Redbubble revenue warning bursts shares

More than 40 per cent of Redbubble’s share price value has been wiped after an admission of poor sales performance.

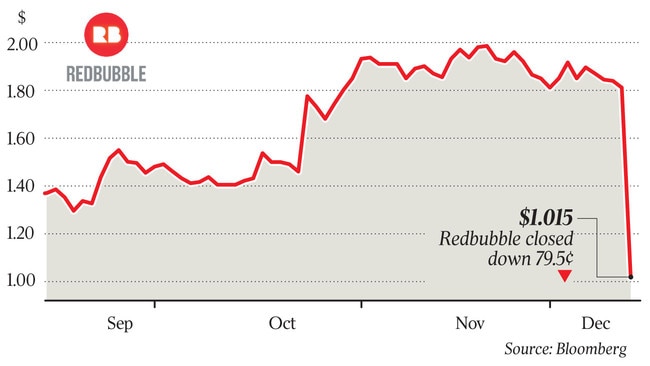

Shares in Redbubble collapsed 44 per cent on Thursday after the technology platform which allows artists to sell designs warned of lower-than-expected revenue growth

The warning sparked a savage investor reaction despite the tech company saying it ishopeful of a pick-up in sales heading into the holiday trading season.

Redbubble’s shares on Thursday fell 80c to close at a five month low of $1.01.

In a trading update Redbubble said increased price competition and the failure of apparel sales to recover to historical growth levels seen prior to October 2018 had meant poor performance in the company’s revenue growth.

It said marketplace revenue growth for the second quarter to date was up 20 per cent year on year.

Redbubble said second quarter sales of its branded online marketplace were running at 2 per cent with growth. It has previously blamed stalled growth partly on changes in Google algorithms.

It said subsidiary brand TeePublic had performed strongly, with quarter to-date marketplace growth of 59 per cent.

“While growth is slower than anticipated, the holiday trading season is still in progress and the core elements of the strategy are working,” Redbubble’s chief executive Barry Newstead said.

Mr Newstead said Redbubble is still expecting to grow operating earnings year-on-year and achieve positive free cash flow in financial year 2020 though focusing on top-line growth.

Mr Newstead said the company was confident the core elements of the strategy were working.

“As a group we will continue to pull all levers to drive growth and deliver the best possible FY20 result, setting up RB Group for long-term success,” he said.

“Our strategy to diversify into new products and secure content partnerships with brands is paying off and we’ve seen strong year-on-year growth across our Fanart, Home, and Wall Art businesses.”

Brokerage RBC said in a note to clients that Redbubble’s trading patterns have not recovered since it was first impacted by Google algorithm changes in October 2018 and sits below the brokers’ forecasts for the Redbubble platform.

“However, we note the stronger than expected performance in the higher margin TP business which still has the potential to deliver synergy benefits in the coming quarters,” RBC said.