Reliance Worldwide on hunt for more buyouts

Reliance is on the lookout for more deals even as it integrates the John Guest business it spent $1.2bn on just three months ago.

Reliance Worldwide is on the lookout for further bolt-on acquisitions even as it works to integrate the British-based John Guest business it spent $1.2 billion on just three months ago.

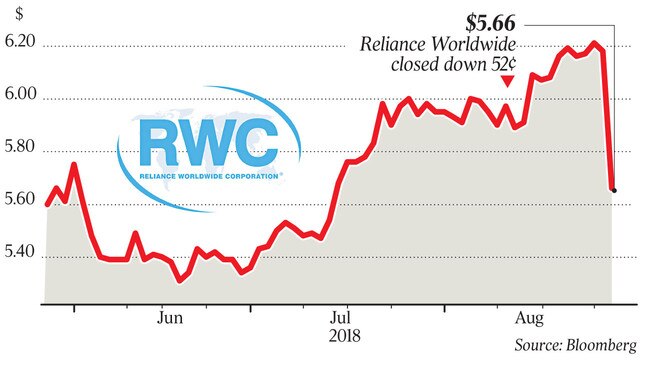

But investors nervous about its growth prospects and the potential impact of US import duties were quick to abandon the plumbing supplies group following the release of its 2018 results yesterday, in a move that saw Reliance’s share price crash 19 per cent in early trade to a low of $5.03. It recovered somewhat to end the session down 8.4 per cent at $5.66. It was a rare blip following a stellar run over the past year that had seen the share price soar more than 70 per cent.

Reliance, which sells behind-the-wall plumbing products such as valves and pipe fittings, yesterday posted a 1 per cent lift in net profit for the 12 months to June 30, with the result affected by the John Guest acquisition. Excluding costs associated with the transaction, net profit rose 20 per cent to $78.6m.

Revenue jumped 28 per cent to $769.4m in the year, driven by strong growth in its US operations as a result of an unusually cold winter that led to a higher number of pipes freezing, as well as the rollout of its products in Lowe’s stores and more plumbers using its Sharkbite brand of push-to-connect plumbing fittings. Its Americas division posted a 29 per cent lift in net sales to $559.7m.

Earnings before interest, tax and other items, excluding the impact of John Guest, rose 25 per cent to $150.9m. Margins were affected by higher copper prices and energy costs, the company said.

Reliance CEO Heath Sharp yesterday told analysts the company would consider any acquisition that supported its growth strategy. It is counting on residential construction activity in the US as a key growth driver for the year ahead, alongside new product development. It recently launched a smart-home water monitor, under the Streamlabs brand name, that provided early detection of leaks.

“This is a great product that moves us into a new area,” Mr Sharp said. “We have a well-structured product road map for this and related products, but perhaps more interesting are the longer-term opportunities presented by applying the technologies we are developing here across our entire product portfolio, to create true smart plumbing solutions for our end users.”

Reliance, which debuted on the Australian stock exchange in 2016, is targeting earnings before interest, tax, depreciation and amortisation of $280m-$290m for the 2019 financial year, which was below analyst forecasts of about $300m. It now expects the integration of John Guest to deliver more than $30m in annual cost savings by the end of the 2020 financial year, compared to its previous estimate of $20m in savings.

“We are really pleased with the achievements over the past 12 months,” Mr Sharp said.

Reliance sought to reassure investors on the impact US import duties would have on its products, with management currently “considering options to minimise the impact”.

“For example, through alternate supply arrangements with manufacturers in countries not impacted by the tariffs. Where this is not possible, management currently expects to be able to recover the additional tariffs through price increases.”

Morningstar director of equity research Adam Fleck said the company’s long-term growth outlook remained intact but said the shares look overvalued, even after yesterday’s sharp drop.

The company will pay a 3c final dividend, in line with last year’s payout, bringing the full-year dividend to 6.5c.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout