Private equity firm Blackstone to buy James Packer-backed gaming group Crown Resorts for $13.10 a share

The Packer family’s decades-long ties to Crown Resorts are set to end after the company agreed to sell its casinos in Melbourne, Sydney and Perth to Blackstone.

The Packer family’s decades-long ties to Crown Resorts are set to end after the company agreed to sell its casinos in Melbourne, Sydney and Perth to Blackstone – but the deal still requires regulatory approval in three states.

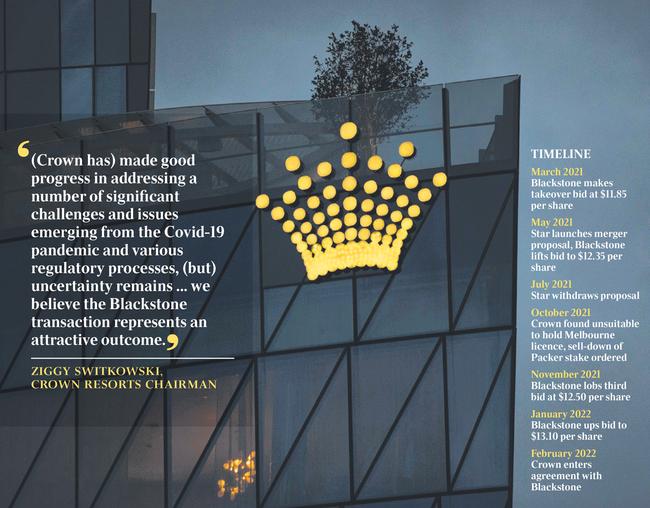

The Crown board on Monday said it backed the $8.9bn takeover offer from the US private equity group – which owns casinos in Las Vegas and across South America – ending almost 12 months of back and forth between the companies.

If the deal is done, the gaming giant’s largest shareholder James Packer will land a $3.3bn payday.

The deal, which would remove Crown from the ASX, adds $845m to Blackstone’s first bid of $11.85 a share in March last year. It revised that bid to $12.50 in November before lifting again last month.

Crown Resorts chairman Ziggy Switkowski said the deal offered shareholders certainty as the company continued to navigate the fallout from the pandemic and three bruising inquiries in NSW, Victoria and Western Australia.

While Blackstone is understood to be working well with state gaming regulators, a casino licence cannot be granted until the regulator examines the binding offer from Blackstone.

The regulatory uncertainty limited gains in Crown’s share price on Monday.

After peaking at $12.76, it eased in afternoon trade to close just 2 per cent higher at $12.64 – 46c below Blackstone’s bid.

Forager Funds Management chief investment officer Steve Johnson said the Blackstone deal was “another step in a process that has some way to run”, citing regulatory and shareholder approval.

Despite Crown last trading at $13.10 a share in May 2019 – before the NSW, Victorian and WA inquiries and Covid-19 slashed international high-roller revenue – Mr Johnson said the company was worth more delisted.

“Crown remains a high-quality and valuable asset and is worth more to private equity than it is ever going to be worth listed on the ASX. They can use more leverage and financial engineering and they don’t have an (environmental, social and governance) discount applied,” Mr Johnson said in a note to investors.

But S&P Global Ratings analysts said the deal “heightened negative pressure” on the company’s credit rating.

“The offer, which is subject to a number of regulatory and other hurdles, could adversely affect the Australia-based gaming and entertainment group’s (BBB/Negative/A-2) credit quality, depending on the financing strategy employed by Blackstone,” wrote analysts Craig Parker and Paul Draffin. “The Blackstone bid has introduced further uncertainty to Crown’s long-term business composition and financial position.

“Among the downside risks to Crown’s credit quality over the next two years are regulatory risks associated with the group’s gaming licences. The group also continues to face Covid-related disruptions and exposure to potential regulatory fines and sanctions arising from various regulatory reviews currently under way.”

The Blackstone deal comes after the Victorian royal commission into Crown last year recommended Mr Packer sell down his 37 per cent controlling stake in Crown to 5 per cent within two years. For Mr Packer, the price is 10c higher than a failed deal that he struck with Macau billionaire, Lawrence Ho, who agreed to pay $13 for a 19.99 per cent holding of Crown in May 2019.

In other words, after becoming a forced seller and seeing Crown’s shares plummet as low as $6.12 at the onset of the pandemic, Mr Packer has not only been able to save face but also secure a higher price than the failed deal with Mr Ho, with his 37 per cent shareholding worth $3.28bn at the $13.10 offer price.

That additional 10c a share puts an extra $25m in Mr Packer’s pocket.

Crown chairman Ziggy Switkowski said: “The Blackstone transaction represents an attractive outcome for shareholders.

“The Crown board and management have made good progress in addressing a number of significant challenges and issues emerging from the Covid-19 pandemic and various regulatory processes,” he said.

“Nevertheless, uncertainty remains, having regard to those circumstances and the underlying value of Crown.

“The all-cash offer provides shareholders with certainty of value.”

Crown founder Lloyd Williams told The Australian that he welcomed the deal, which would “recharge” the Crown brand and secure the jobs of employees.

“James Carnegie/Blackstone are perfect buyers: very, very well-experienced; very well capitalised,” Mr Williams said.

“I am sure they will recharge the Crown brand. The outcome is perfect: existing shareholders receive a very satisfactory price; employees’ future security is guaranteed.

“I am delighted to see James, the son of Sir Roderick Carnegie, my ex-chairman, to have been successful.”

Blackstone is known as a “super investor” and so far has been working well with Australian regulators ahead of submitting its proposal.

Already, Blackstone has been subject to scrutiny from the NSW independent Liquor and Gaming Authority (ILGA) and is understood to have passed most of its regulatory checks, with the final step being a transaction for ILGA to approve.

“I would expect that the due diligence and discussion with Blackstone on their probity will be completed by the end of the month,” ILGA chairman Philip Crawford said last October.

Blackstone’s private equity division has $US120bn ($165bn) in assets under management and another $US30bn ready to invest.

Its global real estate portfolio is worth more, valued at $US448bn. Its real estate investments include Las Vegas’s MGM Grand/Mandalay Bay, which it bought for $US4.6bn in 2020. It also owns the Bellagio casino, which it snapped up for $US4.25bn in 2019.

It has used its substantial coffers to turn around another Las Vegas casino, The Cosmopolitan, which it bought from Deutsche Bank for $US1.73bn in 2014.

It poured $US500m into the casino, renovating 3000 rooms, building another 67 rooms and suites and overhauling the menu and gaming floor to transform it into one of Las Vegas’s premium gaming complexes.

It is understood Blackstone hopes to adopt the same strategy at Crown Melbourne – which is Victoria’s biggest single-site employer but is likely to need significant capital expenditure in coming years to keep pace with Crown Perth, which has undergone a $1.3bn renovation, and its new $2.1bn casino complex in Barangaroo.

Blackstone also believes that the casinos and their non-gaming assets – including hotels, restaurants and high-end shops – will play a big part in revitalising Sydney and Melbourne’s CBDs when international borders reopen later this month.

“Crown plays a pivotal role in Australia’s economy through job creation, investment and as a tourism destination for locals and visitors alike,” Blackstone’s head of real estate, Australia, Chris Tynan said. “We are excited to bring our local expertise and global hospitality and gaming experience to contribute to Australia’s post-pandemic recovery and position Crown for future growth.”

Crown managing director and chief executive Steve McCann said Blackstone’s proposal “appropriately reflects the value of Crown’s world-class assets and global reputation for premium service and experiences”.

“The agreement with Blackstone also highlights the strength of the Crown brand and confidence in our future as we emerge from some challenging times, which is welcome news for our people, customers and stakeholders.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout