Resurgent James Hardie defies downturn

James Hardie Industries has pivoted from a downbeat outlook in May to a profit upgrade.

An improving North American housing market despite the economic shocks caused by the coronavirus pandemic has enabled buildings materials business James Hardie Industries to pivot from a downbeat outlook in May to a profit upgrade on Monday that sent its shares up nearly 10 per cent.

James Hardie also signalled it had won market share in North America, where the materials business garners about 80 per cent of its group earnings, as volumes lifted and the company benefited from a leaner manufacturing operation that helped leverage stronger profitability.

The company on Monday said it had adjusted its previous first-quarter 2021 North America adjusted EBIT guide from a range of 22-27 per cent up to 27-29 per cent.

Its cash flows would benefit with increased liquidity guidance, from more than $US600m at June 30, 2020 to more than $US640m.

Australian volumes for the first quarter would be flat compared to the previous corresponding period while European volume would be in a range of down 14 per cent to down 11 per cent.

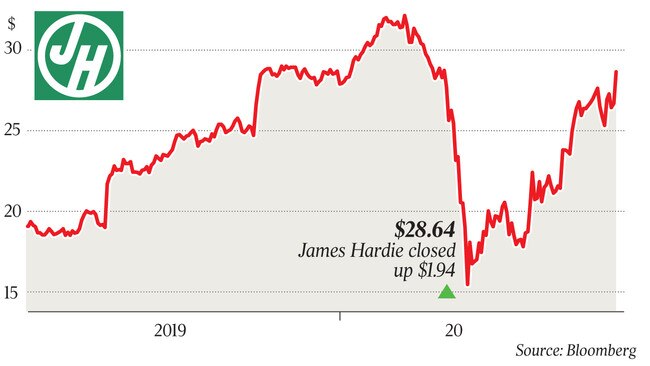

Shares in James Hardie jumped on the profit upgrade for its core North American operation, rising almost 10 per cent before closing up $1.94, or 7.3 per cent, at $28.64.

The more upbeat outlook for James Hardie differs from an update in May when the company lowered its full-year profit guidance from $US350m-$US370m to $US350m-$US355m, and also announced it would suspend indefinitely its dividends to maximise the company’s liquidity position.

On Monday, James Hardie chief executive Jack Truong said housing activity in North America had improved since April against the backdrop of the coronavirus pandemic, with the company also picking up market share.

“In North America, housing market activity has steadily improved during the past seven weeks despite the COVID-19 pandemic. The better than expected underlying housing market during our first quarter of 2021 combined with our continued focus on customer engagement to drive market share gains, resulted in volume growth in the second half of the first quarter,’’ Dr Truong said.

“This improved volume result and our continued execution of lean manufacturing led to the increase of our adjusted EBIT margin guidance range.”

Dr Truong said quick and decisive capital management and working capital actions taken in mid-March continued to drive an improved liquidity and leverage position. “Our relentless focus on these actions along with the continued profitable growth led to the improvement of our liquidity and leverage guidance.

“Our integrated management system, with clearly defined and connected processes, continues to enable the very good execution of our strategic plan through the pandemic and associated volatile markets. Our global team remains relentlessly focused on delivering growth above market with strong returns.”