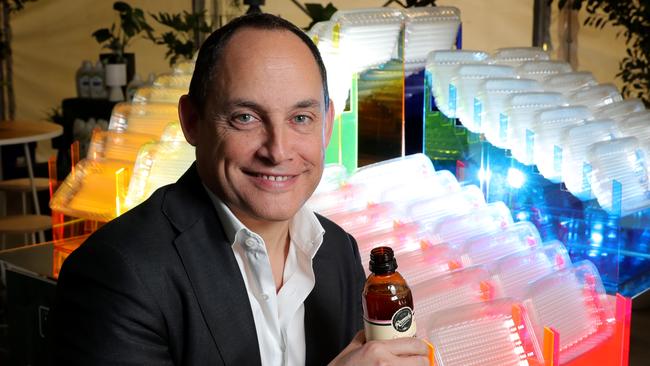

Raphael Geminder has increased his takeover bid for Pact Group

Pact Group shares are up strongly after Raphael Geminder increased his takeover bid, with the new offer coming in at the lower end of an independent valuation.

Pact Group shares have soared after Raphael Geminder’s Kin Group made a final, improved bid for the company, at 84c per share, just creeping in to the bottom range of an independent valuation of the company.

The independent members of Pact’s Board had previously rejected a 68c per share bid from Pact as too low, with a valuation by independent expert Kroll placing a value of 83c to $1.24 on the minority shareholders’ holdings.

The stock jumped 22.6 per cent on Monday to be trading at the new bid price of 84c.

Kin Group currently owns 52.67 per cent of Pact after creeping up slightly from the 50.02 per cent it owned when the bid was made in September.

The bid is still well short of Pact’s 12 month high of $1.40, reached in March last year, and also well short of the $3.80 per share it listed at 10 years ago after raising about $649m.

Following the increased bid, Pact’s independent Board Committee is now recommending shareholders accept the offer, while significant holder Investors Mutual, which owns about 5.5 per cent of the company, has also indicated it will accept the offer.

Kin’s offer is now final and cannot be increased.

“Our improved, unconditional, all-cash offer of 84c per share provides you with liquidity and certainty in this continued unstable macroeconomic environment,’’ Kin said in a statement.

“The offer also allows you to sell your shares and avoid any further risk associated with your investment in Pact.

“You should be aware that if you do not accept the offer, you will be exposed to a number of risks, including that the Pact share price may fall below the offer price and the levels it was trading at prior to the offer being made.’’

Billionaire Geminder founded Pact in 2002, putting together a management buyout of assets from Visy Industries.

Prior to that he was co-founder and chairman of Visy Recycling, part of the Pratt Family’s packaging empire, and he is married to Fiona Pratt.

Pact reported a $6.6m loss for 2023, sliding from its $12.2m profit in the 2022 financial year.

The company also received a 37.6 per cent protest vote against its remuneration report at its annual meeting in November.

The offer is due to close at 7pm on December 21 unless extended.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout