The move comes ahead of its demerger with Dan Murphy’s, with Woolworths set to continue providing payments services to the liquor retailer.

Coles continued providing payments services to Bunnings, Kmart and Target after it split from Wesfarmers three years ago.

Wesfarmers boss Rob Scott is holding a strategy day on Thursday, but while the good fortune of his retail empire continues, analysts are not expecting major news.

Woolies boss Brad Banducci is taking the payments split one stage further by expanding past the old in-house petrol sites under the EG banner and the liquor stores to third-party retailers.

Merchant acquiring machines are not big cash cows for the banks, but the extension opens the door for a wider net of Woolworths loyalty and other data collection tools.

It comes as CBA boss “Magic” Matt Comyn has flagged an extension into broadband services on top of retail energy offers unveiled last week.

The ACCC next month is due to hand down its decision on the merger approval sought by Eftpos, BPay and NPP, the RBA’s digital payments system.

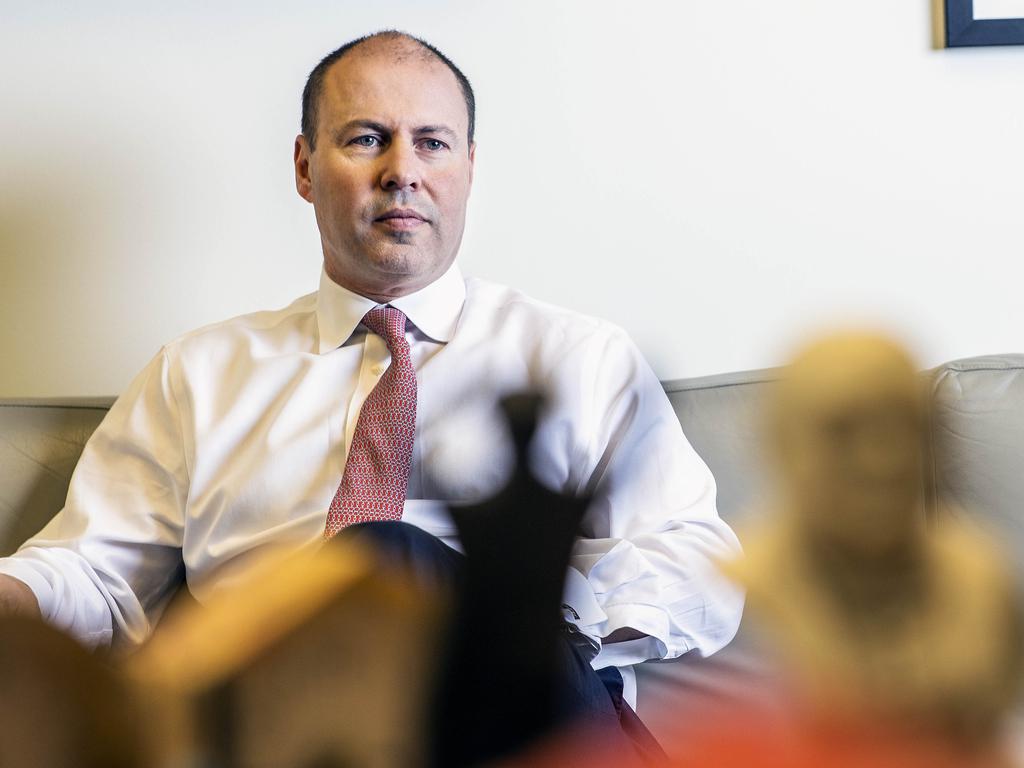

Josh Frydenberg is also due to decide shortly on the regulatory architecture for the payments system that is presently run by the RBA with support from Austrac, APRA, the ACCC and ASIC.

A report on the new system was handed to the government last month by King &Wood Mallesons partner Scott Farrelll.

The UK has created a Payments System Regulator to look at competition in payments on top of the existing architecture run by the Financial Conduct Authority.

The ACCC inquiry into the Eftpos merger has run into heavy opposition from the small business and retail sector worried about increasing bank control.

This comes against a backdrop in which the RBA’s NPP digital payments system has grown fast and some question the long-term viability of the Eftpos system run by Stephen Benton and owned by the big banks and retailers, with the arrival of ApplePay and other mobile phone devices

Coles and Woolworths are Eftpos shareholders along with the banks and the argument in favour of the merger is the old favourite – the local industry needs to get bigger to have the power to fight MasterCard and Visa.

Coles and Woolies are already big players in the payments industry, with their supermarket tills replacing the banks and automatic teller machines as cash dispensers.

Jut how many corner stores or clothing retailers would take a Woolies terminal instead of a bank-run terminal is another question.

But Woolies long ago made its run, expanding into insurance and other services, and CBA is now fighting back.

Its move into energy retailing and broadband services is aimed at keeping customer loyalty.

In 1999, CBA and Woolworths formed a banking joint venture but it went nowhere and, before its initial 10-year timetable was completed, the retailer had teamed up with ANZ to roll out ATMs backed by the bank.

The big retailers now run cash dispensing services from their own checkouts, which has helped destroy the market for ATMs and helped wind back bank branches.

The CBA move to adjacent services is aimed at increasing customer loyalty with the argument being if your home loan, electricity and broadband all come from CBA, it is too difficult to change.

The Woolies move to expand its payment services is aimed more at data collection and an extension of its loyalty schemes.

The battle is being run across town with Qantas selling health insurance and offering to help others buy carbon offsets as part of its Future Planet venture.

If you ask a bank which outsiders pose the biggest danger, they are more likely to point at the big platforms such as Apple, Google, Facebook and Amazon.

They have the financial muscle to run rings around the banks, which in part is why the payments systems inquiries take on renewed importance.

The UK has a flourishing fintech sector in part because more competition is allowed in the payments system.

The government’s open banking system will be rolled out in other industries to boost competition by ensuring customers have control over their own data.

Comyn used this development as opening the door for someone like him to take on Telstra and AGL.

–

Chi-X marks the spot

This week’s Magellan FuturePay launch was instructive among other reasons in that the product will be traded on Chi-X, not its home exchange the ASX.

Magellan uses Chi-X in part because it believes it gets better service from the rival exchange and thinks the Australian market would benefit by more competition. The new FuturePay units are to be traded on Chi-X, as are other Magellan products.

The proposed new carbon trading platform to be launched by the Clean Energy Regulator, while not directly challenging the ASX, opens the door for more financial products to be traded away from the behemoth.

The CER has a tender open until next week to test expressions of interest, and proposals will come from among others the Chicago Mercantile Exchange-backed FEX, Chi-X, which will soon be owned by the Chicago Options Exchange, the Singapore Exchange and the ASX.

All of the above have their own clearing houses, which means what was once an ASX core competence is now just a minnow among many.

–

Advice on advisers

If Josh Frydenberg is relying on the US Securities and Exchange Commission for backing of his proposed crackdown on proxy advisers, he better think again because the SEC has dropped the idea.

Incoming SEC boss Gary Gensler has formally asked staff to review the idea.

The Treasurer issued a discussion paper on proposed changes that mirrored those released by the Trump administration’s plans, which have now been canned.

Both the US and Australian proposals included forcing proxy advisers to send recommendations to target companies at or before release and to disclose conflicts.

The latter is desirable as some US firms also run businesses advising companies how to satisfy proxy firms, but the former is an abuse of free speech.

Frydenberg backed the US proposed changes and circulated a draft with comments due by Friday.

The AICD, which collected $5 million in JobKeeper payments last year, backed the concept of further regulations for proxy advisers and this was one of a string of reforms it requested that were rubber-stamped by Frydenberg.

ISS and CGI Glass Lewis are both based in the US, so any changes in its law would affect Australia.

But now that the SEC has dropped the idea, it is doubtful the government will be so keen to back the JobKeeper-funded AICD’s ideas on the issue.

Twelve years after starting its failed banking joint ventures with CBA and ANZ, Woolworths has launched its own payments vehicle, WPay, to compete with the banks on Eftpos terminals.