Philanthropy Australia boss Jack Heath tells charities to strengthen relations with donors

More than a third of local charities are unsure they will be able to meet their financial targets over the next three years.

More than a third of local charities are unsure they will be able to meet their financial targets over the next three years as they face volatile markets and lower-than-expected returns on investments.

That is the finding of a confidential Mercer report which also concludes 60 per cent of charities worldwide said lower returns were their biggest fears over that same period.

Almost 40 per cent said they were unsure if their portfolios were adequately positioned to survive another extreme market downturn.

Among Australian charities captured by the report, 48 per cent feared lower returns.

Philanthropy Australia chief executive Jack Heath said on Wednesday that charities would need to “double down on their relationships with funders” to weather the market.

“The important thing charities can do is double down on their relationships with funders, including individual philanthropists, trusts and foundations,” he said.

“Now is the time to deepen relationships with the philanthropic sector – a high trust relationship enables a frank exchange that will lead to longer-term sustainability and greater impact over time.”

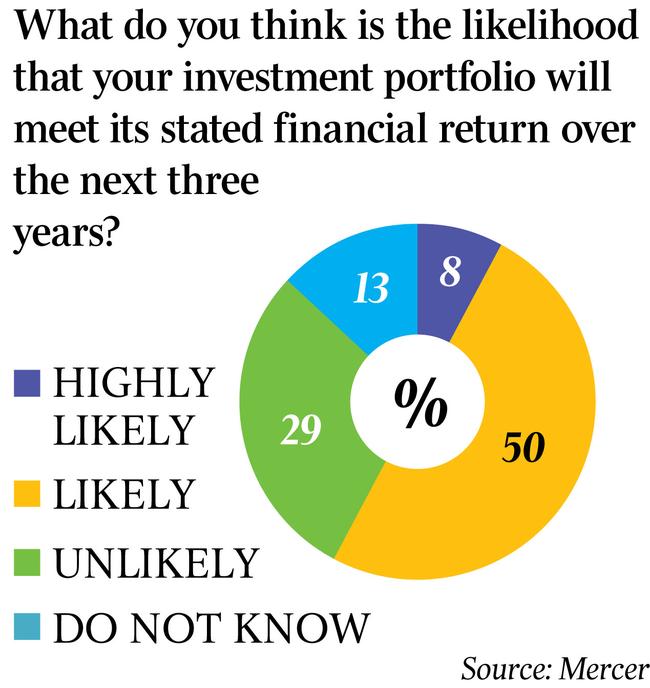

Only half of Australian charities said it was “likely” that their investment portfolios would meet their stated financial return over the coming 36 months.

Despite these concerns, Mr Heath said 76 per cent of Australian respondents were moving away from fixed income and equities, with as many as 96 per cent looking to incorporate ESG into their investment decisions – a move that would ultimately shore up pleasing short-term results.

“In the past three years 71 per cent of not-for-profits exceeded their expected investment returns,” he said.

“For those with significant reserves, this is a positive thing and provides a buffer. (However) for those with smaller investments there is exposure.”

Cooper Investments is one of the country’s largest managers of money for not-for-profits. Natalie Elliott, its head of private capital, said charities were looking for investment strategies focused on delivering a “smoother journey”.

“By that, I mean investment strategies aimed at preserving their capital while still delivering returns so they can deliver on their missions,” she said.

“Endowment-style investing is one approach that may be suitable for NFPs seeking to strike a careful balance between protecting precious capital while growing it over a longer horizon.”

Mr Heath also called for more government support for the sector, including systems to make it easier to give posthumously.

“Philanthropy Australia is advocating to government to make it easier to donate excess super when people pass away,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout