Perpetual’s Pendal plans in doubt after legal move

Lawyers acting for Pendal have gone to court in an attempt to delay the merger process by a week.

Perpetual’s plans to acquire Pendal are in disarray after the smaller fund manager went to court in an attempt to force its would-be partner to go through with the deal.

In a late afternoon hearing on Friday, lawyers acting for Perpetual moved to delay the merger process by up to a week. The NSW Supreme Court will on Wednesday also hear arguments on whether Perpetual can walk away from the $2.7bn deal with Pendal if there is a better arrangement.

On Thursday, Perpetual rejected a $33-a-share offer from Regal Partners and BPEA EQT, a second attempt from the consortium to acquire the fund manager.

On Friday, David Thomas, SC, acting for the consortium, attempted to intervene in the dispute between Pendal and Perpetual. He argued that a lack of a fiduciary carve-out in the contract between the two companies was contrary “to Takeover Panel guidelines” and “contrary to public policy”.

Pendal has argued in releases to the market that the Perpetual transaction is legally binding and the deal contains a clause that does not allow the acquirer to walk away from the contract.

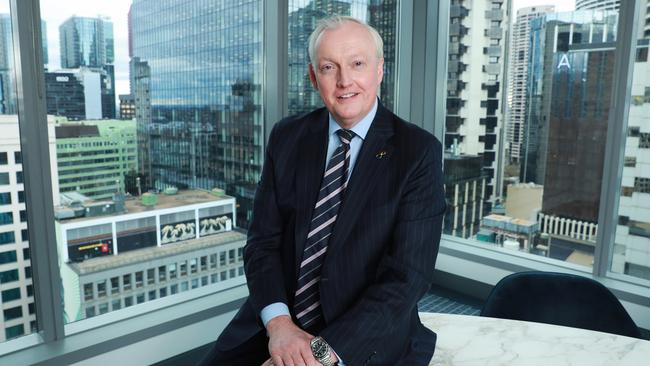

Hours before his lawyers attempted to delay the process, Perpetual chief executive Rob Adams said the deal was “strategically compelling … over the medium and longer term”. “Clearly there are a lot of moving pieces to any complex deal. We’re in volatile markets right now, and anybody would take all of those things into account,” Mr Adams told The Weekend Australian.

“What we have to do is act in the best interest of our shareholders … fundamentally nothing has changed about the compelling nature of this deal from a strategic perspective and a financial perspective.

“We want to have the right … to deal with certain defined unforeseen circumstances where the interests of our shareholders might actually override the interests of completing the Pendal deal.” Perpetual wanted the documents presented to shareholders considering the Pendal deal to be “appropriate and fulsome and reflective of the situation”.

Mr Adams denied there had been a breakdown in the relationship between Perpetual and Pendal. “There’s a real unified view that this still makes sense and we’re in the process part of it now and sometimes process can get in the way a little bit,” he said.

Perpetual shares rose $1.40, or 4.2 per cent, to close at $34.80 on Friday, while Pendal closed up 29c at $4.20, a 7.4 per cent jump.

UBS analysts told clients that a $33-a-share bid from Regal and its partner was “less than the market expected” following a bid of $30 a share early this month.

“In the absence of a large control premium, Perpetual’s decision to reject the offer as materially undervaluing the company is therefore not surprising,” wrote UBS equities analysts Shreyas Patel and Scott Russell.

“Notwithstanding the lack of board support for the consortium’s offer, Perpetual has highlighted its pathway out of the Pendal merger which would be on fiduciary grounds, which we interpret as conditional on a materially higher bid for a Perpetual control transaction emerging.”

While the end outcome remains highly uncertain, the market is implying (an approximate) 20 per cent probability of the scheme progressing, they said.

The Australian reported on Thursday that other parties have also been interested in Perpetual. KKR has held discussions with Perpetual in recent months, having last attempted to purchase the company in 2010. The fact details have not been disclosed to the market suggests discussions have not progressed to a formal offer.

Perpetual has been planning a deal with Pendal since April – although many in the market have remained sceptical about whether the proposal was the best outcome for shareholders.

If Perpetual’s takeover of Pendal goes ahead, the merger would be among the top five Australian asset management deals by size, according to Refinitiv. Others of that scale include Mitsubishi UFJ Trust and Banking Corporation’s $4bn acquisition of Colonial First State Global Asset Management, NAB’s purchase of MLC and Commonwealth Bank’s initial buy of Colonial in 2000.

CLSA brokers told their clients in a note on Friday that they expected Perpetual to walk away from the deal with Pendal only if it received an offer that was near to $40 a share, with limited or no string attached to the bid.

“It does, however, seem that Perpetual is open to other offers after announcing it proposed a short deferral to the first court hearing with Pendal ‘in light of recent developments’, which includes the consortium offers as well as ‘further actual and speculated interest’ by other parties,” brokers Ed Henning, Anthony Hoo and Rachel Ryan wrote.

“We acknowledge there seems to be momentum gathering for Perpetual acquirers, although the current bid is some way off from where we believe a deal could be done,” their note reads.

Mr Adams, in an interview on Friday, acknowledged there had been a “fairly high and constant level of interest” in Perpetual’s corporate trusts business and the private client business.

“We’re a great owner of the business and we’ve demonstrated that though its performance,” Mr Adams said. “The corporate trust business has delivered a 15 per cent compound annual return in underlying profit after tax over the last decade, so we are actually doing a pretty good job.”

The Regal consortium was unsuccessful in its intervention. The matter will be heard next week.