Profits return as economy recovers from COVID-19 shock

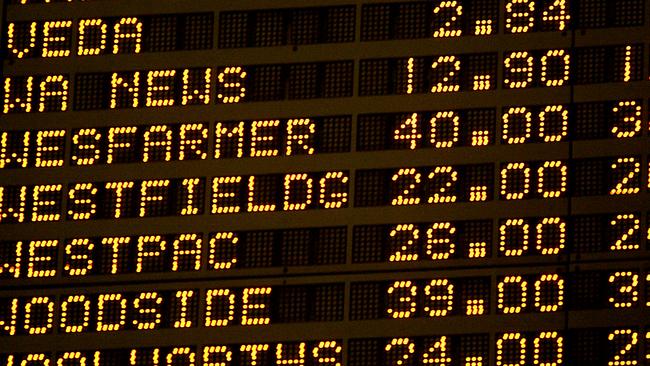

Corporate balance sheets are expected to grow 34 per cent this financial year as almost nine out of 10 ASX 200 companies post a profit.

Corporate balance sheets are bouncing back from the COVID-19 shock faster than expected with almost nine out of 10 ASX 200 companies posting profits in the recent reporting season.

Retailers, banks and media companies are expected to benefit from an accelerating economic recovery driven by a housing market boom and increased infrastructure spending.

A CommSec survey found that 86 per cent of companies reported profit in the six months to the end of December, 79 per cent issued a dividend and 70 per cent lifted cash holdings.

CommSec chief economist Craig James said that while some companies had faced the toughest conditions in living memory, others were experiencing the best trading in a decade.

Mr James said the recovery had been helped by strong government action on lockdowns and stimulus measures such as JobKeeper.

“It’s not boom time yet, but you have retailers like Gerry Harvey saying profit is going gangbusters,” he said. “Retailers that either had a good online presence to begin with or were quick to put plans in place have been hugely successful.”

But Mr James cautioned it had been an uneven recovery with companies dependent on people’s mobility, most notably airlines and travel companies, continuing to struggle.

“Companies like Qantas and Flight Centre are facing significant challenges,” he said. “Local lockdowns and the closure of foreign borders have also buffeted services like hospitality, accommodation and gaming operators.”

Energy companies had been hit by lower demand, but some miners had benefited from favourable commodity prices.

The recovery of the Chinese economy remained encouraging for mining and engineering sectors, with iron ore prices near decade highs and oil close to 13-month highs.

Mr James said that while aggregate interim profits fell by 17 per cent, aggregate dividends were up 5 per cent on a year ago.

The economy was now moving into a new phase, with vaccines, super-low interest rates and a home building boom set to provide further momentum this year.

“Corporate Australia is in solid shape with strong balance sheets being maintained,” he said. “Of course this is still early days. Mutant strains of the virus could be less responsive to vaccines, putting us back to square one. Issues to watch in coming months include lifting market rates, migration and the difficulty of accessing stock and labour.”

AMP Capital chief economist Shane Oliver said there were expectations profit would grow 34 per cent this financial year, a considerable upgrade from earlier estimates.

“Six months ago, the forecast was for profit to grow only 8 per cent,” Dr Oliver said. “Media companies, banks and retailers are expected to experience the biggest upside.”

He said the recovery in profit was in line with broader economic data showing rebounds in jobs and the housing market. “Retail sales are up, there has been a 90 per cent recovery in the jobs market and housing is booming,” he said.

Dr Oliver said airlines and travel companies would take longer to recover given international borders remained closed, but there had already been a bounce back in domestic travel.

Citi said the half-year reporting season had been better than expected with 36 per cent of companies topping profit expectations while 28 per cent had missed.

“While some sectors of the market are benefiting from buoyant retail conditions, others are still negatively impacted by border closures,” Citi analysts Liz Dinh, James Wang and Rory Anderson said. “Those companies that are incurring pandemic-related costs may find offsets from government support measures.”

Citi said the resources sector had seen a dividend bonanza as a result of strong cash flow and lower levels of debt. “Dividend growth has been particularly strong in the domestically focused part of the economy.”

But Mr James cautioned it had been an uneven recovery with companies dependent on people’s mobility, most notably airlines and travel companies, continuing to struggle.

“Companies like Qantas and Flight Centre are facing significant challenges,” he said. “Local lockdowns and the closure of foreign borders have also buffeted services like hospitality, accommodation and gaming operators.”

Energy companies had been hit by lower demand, but some mining companies had benefited from favourable commodity prices.

The recovery of the Chinese economy remained encouraging for mining and engineering sectors, with iron ore prices near decade highs and oil close to 13-month-highs.

Mr James said that while aggregate interim profits fell by 17 per cent, aggregate dividends were up 5 per cent on a year ago.

The economy was now moving into a new phase, with vaccines, super-low interest rates and a home building boom set to provide further momentum this year.

“Corporate Australia is in solid shape with strong balance sheets being maintained,” he said. “Of course this is still early days. Mutant strains of the virus could be less responsive to vaccines, putting us back to square one. Issues to watch in coming months include lifting market rates, migration and the difficulty of accessing stock and labour.”

AMP Capital chief economist Shane Oliver said there were expectations profit would grow 34 per cent this financial year, a considerable upgrade from earlier estimates.

“Six months ago, the forecast was for profit to grow only 8 per cent,” said Dr Oliver. “Media companies, banks and retailers are expected to experience the biggest upside.”

He said the recovery in profit was in line with broader economic data showing rebounds in jobs and the housing market. “Retail sales are up, there has been a 90 per cent recovery in the jobs market and housing is booming,” he said.

Dr Oliver said airlines and travel companies would take longer to recover given international borders remained closed, but there had already been a bounce back in domestic travel.

Citi said the half-year reporting season had been better than expected with 36 per cent of companies topping profit expectations while 28 per cent had missed.

“While some sectors of the market are benefiting from buoyant retail conditions, others are still negatively impacted by border closures,” Citi analysts Liz Dinh, James Wang and Rory Anderson said. “Those companies that are incurring pandemic-related costs may find offsets from government support measures.”

Citi said the resources sector had seen a dividend bonanza as a result of strong cash flow and lower levels of debt. “Dividend growth has been particularly strong in domestically focused part of the economy” Citi said.

.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout