In round terms, the industry collects 1 per cent for every $1 under management — which translates to $30bn for the $3 trillion now under management.

The early release scheme has taken $33bn in funds from the scheme, which works out to around $330m in industry fees.

In the 10 years since Jeremy Cooper completed his report on the industry, funds under management have tripled, the great bulk of which has come from market returns as opposed to increased contributions.

The numbers, it should be noted, are in round terms and, by way of example, Australia’s largest fund AustralianSuper has $185bn under management and fees and costs of $1.1bn, about 0.6 per cent.

The industry has benefited from the increase in funds under management of which it is directly contributed through — in some sections at least — good investment performance.

In 1999, net contributions of $32bn grew the Australian super system by a hefty 9 per cent.

In 2009, net contributions grew the then $1 trillion system by just 5 per cent but by 2019 the $2.7 trillion system increased just 0.78 per cent by way of contributions, totalling $20.6bn.

The industry will survive if the guarantee expansion is halted, but the issue is individual member returns. The excuse for stopping the expansion is COVID-19 and its devastation of the Australian economy, and everyone from the RBA to Brendan Coates at Grattan have argued against the increase on the grounds that it would kill wages growth, and more importantly jobs.

Let’s forget wages growth, it won’t happen any time soon, so the issue is employment costs.

Young workers lucky enough to have a job would of course be better off if the guarantee was increased because at least they would be getting legislatively backed increases.

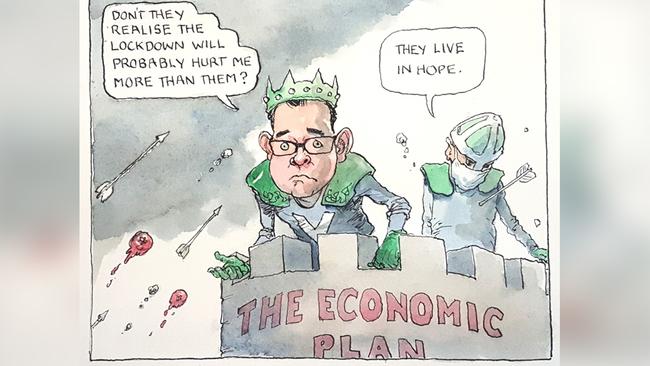

Treasurer Josh Frydenberg and some of his colleagues (who work under a taxpayer-funded 15.4 per cent contribution rate) have an ideological bias against the industry funds that rule the market, so COVID-19 has turned into a convenient excuse to put the brakes on expanding the super guarantee.

In truth, they were planning to put the brakes on anyway, and while the Callaghan review was stated as being just getting the facts with policy recommendations, we can be sure it will also be used to kill the present legislation expanding the guarantee

There are, of course, many reforms awaiting action, such as responding to the Productivity Commission report on the super industry, including how to break the nexus between union awards and default contributions.

Superannuation is designed to save money until retirement but the trick then is to get people to spend the money through some form of retirement covenant or concession to boost annuity type schemes.

Dairy deal souring

Lion Australia boss Stuart Irvine has a decision ahead on his $600m dairy business — with his Mengniu deal likely to fall over next Tuesday.

As reported by The Australian last week, the drop-dead date on the deal is August 25, with Lion having an option to withdraw if the deal, signed last November, doesn’t proceed by then.

The deal covers prized assets including Pura milk, Big M flavoured milk, Yoplait yoghurt, Berri fruit juice and the second-biggest cold food distribution arm in Australia behind Coca-Cola Amatil.

Mengniu was the ideal buyer following recent deals, including $1.5bn for Bellamy’s and control of Gippsland producer Burra and offering farmers access to the Chinese market.

The ACCC and FIRB approved the Bellamy’s and Burra deals and the Lion acquisition — and the seller is, after all, a Japanese company — Lion’s owner, Kirin.

But the federal Treasurer has ultimate power over FIRB deals and despite his officials approving the deal he told Mengniu he was “mindful” to reject it.

The hope was the Chinese either walked or, like the Kidman property deal, came back to the table with an Australian partner.

If neither of that happens by Tuesday, then Frydenberg is considered likely to formally reject the deal.

Last week’s threat to impose dumping duties on Australian wine exports has further raised the trade tensions between Australia and China.

Frydenberg has an alternate course of action, which is to follow his department’s advice and approve the deal, which would be seen as an olive branch to China.

This could calm tensions and relieve the pressure on more than $1bn in wine exports, red meat, barley and infant formula, among other victims of the trade tensions.

But unless the benefits were immediately apparent, the politics are tough.

If Frydenberg plays hardball on the deal, then Irvine would first look to see whether another buyer could be found.

Last time around, Bega, Asahi, Parmalat, Saputo and Coca-Cola Amatil were all potential buyers.

Parmalat and Saputo would have both ACCC and FIRB issues, and Coca-Cola Amatil would also have ACCC issues.

Fonterra is seen as more a seller than a buyer in Australia.

The country is in recession and the food service sector, in particular, is in diabolical trouble. All of which suggests that if Mengniu can’t close the deal by Tuesday, then Irvine will simply say thanks and let his gun dairy boss Kathy Karabatsas manage the business as best she can in the present circumstances.

A rival offer would have to be clean and quick. That not being the case, Lion’s parent Kirin is best served by keeping the business.

Food for fraught

When the ACCC opens its inquiry into the Woolworths acquisition of food service provider PFD it will hear complaints from suppliers.

If Woolies scrapped your cheese from the shelves in the past you could chase food service as an alternate outlet, but not now that Brad Banducci controls that too.

The Woolies boss argues that the top three suppliers control just 25 per cent of the food service market so there are plenty of alternate outlets.

No season to be jolly

The corporate profits season has not surprised in the middle of a recession, with 67 per cent of companies reporting falling earnings and 53 per cent cutting dividends.

So far, about 80 per cent of the market by value has reported and the bearish trends are clear, with the market cutting estimates for both 2020 and 2021 earnings.

Normally at this stage of the profit season the last year’s numbers are revised down and the forward year up.

AMP’s Shane Oliver said amid the gloom that 59 per cent of companies had outperformed expectations, but expectations were weak heading into the season.

The ASX 200 index is down 8 per cent this year but in the month of August is up 3.2 per cent, which reflects a positive reaction against subdued expectations.

Investors feared the worst and that’s about what they got.

Paul Keating says always back self-interest — and on those grounds be cautious about politicians and the superannuation industry when it comes to the debate over increasing the super guarantee from 9.5 per cent to 12 per cent.