Property boom buoys Harvey Norman

Gerry Harvey’s chain has hit its best share price since 2008 as population growth spurred a 30pc jump in profit.

Retailer Harvey Norman has seen its shares soar to their highest price since the global financial crisis, after reporting a 30 per cent jump in earnings which outstripped market expectations.

The strong result came as strength in the property market raised demand for whitegoods and home appliances.

The group (HVN) booked a net profit of $348.6 million for the year to June 30, a 30 per cent boost on fiscal 2015 as franchisee sales grew 7.6 per cent to $5.33 billion.

The record reading topped market forecasts for earnings of $323.5m.

The news helped drive the company’s share price as high as $5.58 in the wake of the result, its strongest since February 2008. In mid-afternoon trade, the shares were up 3.4 per cent at $5.42.

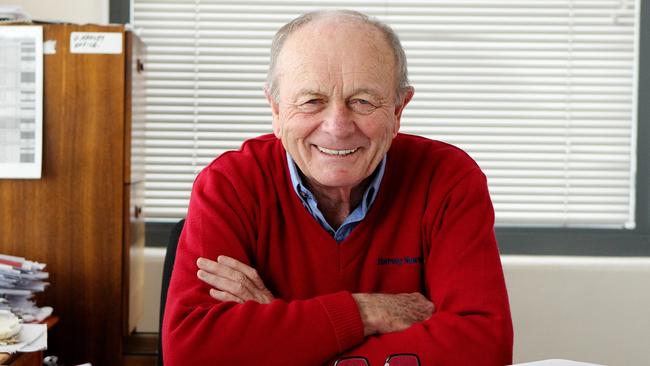

Harvey Norman founder and chairman Gerry Harvey tagged the result as “outstanding”, as franchisee sales growth came in at double the rate of the prior year.

“Franchisee sales growth remains strong in the home and lifestyle market, underpinned by a resilient residential property market,” he said.

The positive benefits flowing from strength in the property sector were not expected to fade in the near-term, he added.

“Housing market conditions have been robust, responding positively to the reduction in interest rates in recent years,” Mr Harvey said.

“The number of newly-approved dwellings has been above completions for some time which suggests a continuation of solid housing activity, particularly in New South Wales and Victoria.”

Harvey Norman said fiscal 2017 had started in a similarly strong vein to the prior financial year, with franchisee sales revenue up 6.4 per cent from July 1 to August 28.

The retailer declared a final dividend of 17c a share, above market expectations for 11.5c a share.

Mr Harvey said the retailer was now generating some of its strongest sales in a decade.

“Yes, these are some of the best results we have seen since the GFC, if you look at where we were a few years ago, just before the GFC we were really powering along, and then we hit some really bad times — all the things that happened in Ireland that knocked the shit out of us,’’ Mr Harvey told The Australian.

“Now we have got Ireland back on track after many years, we have stuck in there and have just bought a property there and opening a big new store, and so our Asian business has had a good turnaround this year and we expect that to go better again.”

Mr Harvey said the housing boom and rising property prices were helping, but that consistent increases in Australia’s population were also a key factor behind the company’s results.

“I think the commentators place a very large store on that (housing boom), I think it’s important but I don’t think it’s as important as they do. I think the fact Australia’s population increases by a million every three and a bit years is much more important because that’s another million people we are servicing three and half years from now.

“And let’s say they already have got a house, or stop building houses, then they start renovating houses.’’