Premier Investments soars on record sales, profits

Solomon Lew’s Premier Investments retail prowess in Australia and overseas has delivered record sales, profits and dividends.

Solomon Lew’s Premier Investments retail prowess in Australia and overseas has delivered record sales, profits and dividends for 2019, pulling off one of the best results for a retailer in the just-completed profit season to send the share price rocketing on Friday.

Shares in company rallied more than 22 per cent as investors looked beyond pre-tax charges of $25.9m linked to the disruptions of Brexit to its Smiggle stores in the UK as it tries to rework its leasing deals with landlords to focus instead on the growing earnings strength of the chain and stablemate stores like Just Jeans, Dotti, Peter Alexander and Portmans.

At a time when retail, and in particular fashion and apparel, is struggling to capture sales growth, Premier Retail, which operates the portfolio of fashion stores, posted underlying earnings before interest and tax of $167.3m, up 11.5 per cent on the previous fiscal year. Its clothing brands delivered strong sales growth, with total sales up 6.9 per cent and like-for-like growth of 7.8 per cent, Premier said, as the group continues to close unprofitable stores and walk away from landlords refusing to negotiate better rental deals.

Premier Investments, the parent group that is almost 50 per cent-controlled by billionaire retailer Mr Lew and includes the fashion retail arm as well as sizeable investments in ASX-listed companies Myer and Breville, posted a 7.7 per cent gain in sales to $1.28bn and a 27.7 per cent lift in full-year net profit to $106.8m.

Amid a landscape of failing retailers and others barely surviving, Mr Lew was happy to show off the earnings and balance street strength of Premier Investments — boasting of the fatter dividend to shareholders — as well as reminding landlords that the company was comfortable to shut down stores where rents were out of touch with the realities of shopping centre foot traffic.

“Our cash flow remains strong and, while many of our competitors are failing or struggling in these very challenging times, my fellow directors and I are pleased to be in a position to reward the confidence of our shareholders with a record final dividend of 37c per share, taking full-year dividends to 70c per share, fully franked and up 12.9 per cent,” he said.

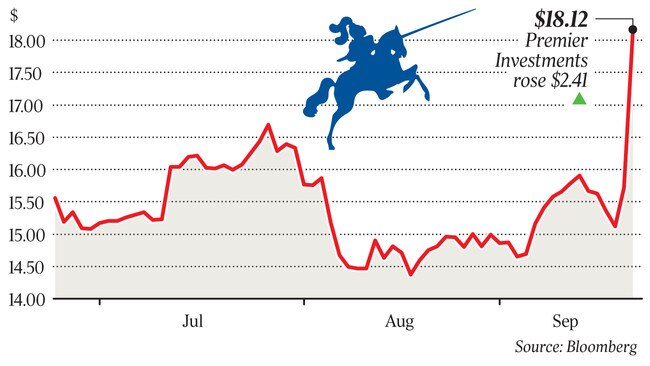

The final dividend will be paid on November 15. It was a record dividend and the market leapt on the results, sending shares up more than 22 per cent before closing up $2.41, or 15.34 per cent, at $18.12 — a 12-month high.

But there were growing pains for Premier, in particular its ambitious plans to push out Smiggle to the world to deliver $450m in annual global retail sales in calendar 2021 or 2022.

The culprit was Brexit. Premier said that further upheaval and destabilisation in Britain caused by the Brexit drama had pushed it to negotiate leasing obligations for its Smiggle stores in the UK.

The company said that as a result of continued economic and political uncertainty in the UK and the impact on landlord and retail markets, Premier had reviewed its depreciation methods for its UK store plant and equipment. This would trigger charges of more than $25m.

The accelerated depreciation charges linked to its leases in the UK will give Smiggle the option to break most of its store leases after just five years, allowing Premier to negotiate better rent deals at a time when many UK retailers have collapsed and landlords are facing empty sites.

Many of these failed British retailers are negotiating better rents through their insolvency administration process, and Premier Investments believes it should also get some of these lower rents for its Smiggle stores as well.

It is the same hardball game Mr Lew and Premier CEO Mark McInnes have played with landlords in Australia that has seen them get more favourable rents.

Outside of its retail businesses the company’s balance sheet remains robust. Premier Investments’ year-end balance sheet included cash on hand of $190.3m, an investment in Myer valued at $46.9m. The market value of the Breville investment at year end was $691.7m.

Smiggle had record sales of $306.5m in 2019, and Peter Alexander record revenue of $247.8m.

Premier Investments said the strategy of clarifying the market position of each of the apparel brands and further investing in products and merchants had delivered strong sales growth.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout