Premier’s Solomon Lew: some stores will never reopen

Retail billionaire Solomon Lew says some stores hit by the coronavirus will never reopen, renewing his attack on malls.

Billionaire Solomon Lew believes many retailers will never reopen after the forced hibernation caused by the coronavirus pandemic, leaving many shopping malls with empty spaces and once popular food halls deserted.

Mr Lew, who has built his estimated $2.51bn fortune on almost 50 years in the retail business, told The Australian the ability for the retail sector to absorb millions of unemployed people and put them back to work would greatly depend on shopping centre landlords offering rent reductions that mirrored the collapse in sales.

Leading that charge will be his Premier Investments vehicle, owner of outlets such as Portmans, Just Jeans and Smiggle, which is beginning to reopen hundreds of its Australian stores and bring back some of the 9000 workers it stood down last month. But in a clear challenge to his landlords, which include the most powerful commercial property owners in the nation such as Scentre Group and Vicinity Centres, Mr Lew says he will only pay rent in arrears in proportion to the sales slump his stores are experiencing as they open.

Mr Lew, who has for years had a somewhat adversarial and prickly relationship with shopping centre landlords, said if property owners failed to offer fair and reasonable rentals to reflect the poor economic conditions, it would ultimately dent any economic recovery and force unemployment higher.

“I think it is all about getting people back to work and from our perspective we are doing our bit,’’ Mr Lew said on Tuesday, adding it was also up to landlords to “accommodate” retailers.

“Nobody has paid rent in April and May. In fact they are seeking rebates for the March rent they paid and everybody is looking to go on to proportional rent as the Prime Minister stated in early April, he was emphatic that proportional rent of at least 50 per cent had to apply.

“Otherwise it will be very difficult to get the workers back. There is a million-odd people circling in distribution, retail, transport etc and in manufacturing that could get back to work.

“But a lot of it will depend on the retailer negotiations with the landlords and there are many people who won’t come back into business.’’

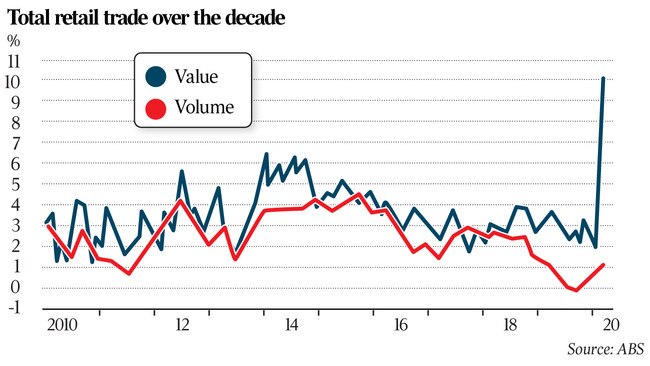

His comments came as John Frydenberg on Tuesday said Treasury was forecasting GDP to fall by more than 10 per cent in the June quarter, which would represent the biggest fall on record.

Treasury is also forecasting the unemployment rate to reach about 10 per cent, or 1.4 million unemployed, in the quarter. At the same time, household spending is expected to be about 16 per cent lower, the Treasurer noted.

This week Scentre, the owner of the local Westfield mall empire, warned it would not pay a dividend for the first half of 2020, in a move that could be quickly followed by other shopping centre owners as the economic impact of the pandemic and rental incomes constrict cash flow.

Scentre told investors that only a minimal number of rent relief packages with landlords had been locked in, and its preference was for negotiations to accelerate once stores had reopened and foot traffic had returned.

In a trading update on Tuesday, Premier revealed it had suffered a 74 per cent slide in sales for the six weeks to May 6, while its overseas stores booked a huge 99 per cent dive in sales.

Premier said it would be reopening most of its Australian stable of stores, barring airport and some CBD stores, by Friday.

Despite the disruption, Premier said it remained in a strong financial position with $256.2m in cash and access to undrawn facilities of $91.8m — other retailers were not that fortunate and would never come back.

“Without a doubt, there will be retailers who will not be able to recover from this and they were on the brink anyhow,” Mr Lew said.

“When I talk to the bankers they will tell you that it is a sector they are watching very closely and as much as they want to support, they can’t support.

“And there will be lots of empty spaces (in malls) and the fact that the public will be concerned about mingling in food halls, where in the past it was an outing, a family outing, to go to a mall, it’s a long way off and that means foot traffic is going to subside dramatically.”

Premier Investments chief executive Mark McInnes said there was “real uncertainty about the economic recovery” and particularly the response by consumers in each country and region.

“We are still in the recovery phase and how long that lasts for will be determined by how the virus goes in this next phase of increased relaxation of social distancing by all state and federal governments,” Mr McInnes said.

He said landlords should not have an issue with Premier not paying rents on shops that were closed and not trading.

“We do recognise that it is incumbent upon both ourselves and landlords to bring the economy and jobs back to life and we have said that we will pay during the recovery and reopening stage a percentage of rent in arrears that starts from this weekend,” he said.

However, Premier said online sales had been booming over the lockdown period, with sleepwear chain Peter Alexander breaking its weekly records with online sales rocketing 295 per cent.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout