Reliance Worldwide shares smashed after downgrade as Asia-Pac, Europe disappoint

Reliance Worldwide downgrades its full year earnings guidance and says it remains wary of the impact of coronavirus and of Brexit.

Reliance Worldwide will stand by its global strategy despite an alarming lack of revenue growth in the December half, especially in its flagship American business, which led to a shock profit downgrade and sharp slump in the plumbing giant’s share price.

Reliance, the world’s largest manufacturer of push to connect (PTC) plumbing fittings and water control valves, on Monday downgraded its full year earnings guidance due to weaker than expected demand in its key UK and Asia Pacific markets and a surprise slump in North American revenue.

The plumbing group now expects net profit to be in the range of $140 million to $150 million compared to a previous guidance range of $150 million to $165 million, which slashed its share price on Monday by more than 25 per cent to its lowest level in 7 months.

Reliance reported Adjusted half year NPAT of $63.7 million compared to $80.5 million a year ago and declared a 13 per cent increase in its interim dividend to 4.5 cents per share.

But revenue grew just 0.4 per cent in the half after stripping out favourable currency movements.

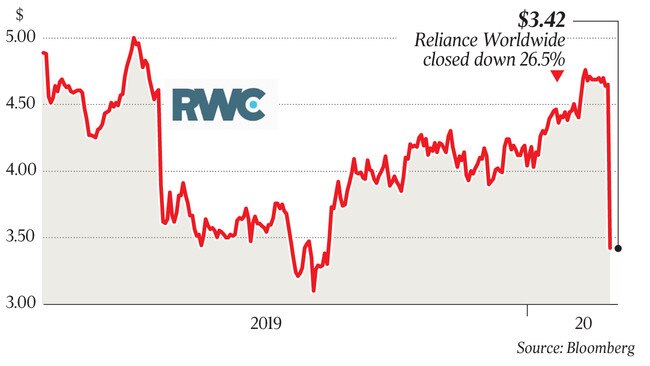

Shares in reliance tumbled on Monday, falling more than 26 per cent to be trading at $3.42 during the afternoon.

“We believe we have a handle on the revenue issues. The key issue is our overall strategy is unchanged. It has been a tough half but long term it is the same outlook as we have always had,’’ said managing director Heath Sharp.

“And our operational performance in the half was really quite strong.”

He said the company’s performance in North America, which accounts for half its revenues, was partly explained by the timing of some of marketing and promotional activities.

“We are pretty comfortable the US looks good in the second half,’’ Mr Sharp said. Reliance products are carried in more than 1000 Lowe’s and Home Depot stores across the US.

He said Reliance was continuing to evaluate the impact coronavirus will have on its supply chain and customers but said its exposure to manufacturing in China was limited given the core plumping product that drives its business is now manufactured in America and Australia.

“At this point we have had no impact on our business. In general we are in a pretty good inventory position with those items they make for us in China. There is a handful (of factories) we needed to come back from Chinese New Year and manufacturing and that seems OK.”

Mr Sharp said Reliance also remained wary of the impact of Brexit on the UK economy, which represents 35 per cent of its revenues. Only 15 per cent of revenue comes from Australia.

It expects subdued market conditions to continue in the UK and in Australia.

In 2018 Reliance substantially lifted its exposure to the British economy with the $1.2 billion acquisition of John Guest Holdings, which makes a plastic version of the push-to-connect plumbing fittings which are a cornerstone of its US business.

Mr Sharp said the group was right to pursue the acquisition at the time and now had no mis-givings about the move.

“For sure and certain. The long term value that we can get from that business and the ability to sell their product in other parts of the world and for us to sell our products in the UK using their distribution is substantial,’’ he said.

“We have moved in the UK to improve delivery performance to our customers significantly. This will put them in a strong position when the market comes back.”

One positive in the result was the cash flow statement, which showed operating cash flow of $112.8 million, up $69.9 million. This helped the company reduce its net debt.

The company is also reviewing its research and development spending to focus its pipeline on products which have the biggest market share and brand recognition.

Reliance, which floated on the ASX in April 2016, was previously owned by the Munz family which built it from a small manufacturing entity to a $4 billion global company. Its former chairman Jonathan Munz has extensive horseracing interests.

While the shares are still significantly above the their issue price of $2.50, they are well below the all time high of $6.21 reached in late August 2018.

A year ago Mr Munz severed a 33-year connection with Reliance when he sold his final 10 per cent stake in the company at a price of $4.65.

The family had sold its previous stake of 20 per cent at $3.55 per share in August 2017 in a block trade after a retaining a 30 per cent holding at the float.