Raphael Geminder’s Pact calls for national co-ordination on Covid response

Packaging producer Pact Group has taken a shot at the disjointed state by state approach to handling the COVID-19 pandemic.

Packaging producer Pact Group, controlled by Melbourne billionaire Raphael Geminder, has taken a shot at the disjointed state by state approach to handling the COVID-19 pandemic, after resuming its interim dividend payout for the first time in two years.

Pact has been able to keep operating through the pandemic but said the different application of rules by states had strengthened the need for a national approach to clear any confusion.

“I would like to see a national approach, that’s for sure, because that just brings certainty,” Pact chief executive Sanjay Dayal told The Australian.

“There are constant problems in that the moment you shut down borders there are issues with permits for our trucks and movement of raw materials across Australia.

“We have been able to manage it compared to say the tourism or hospitality sectors, but the certainty of a common approach would certainly benefit us, as well as all the other industry sectors.”

Pact — which has more than 4000 staff — supplies a wide range of plastic and steel packaging to the food, household cleaning, pharmaceutical, personal care, agricultural, chemical and industrial markets. The manufacturer profited from strong growth for hygiene, health and agricultural products amid COVID-19 with underlying net profit for the half surging 59 per cent to $52m.

Underlying earnings before interest and tax jumped by a quarter to $99m ahead of expectations.

Earnings for the 2021 financial year are expected to be higher than 2020.

An interim dividend of 5c per share marked a resumption of a payout for the first time since 2019, after last year’s dividend was cancelled due to uncertainty from the pandemic.

A year ago, Pact put its contract manufacturing division up for sale through investment bank Citi and the process has proved slow going despite the strong lift in sales from making products to guard consumers against the pandemic. The company may now keep that part of the business if offers from suitors fail to meet expectations.

Mr Dayal said it would only sell at the right price, even as it regards the business as non-core.

“One of the reasons for the delay was COVID because anyone buying a business needs to go and see the factories and interact with the people,” Mr Dayal told The Australian.

“I do have a value in my head without which I am not going to sell it, and I don’t have a compelling reason to sell it because of my balance sheet or cash generation.

“If I get a good price for it I will sell it, otherwise I will have it humming along on the sidelines.”

A Sydney-based private equity group is believed to have been in talks with Pact for a potential acquisition of its contract manufacturing division.

Pact expects to clarify in the next few months whether a sale will proceed.

Contract manufacturing reported a 7 per cent lift in sales to $169m for the first half of 2021 and increased earnings before interest, tax and depreciation by 91 per cent to $21m.

Mr Geminder — married to Fiona Geminder, daughter of the late cardboard box king Richard Pratt — is the chairman and 40 per cent owner of Pact.

The nation’s largest manufacturer of rigid plastic packaging said in 2018 it would look to move more of its operations offshore to Asia because of the soaring cost of doing business in Australia.

It had closed three manufacturing sites at the time, after a tough period of trading, but Mr Dayal said that now its 100 global plants, including 25 in Australia, were ticking along and he did not expect any shutdowns.

“That’s not a priority,” Mr Dayal said.

“Our strategy is about increasing employment and building plants rather than shutting plants.”

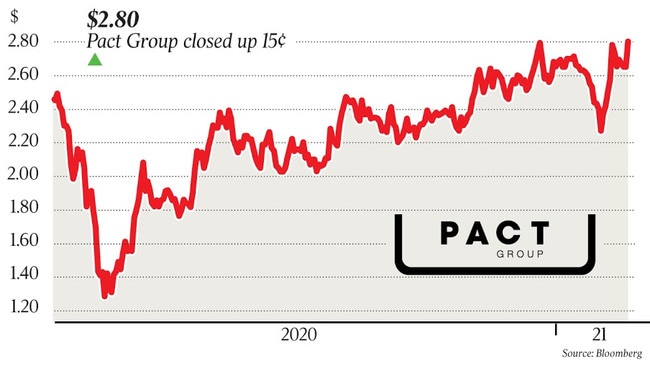

Pact rose 5.7 per cent to $2.80.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout