Regulator stops AGL bid to buy MacGen

THE competition chief says the big NSW coal-fired power stations would be better with ERM Power than rival bidder Agl Energy.

THE nation's competition chief says the big NSW coal-fired power stations he has blocked AGL Energy from buying would sit better in the hands of rival bidder ERM Power than the state government.

The Australian Consumer & Competition Commission yesterday blocked AGL Energy from buying the NSW government's Macquarie Generation assets in the Hunter Valley in a move that scuppers a $1.5 billion deal revealed last month.

Both the government and AGL said they would review the decision, which could see a legal challenge in the Federal Court from AGL.

There were three bidders for the assets, with the other two, which included ERM Power, offering bids that NSW Treasurer Mike Baird said did not exceed the state's retention value of the plants.

Mr Baird said the state government would not reconsider the other bids unless they exceeded the retention value.

"We will proceed with the sale of the state-owned assets only if it is in the best interests of taxpayers," he said. "We are not involved in a desperate fire sale."

The ACCC blocked the deal because it was likely to result in a substantial lessening of competition in the NSW retail power market. It had approved the bid from ERM Power, which is not a big retail player.

ACCC chairman Rod Sims said bid value aside, MacGen would probably sit better in the hands of ERM than the government. "Government is probably not a very good owner of this sort of assets, so we can see why the NSW government wants to privatise them," Mr Sims told The Australian.

"With the sale to AGL we have competition concerns -- we certainly don't have any concerns with ERM.

"ERM is a commercial owner, and so that would satisfy the government's privatisation objectives."

Although the ACCC had made its opposition to the AGL bid known, the company had scheduled a press conference yesterday with chief executive Michael Fraser in the hope the deal would be approved. It was cancelled after the release of the decision.

"AGL is reviewing the reasons for the ACCC's decision and will, in due course, make a further statement about what actions, if any, it may take in response," was all the company would say yesterday.

It is believed a decision within the next two weeks is being targeted.

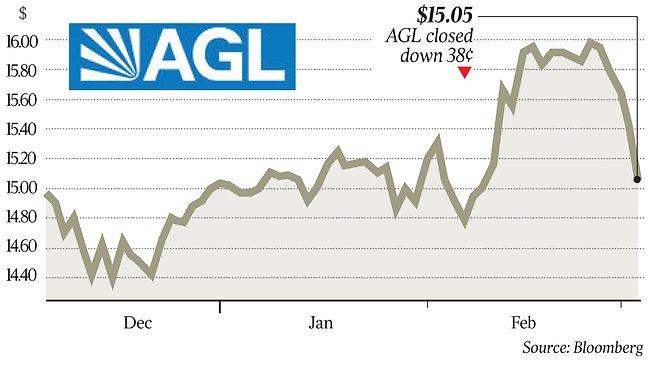

Yesterday, AGL shares fell 38c, or 2.5 per cent, to $15.05. ERM shares rose 8c to $2.40.

Credit Suisse analyst Sandra McCullagh said the terms of the deal implied a full price, so its falling through was not a concern.

The two MacGen power stations, Bayswater and Liddell, account for 27 per cent of NSW power capacity.

"With this acquisition, the three largest retailers in NSW would own a combined share of 70 to 80 per cent of electricity generation or output," Mr Sims said.

"This is likely to raise barriers to entry and expansion for other electricity retailers in NSW and therefore reduce competition."