving online at pace?

“They are — slowly. I won’t mention names but some of our biggest retailers in the country do not sell furniture online,” he says.

Rather than bricks and mortar versus online, Coulter talks “online” versus “offline”. This sounds almost dismissive of the physical and no doubt all part of the shift that onliners are hoping for.

“A business thinks, ‘I have to have an online strategy, I have to have an offline strategy’. That’s not how a customer thinks. A customer thinks, I have a need right now: something’s broken or I’ve moved or I’ve had a baby which means you are now in market. That’s where you have to realise that customers sometimes want online, sometimes offline.”

Temple & Webster has settled on being best of breed online.

Coulter argues that if you are an omnichannel retailer, you have to be best of breed in both. “We did try offline. It was actually quite difficult. We’re going to stick to our knitting.”

Temple & Webster announced stellar sales at last week’s AGM, up 138 per cent on last year, but the share price checked 16 per cent on the day. Where the market does seem a touch concerned is whether the business can maintain the pace once closed shopfronts are a thing of the past. Some consumer buying must have been brought forward and slimmer times may be ahead.

Coulter says he is just concentrating on results. But he also stresses that new customer behaviours and habits are forming.

“We were always going to go on an adoption curve. You look at markets like the US, the UK, they’re ahead of us in terms of the adoption curve, that was always going to happen to us, regardless. COVID has brought forward that adoption, potentially up to five years.

“Once you experience the benefits of online shopping, I don’t think you just go back to being an offline shopper 100 per cent.”

We can only marvel at what Mr Temple and Mr Webster in the 1820s might have made of Coulter, a maths graduate, mixing data analysis with a strong nous of seasoned buyers.

“They were convicts,” says Coulter. “Will Templeton and John Webster were two convict furniture designers and they made two chairs for Governor Macquarie. Those chairs are still around today, one is in the Powerhouse, one in Macquarie University, it’s used as the VC’s chair.

“We wanted a name, because retail needs a name in Australia, Harvey Norman, David Jones, etc, but we didn’t want to pick random names or use the co-founders. And we found this story on record and we thought it represents Australia, furniture design and a bit of convict.”

Like the other remarkable online retail story, Kogan, some investors have been concerned that Coulter and other individual stakeholders in August reduced their own holdings in Temple & Webster. Was this a signal that the best was behind the business and the founders were bailing?

“We’re definitely not bailing” Coulter insists. “Stephen Heath our chairman sold for personal reasons. He is still a long-term believer in the stock. Myself, I’ve still got 75 per cent of my shareholding. Yes, I sold down a bit, but by far the majority of my wealth is tied to Temple & Webster.”

He grins, adding that it had been a long journey. Coulter sold down at $9. The shares closed on Friday at $10.65.

The most interesting part of Temple & Webster is the share register, which is one reason Coulter is so bullish about the future. There is a growing presence of local institutions like industry super, a strong retail component of about 25 per cent but also quite a heavy US investor base.

“US investors definitely take a longer-term view and what they have seen is the US story playing out. The closest competitor we have is a company called Wayfair in the US. Wayfair is now $US9bn ($12.5bn) in revenue. It’s bigger than Ikea, bigger than Williams-Sonoma, it’s bigger than Ashley which is the equivalent of Harvey Norman here.

“Now if you apply that to Temple & Webster, that means sooner or later we will be bigger than Ikea, we’ll be bigger than Harvey Norman. That growth path is just ahead of us.”

Before lockdown, many Australians would not have heard of Temple & Webster. This year shares in the online furniture company have shot up over 400 per cent. CEO Mark Coulter says it is only a matter of time before Temple & Webster is bigger than both Ikea and Harvey Norman in Australia.