Premier leads as retail shares surge with positive forecasts

Premier Investments hit new highs on Wednesday, but Universal Store, Baby Bunting and JB Hi-fi joined the charge.

Retailers surged following a better than expected sales update from the owner of Just Jeans, Smiggle and Peter Alexander, in a sign that the economy is on a fast track to recovery despite the Christmas Covid flare up.

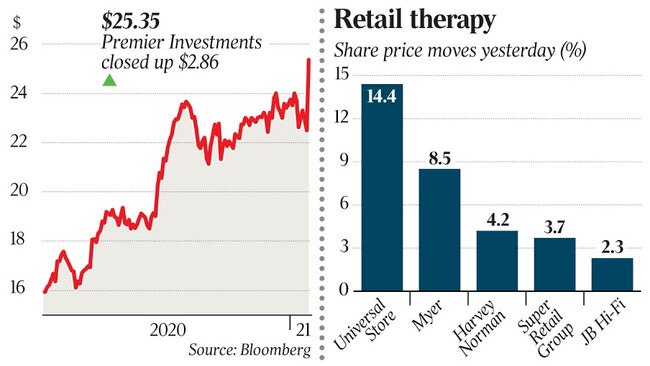

Shares in Premier Investments hit new highs from the get-go on Wednesday, surging more than 18 per cent to an intraday high of $26.70 after announcing that earnings before interest and tax for the first half of the financial year will lift by up to 85 per cent to $221m-$233m.

The company closed at $25.35 a share, up 12.7 per cent, valuing chairman Solomon Lew’s 42 per cent stake in the company at around $1.69bn. With a fortune estimated at around $2.51bn, Mr Lew currently ranks at 33 on The List – Australia’s Richest 250.

Analysts at Goldman Sachs said the result was “significantly stronger” than expected. A Blue Ocean Equities analyst called them “very impressive” and Morgan Stanley researchers lauded the result as “exceptionally strong”.

The results sparked a sense of confidence in consumer spending and the Australian economy and investors jumped on other retail stocks, most of which are yet to issue guidance.

Shares in JB-Hi Fi jumped by 2.3 per cent to close at $51.86 after hitting a record high of $53.05, while infant retailer Baby Bunting lifted 3.8 per cent per cent to close at $5.15 after hitting a record high of $5.37.

Myer, in which Premier Investments holds a 10.8 per cent stake, was up 8.5 per cent to 32c while Harvey Norman lifted 4.2 per cent to $5.20 and outerwear retailer Kathmandu ticked up by 3.4 per cent to $1.22.

ASX newcomer Universal Store lifted 14.4 per cent to hit a new high of $5.89 after it announced EBIT for the first half of the financial year would be in the range of $30m to $31m, representing earnings growth up to 67 per cent.

It also means the retailer has seen its share price grow more than 50 per cent since it listed on the ASX in November.

Head of Industry Affairs at the Australian Retailers Association Fleur Brown told The Australian she was “relieved and encouraged” by the trends emerging in the industry.

“While there are still deep pockets of pain, within CBD and Victorian retail in particular, discretionary retail has seen some promising signs with clothing, footwear and personal accessories up 18 per cent year on year in November,” she said.

Important indicator

“This is a very important indicator for the health of overall retail as it’s a good sign of consumer confidence returning.”

NAB Group chief economist Alan Oster told The Australian he agreed that the economy is moving back into gear. Mid last year the bank expected neutral growth in the December quarter. Now it’s forecasting 2 per cent growth.

“We expect the December quarter to be quite strong, and then we expect March to not be quite as strong – but over the next 12 months we are expecting growth of 4 per cent, and for consumption, something like 8 per cent,” Mr Oster said, adding that there were a few factors driving the economic uptick.

“There’s pent up demand from the lockdowns and now the reopening of the economy,” he said.

“You can’t go overseas, so you spend locally, and there’s a hell of a lot of people who are still getting a lot of payments from the government, and people have had some tax cuts as well.”

Chief economist at AMP Capital Shane Oliver told The Australian the pandemic has gifted the retail sector a brief reprieve from structural headwinds.

“The problem Australian retailers have had for many years is that goods, and that does include restaurants, have been declining as a share of consumer spending because of a services boom – people are spending more on holidays, yoga and all that sort of stuff,” he said.

“What’s happened is that people haven’t been able to pick up their spending on services again … So in the meantime they are spending more on things like household equipment and clothes.”

Shift to online shopping

The economists also agreed that retail sales are being underpinned by a structural shift towards online shopping.

“People in lockdown had no choice but to shop online and discovered that it’s really not so bad,” Mr Oster said.

Premier Investments said its half-year result was driven by growth in higher-margin online sales which “have continued to accelerate” into the second half of the financial year.

Overall group sales increased by 5 per cent to $716.9m – but online sales increased by 60 per cent to $146.2m to comprise slightly more than one-fifth of group sales as rolling lockdowns affected Premier’s stores in Australia, Malaysia, Ireland and the UK.

Universal Store also managed to leverage its online channel to grow sales, with physical and online sales growing 26.5 per cent on a like-for-like basis despite rolling Covid shutdowns shuttering parts of its 65 store network.

Mr Oster said that although the preliminary results were encouraging, investors should not expect bumper Christmas sales data across the board.

“It’s important to be a bit careful about this,” he said.

“I’ll take a lot of bets now that retail sales in December were negative.”

Ms Brown said the Australian Retailers Association had its sights set firmly on the March quarter of the financial year.

“March remains a concern as much of the recent spend can still be attributed to stimulus remaining in the economy from JobKeeper and JobSeeker,” she said.

“We are cautiously optimistic around 2021, but while we are living with Covid, many elements remain unpredictable this year.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout